The global economic cycle is not ending yet – it is reshaping. Following a volatile first quarter and trade escalation at the start of April, May 2025 shows de-escalation amid numerous trade tariff headlines. Inflation is no longer falling in the US, remaining uncomfortably sticky, while it is drifting towards the ECB target in the Eurozone giving room for manoeuvre to the central bank. Growth is softening globally, yet the feared hard landing is deferred, not delivered.

Against this backdrop, market narratives continue to swing between optimism that a peak in US tariff rates have been reached on 2 April and fear that the final outcome will be a multiple of the 2.5% average US import tariff rate registered at end of 2024. Given the new phase of de-escalation by the US administration, our investment approach remains nimble and flexible and we have upgraded our allocation to risk assets. While European growth is clearly fragile, a willingness to put an end to fiscal frugality has been decided. The US is holding, but not without strains. And China’s economic rebound does not yet appear to be structural, pushing the authorities to the negotiation table with the US. Overall, as this is not a synchronised slowdown, patience is needed to see a clearer picture emerging from current record uncertainties and become even more constructive.

Incomplete Disinflation but Easing Financial Conditions

The inflation narrative is diverging regionally. In the US, disinflation momentum has stalled, particularly in goods, where renewed price pressures are visible at the production level. Conversely, in the Eurozone, headline inflation is drifting toward the ECB’s target, bolstered by energy base effects and a slowdown in consumer goods prices. Japan continues to experience a delicate transition from deflation to moderate inflation. In China, finally, deflationary forces will keep a solid grip on the economy as long as authorities do not achieve a credible restoration of consumer confidence. These diverging trends complicate coordinated central bank actions, reinforce bond market dispersion and could, ultimately, shape currency evolutions. The European Central Bank appears among the best positioned to use the room for manoeuvre opened by the fall in inflation to mitigate negative effects on growth from trade uncertainties with the US.

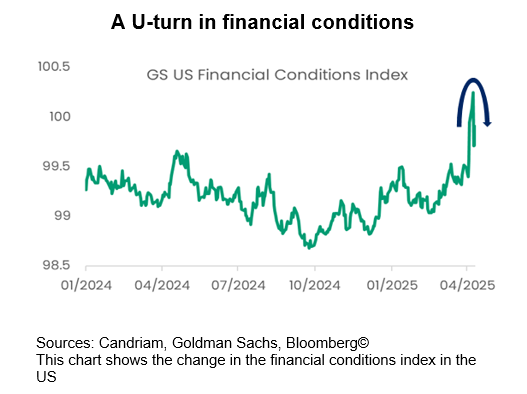

Contrary to last month, financial conditions have seen a notable easing, kick-starting the market recovery. As highlighted in recent data, credit spreads are narrowing, equity valuations have risen, and liquidity is returning to risk assets, driven by flows from retail investors and an increase in hedge fund exposures. This U-turn introduces renewed reflationary dynamics but, in return, further complicates the Federal Reserve’s ability to ease decisively. Notably, financial conditions have loosened while the FOMC May statement pointed to upside inflation and upside unemployment risks, raising the question of whether market optimism is premature or merely front-running macro inflection points. In a nutshell: the Fed’s cautiousness may be warranted as it faces policy lags and political uncertainty, and markets appear hesitant in timing expectations, shifting from three to four and back to only two expected cuts in the funds rate in 2025.

Four Reflationary Forces at Play

- Lower Tariffs. The US de-escalation following its self-inflicted pain by escalating trade tariffs since the start of the year has been well received by financial markets. Renewed trade talks and marginal easing of tariff regimes could support global trade flows and disinflation in goods. The US has begun unwinding select Trump-era tariffs, particularly in intermediate goods. China, under stimulus pressure, has also softened some import duties on high-tech components. While these shifts are incremental, they signal a departure from peak fragmentation.

