The year opens with a global economy that is neither stalling nor accelerating decisively, but increasingly shaped by overlapping and, at times, conflicting forces. Growth has proven more resilient than expected, inflation has eased materially, and financial conditions are no longer restrictive across most developed markets. Yet uncertainty remains elevated – driven less by cyclical imbalances than by geopolitics, fiscal constraints, and institutional questions that are once again moving to the foreground.

Growth: As good as it gets

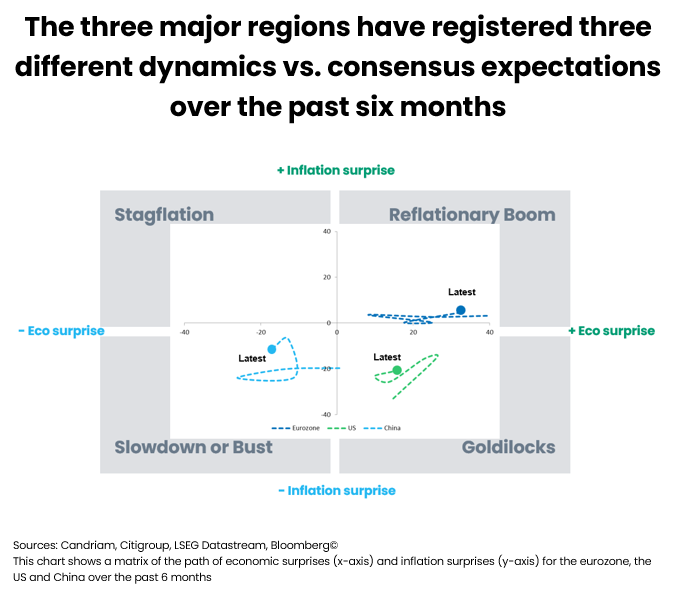

Global activity has remained resilient into year-end, buoyed by easing monetary policy and solid private demand, particularly in the United States. Momentum, however, is becoming less uniform. Survey data still point to expansion, but manufacturing continues to lag in most advanced economies, while services remain the main engine of growth – supportive in the near term, but less conducive to productivity gains and sustained upside surprises. In this environment, markets are likely to be driven less by a single macro-outcome and more by structural forces that persist across scenarios.

In the United States, growth continues to rest on private domestic demand, though its composition has shifted. Consumption is slowing as wage growth decelerates and confidence weakens, while investment – especially in AI-related infrastructure – has become the dominant driver. On balance, labour market conditions are not deteriorating as job creation has moderated, but unemployment has edged lower, and wage pressures are receding. Recession risks remain contained, but growth surprises are likely to be narrower and more selective. The implication for markets is clear: timing the cycle matters less than aligning with investment themes that remain valid even if growth slows or policy paths diverge.

The eurozone presents a subdued but stabilising or even improving picture. Growth has remained modest, with early signs of improvement in domestic demand as lower mortgage rates and easing inflation filter through. Labour markets remain resilient, supporting income, but elevated saving rates and weak confidence continue to cap consumption. External headwinds persist, leaving net trade unlikely to contribute meaningfully. In the past months, consensus expectations have been so dismal that even a mediocre growth rate was sufficient to surprise positively. We continue to expect that fiscal policy should provide some offset in 2026 (most visibly through Germany’s fiscal pivot) but implementation will be gradual, pointing to a slow recovery rather than a decisive rebound.

China remains a source of asymmetry in the global outlook. Policy support is stabilising headline growth, but underlying dynamics remain weak. Property adjustment, subdued corporate investment incentives, and persistent deflationary forces continue to weigh on domestic demand. External trade is unlikely to provide the same offset as in previous cycles, particularly in a world marked by strategic rivalry with the United States. As a result, the economic releases have systematically surprised on the downside in H2 2025. For investors, this reinforces the need to move away from broad, beta-driven emerging-market exposure toward targeted themes linked to strategic supply chains and capital spending priorities.

Inflation: How much further can rate cuts go?

Inflation dynamics have shifted decisively. Disinflation has progressed further than expected across developed economies, moving policy debates away from price pressures toward the limits of monetary easing.

In the United States, inflation is converging toward target, supported by easing wage growth and lower oil prices. Two further Fed cuts are expected in 2026, but the path is increasingly contested. This is not because inflation credibility is in doubt, but because institutional credibility has become part of the debate. The renewed tensions between the administration and the Federal Reserve, combined with an upcoming change of Chair, have revived concerns around central bank independence. Markets are not pricing a return of inflationary pressure; instead, they are pricing higher term premia, reflecting uncertainty around fiscal dominance, rising deficits, and political influence over monetary policy. This helps explain why long-term US yields remain elevated even as policy rates are expected to fall.

In the eurozone, the ECB has reiterated confidence that policy is appropriately calibrated. We agree. Inflation has returned to target, core pressures are easing, and wage growth is slowing. 2026 is expected to deliver sub-2% consumer price inflation in the region. The ECB is therefore expected to remain on hold through 2026, with a high bar for further cuts and little appetite for tightening. Monetary policy is no longer a tailwind, but it is no longer a headwind either. Japan remains an exception, with more entrenched inflation and improving wage dynamics prompting gradual policy normalisation, i.e. rate hikes.

