Global activity proved resilient into the new year as policy uncertainty around US trade eased from late-2025 peaks and the IMF nudged world growth forecasts modestly higher. Within the euro area, Q4 growth accelerated, but January PMIs were mixed – manufacturing stabilised while services softened, pointing to a slight loss of momentum at the start of 2026.

Equities started 2026 on a positive footing but displayed dispersion across geographies and sectors. US equities were resilient due to strong earnings but lagged regions such as Europe, Korea and Japan due to a rotation out of information technology into energy, materials, staples and industrials. The main driver of market softness was software businesses, which are perceived to be at higher risk of being disrupted by AI. European equities were up mid-single digits, helped by improving earnings expectations. Equities in Taiwan and Korea benefited from strong demand for technology hardware and semis.

For sovereign issues, Euro 10-year yields were stable while US and UK yields pushed a bit higher. However, the key takeaway was Japanese 10-years reaching 2.23%[1] at the end of January. Overall, investment grade and high yield credit spreads remained stable to slightly wider over the period. However, listed BDCs from private credit lenders suffered from active selling towards the end of the month due to high loan exposure to software companies.

On commodities, items such as coffee declined around 5%[2] during the month due to expectations of very good yield crops, but the focus of the start of 2026 was the sharp pull-back in gold and silver prices in the last trading days of the month.

The HFRX Global Hedge Fund EUR Index was up at +1.86% over the month[3].

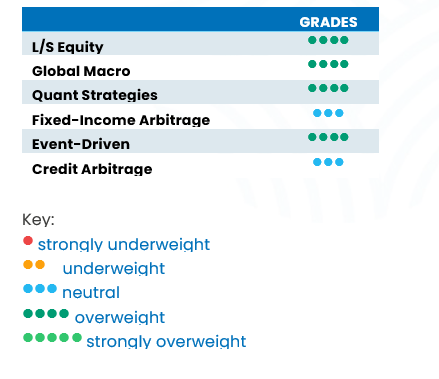

L/S Equity

It was a strong month for Long-Short Equity strategies with returns driven by beta and strong alpha generation. Fundamental LS strategies outperformed printing a spread between their long and short positions’ returns which is, on average, in line or above equity indices’ absolute returns. Gross and net exposures remained stable during the period. Technology de-risking was pronounced, especially in software, in favour of industrials, financials and communications services, consistent with rotation rather than retreat. The environment argues for continued stock-picking in a high-dispersion regime, with positioning discipline key if macro or AI narratives re-price abruptly. Long-Short Equity strategies are well positioned to be beneficiaries of increased dispersion across sectors, offering a supportive backdrop for active stock selection.

Global Macro

Macro strategies led hedge-fund performance, benefiting from sustained trends across FX and commodities. In systematic macro, January’s big payoffs came from commodities and rates. The month also featured an extreme late-month precious-metals drawdown following news around a potential Fed leadership transition. Positioning appeared geared to trend persistence but vulnerable to sharp “policy headline” reversal. Opportunities remain attractive, but outcomes may be affected by episodic volatility around central-bank signalling and geopolitics rather than smooth disinflation.

Quant Strategies

Quant outcomes were bifurcated during the month. Systematic trend-followers had a strong month while quantitative market neutral were flat to slightly negative. Trend-following strategies saw positive contributions from all asset classes, but returns were mainly driven by equities and commodities. Quant equity-market strategies had a challenging period, which is consistent with an environment where factor leadership rotated and crowded exposures broke down. Quantitative strategies remain core, positioned for tariff-driven volatility, style rotations and rate or forex directional or relative value opportunities.

Fixed Income

Fixed income arbitrage/relative value made steady gains in January as rates were “little changed” at the month level, even though intra-month policy headlines created pockets of curve volatility. Relative value performance was consistent with carry-and-roll plus selective curve/swap-spread opportunities rather than directional duration bets. Positioning likely leaned toward funded RV (swap spreads, curve steepeners/flatteners, basis) with careful risk budgeting given uncertainty tied to Fed transition talk and heavy sovereign issuance dynamics. The outlook is constructive provided rates volatility remains contained. The main risk is a regime shift toward higher term premium or balance-sheet tightening that widens RV ranges faster than leverage can adjust.

Event Driven

January was a solid month for Event-Driven strategies, supported by a constructive equity environment and ongoing deal flow. Both merger arbitrage and special situations strategies generated positive returns, with the latter having on average the higher contribution to performance. Strategy behaviour appeared focused on disciplined spread capture rather than aggressive risk-taking, reflecting supportive financing conditions, but still-elevated headline risk. The environment should remain favourable, with several structural and cyclical factors underpinning continued activity.

Credit Arbitrage

Credit arbitrage benefited from tight spreads and strong demand for carry, but the asymmetry of “tight risk premia” became a more visible constraint. News flow in early 2026 highlighted historically compressed IG/HY spreads, raising concerns that compensation for downside risk was shrinking. Managers are favouring higher-quality carry plus targeted idiosyncratic trades rather than broad beta. The near-term outlook: carry remains supportive, but the strategy’s edge depends on security selection and liquidity management if a macro shock forces a rapid, nonlinear widening from very tight starting levels.

[1] Source: Factset – 31/01/20226

[2] Sources: Bloomberg©, ICE futures – 31/01/20226

[3] Source : HFRX – 31/01/20226