- Market expectations for lower Fed Funds rates have accelerated during April before reversing in the second part of the month. Overall, cuts are now increasingly priced for the second half of 2025, powering asset reflation. Crucially, these expectations have outpaced the Fed’s own guidance, raising the risk of a market-policy disconnect. The easing narrative, built largely on cooling growth momentum, risks being challenged if tariff-led inflationary pressures or wage growth reaccelerate.

- Weaker US Dollar. The broad-based softening of the US dollar supports global liquidity and improves risk appetite, particularly in emerging markets. This also alleviates balance of payments pressures and stabilises capital flows in fragile markets. The weakening narrative, built largely on tariff escalation, could be challenged if tariff levels durably and credibly normalise again.

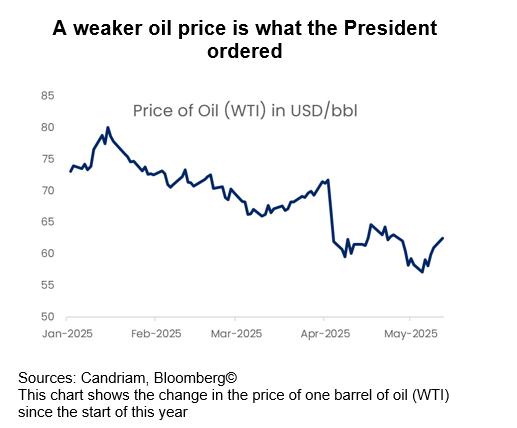

- Lower Oil Prices. Energy cost relief acts as a quasi-stimulus to households and businesses, reinforcing real income gains. Brent and WTI have both softened, driven by increased OPEC+ output and softer Chinese demand. However, geopolitical risks – especially in the Middle East – remain a wild card that could quickly reverse this dynamic.

Taken together, these four forces are creating a significant reflationary potential. While they support asset prices in the short term, they risk blurring the line between soft-landing optimism and premature exuberance. Patience will likely be required to see uncertainty reduce substantially from current record levels and lead to strong investment convictions.

Global Earnings Fatigue

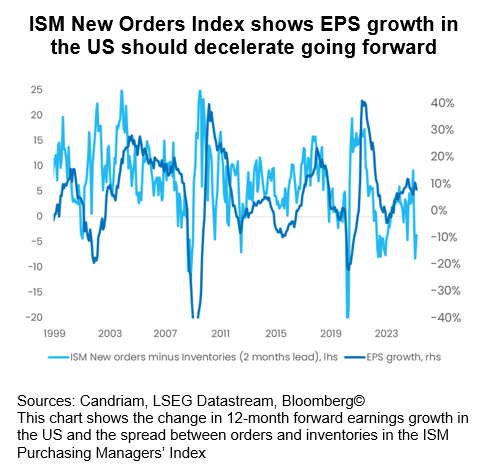

Economic uncertainty has now led to downward adjustments regarding corporate profits. While equity markets have shown a sharp recovery from post-“Liberation Day” lows, earnings growth is falling. EPS growth expectations are heavily dependent on trade war developments and could therefore shift again: At the current juncture, our US GDP growth projections lead us to project now +5% Earnings Per Share (EPS) growth in Y25 and +2% in Y26, well below consensus projections (+9.5% & 14.2%). Leading indicators, such as the ISM New Orders Index point to EPS deceleration going forward.

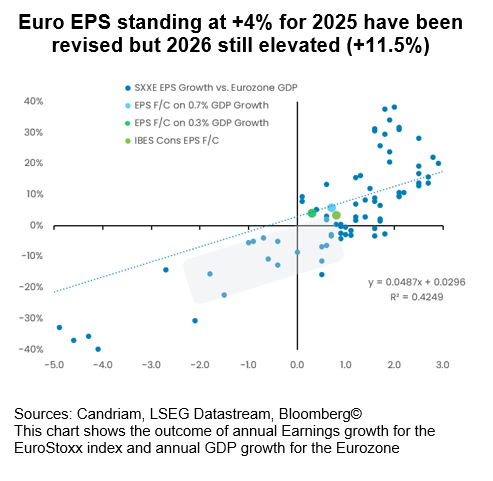

In Europe too, forward earnings revisions have turned negative. Eurozone EPS are now standing at +4% for 2025 and have been greatly revised but 2026 still looks elevated (+11.5%) in our view. However, valuations are in line with historical averages.