As inflation concerns recede, attention is shifting toward fiscal sustainability and term premia. High deficits are no longer a temporary policy response but a structural feature. In the United States, rising deficits, looming mid-term elections, and institutional uncertainty keep term premia elevated. In Europe, fiscal risks are more fragmented but still relevant, particularly in parts of the semi-core. In our portfolios, government bonds continue to play a role as diversification and downside protection, but they are no longer a simple duration call. Returns increasingly depend on fiscal credibility and political stability, not just inflation and growth.

Multi-Asset allocation: Staying invested despite geopolitics

Against this backdrop of resilient growth and inflation converging towards central bank targets, we remain overweight in equities, with a balanced regional allocation that prioritises earnings visibility over exposure dependent on further economic acceleration. Our strongest conviction for 2026 is that markets will be driven less by cyclical turning points and more by long-term investment forces. Technology-linked investment, electrification, defence, and infrastructure are not cyclical rebounds; they reflect strategic capital spending decisions driven by geopolitics, security concerns, and productivity gains. These forces underpin earnings visibility – double-digit consensus profit growth expectations for 2026 on both sides of the Atlantic – and justify staying invested into 2026.

In the United States, technology remains a core allocation, buoyed by earnings leadership, strong balance sheets, and sustained investment in AI-related infrastructure. This is not a bubble: valuations are elevated, but they are underpinned by tangible cash flows and a real investment cycle. Momentum may slow and dispersion increase, but technology remains a structural allocation rather than a late-cycle excess. In Asia, exposure focuses on cost-efficient AI and semiconductor leaders, where valuations are more compelling and policy support more targeted.

In Europe, equity opportunities are increasingly shaped by fiscal choices. Geopolitical fragmentation has exposed the cost of dependency – in energy, defence, semiconductors, and raw materials – and has triggered a strategic reorientation of public spending. Programmes focused on infrastructure, defence, and industrial resilience support a constructive stance on Industrials, with a particular focus on German mid-caps that benefit from localisation and public investment visibility. After years of scepticism, Europe has the potential to deliver growth in 2026.

These themes extend beyond equities. Electrification, AI-related investment, defence spending, and infrastructure renewal are overlapping forces that together underpin demand for base metals. The recent rise in metal prices reflects the convergence of cyclical recovery, sustained AI capex, rising defence budgets, and the long-term requirements of the energy transition, compounded by persistent supply constraints. In contrast, oil remains more exposed to ample supply and uneven demand, reinforcing a selective commodity stance.

Fixed income plays a dual role in this environment. Duration has regained relevance as portfolio insurance amid easing inflation, late-cycle dynamics, and rising uncertainty. At the same time, historically tight spreads across developed-market credit limit return potential and shift the focus toward carry rather than compression. Our strongest conviction lies in emerging-market debt, supported by a weaker US dollar, ongoing central bank easing, improving commodity demand, stabilising trade dynamics with the United States, and a gradual recovery in investment flows. Compared to developed credit, EM debt still offers a more attractive balance of yield and fundamentals.

Geopolitics: uncertainty remains a defining feature in 2026

Tensions involving Ukraine, the Middle East, Iran, and Venezuela show little sign of rapid resolution, while the global political calendar is dense, with key elections scheduled across advanced and emerging economies. Geopolitical opposition is no longer a tail risk; it is a structural regime. For investors, this reshapes opportunity rather than destroying it, but it demands selectivity. In this context, precious metals retain a strategic role in the multi-asset portfolio, supported by declining real yields, reserve diversification, and elevated political risk.

In FX, these views are expressed through relative positioning rather than directional bets. Expectations of a softer US dollar are reflected in currencies linked to structural demand for commodities and capital goods. In particular, the preference for a “long base metals, short oil” stance is expressed through a positive view on the Australian dollar versus a negative view on the Canadian dollar, and a tactical long Japanese Yen.

Overall, portfolios remain fully invested but intentionally constructed. The objective is not to maximise exposure to a single macro-outcome, but to align allocations with forces likely to persist across scenarios: resilient but uneven growth, decelerating monetary easing, rising geopolitical tensions, and a capital spending cycle increasingly shaped by technology, security, and the energy transition.

Candriam House View & Convictions

Legend

-

Strongly Positive

-

Positive

-

Neutral

-

Negative

- Strongly Negative

- No Change

- Decreased Exposure

- Increased Exposure

| Current view | Change | |

|---|---|---|

| Global Equities |

|

|

| United States |

|

|

| EMU |

|

|

| Europe ex-EMU |

|

|

| Japan |

|

|

| Emerging Markets |

|

|

| Bonds |

|

|

| Europe |

|

|

| Core Europe |

|

|

| Peripheral Europe |

|

|

| Europe Investment Grade |

|

|

| Europe High Yield |

|

|

| United States |

|

|

| United States |

|

|

| United States IG |

|

|

| United States HY |

|

|

| Emerging Markets |

|

|

| Government Debt HC |

|

|

| Government Debt LC |

|

|

| Currencies |

|

|

| EUR |

|

|

| USD |

|

|

| GBP |

|

|

| AUD/CAD/NOK |

|

|

| JPY |

|