Investment opportunities: Repositioning in a Softening Tariff Stance

Our strategy is patient, regionally diversified, and centred on visibility. The cycle has not ended, but its contours have changed and a large range of fresh impulses are currently delivered. That requires a nimble approach and positioning not for momentum, but for transition.

- Equities: Neutral overall with no clear regional bias. The Trump administration shifted to damage control and de-escalation mode. Equity markets appear to have digested much of the macro stress, and we upgrade our positioning towards neutral. We think an overweight is not warranted yet as upside is capped without earnings support. As a result, we favour a well-diversified factor and sector approach. We also see opportunities in segments linked to European infrastructure and defence, which should continue to benefit from fiscal tailwinds.

- Fixed Income: Overweight duration in Europe. Neutral US Treasuries. Positive on core sovereigns. The ECB is expected to pursue its easing cycle. Inflation is falling, growth is weak, and the trade uncertainty is expected to leave some scars. Therefore, European fixed income continues to offer attractive entry points. Our overweight in European duration, particularly in core sovereigns, reflects this conviction. Peripheral spreads remain stable, with limited political noise ahead of the summer. We further note that the hedging cost for non-USD based investors has pushed European sovereign bond yields above their counterparts in the US.

- Slight underweight high yield. Spreads have finally widened and tightened back and HY credit technicals and fundamentals remain strong, leading us to upgrade the asset class by one notch from underweight to slight underweight. We remain cautious as policy uncertainty and sentiment represent important hurdles before re-entering the asset class more substantially.

- Gold as a Strategic Anchor: Gold remains a strong hedge in a world of geopolitical complexity and real rate volatility. Despite high nominal yields, demand for gold is buoyed by central bank purchases and a shift in reserve preferences. In addition, retail and ETF demand has strengthened as investors seek protection from macro tail risks. We maintain our overweight position.

- USD Peak, FX Opportunity: The dollar remains firm on a historical basis, but as Fed cuts are eventually delivered and growth weakens, we expect depreciation. We maintain overweight exposure to defensive currencies such as the Japanese yen and see opportunities in select EM FX where real yields are attractive and balance sheets are improving. This leads us to upgrade EM debt one notch from underweight to slight underweight.

- Alternatives and Market-Neutral Strategies: In light of persistent volatility and asymmetric market risks, we keep our allocation to market-neutral and alternative strategies. These approaches provide portfolio stabilisation and complement more traditional and directional exposures.

Candriam House View & Convictions

Legend

-

Strongly Positive

-

Positive

-

Neutral

-

Negative

- Strongly Negative

- No Change

- Decreased Exposure

- Increased Exposure

| Current view | Change | |

|---|---|---|

| Global Equities |

|

|

| United States |

|

|

| EMU |

|

|

| Europe ex-EMU |

|

|

| Japan |

|

|

| Emerging Markets |

|

|

| Bonds |

|

|

| Europe |

|

|

| Core Europe |

|

|

| Peripheral Europe |

|

|

| Europe Investment Grade |

|

|

| Europe High Yield |

|

|

| United States |

|

|

| United States |

|

|

| United States IG |

|

|

| United States HY |

|

|

| Emerging Markets |

|

|

| Government Debt HC |

|

|

| Government Debt LC |

|

|

| Currencies |

|

|

| EUR |

|

|

| USD |

|

|

| GBP |

|

|

| AUD/CAD/NOK |

|

|

| JPY |

|