Global markets enter November with better visibility than at any point this year – growth stronger than expected, inflation lower than expected and policy still broadly supportive. While the immediate outlook remains clouded after weeks of patchy data and hesitant sentiment, the outlines of the next few months are coming into view. As activity has held up and price pressures are easing, volatility has remained in check. Investors will soon no longer navigate by guesswork; they should see enough of the road ahead to accelerate gradually, with more confidence.

Visibility gradually returning, but not yet restored

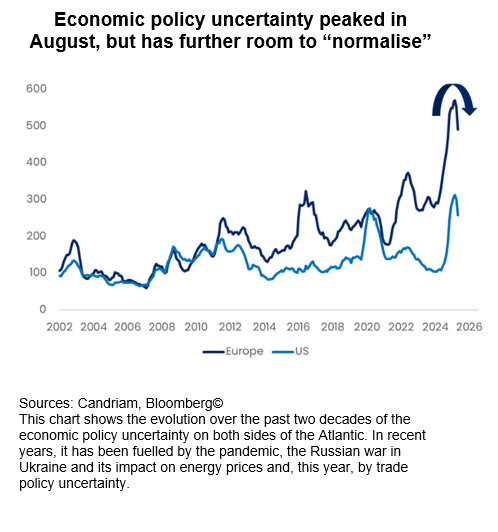

Uncertainty peaked in August and has since subsided. Policy risk has eased, financial conditions have improved, and even geopolitical headlines now carry less shock value. A year after a presidential election that promised turbulence, the macro backdrop looks steadier, not shaken. For markets, this matters: the balance between caution and opportunity is shifting towards risk-taking.

The global economy continues to prove itself to be more resilient than consensus expected in the dark days of Liberation Day last April. Since then, growth in the US and Europe has surprised to the upside, and US inflation, once feared to rise above 4%, should peak around 3.75% at the turn of the year. Economic and inflation surprises have flipped polarity – activity printing stronger, inflation weaker. This combination has restored the credibility of our soft-landing scenario and, in doing so, extended the shelf life of the current expansion.

The Fed’s dilemma

At the same time, broader policy architecture is becoming clearer, even if the paths diverge. After its back-to-back cuts in September and October, the Federal Reserve has entered the next phase of the cycle: gradual, conditional easing that reassures markets without reigniting speculation. The ECB describes its stance as “in a good place,” signalling comfort with the current level rather than any bias to move. After years of yield suppression, the Bank of Japan is cautiously preparing its next tightening step. Central banks are clearly no longer moving in lockstep – but that, paradoxically, is what stability looks like. Divergence has become a marker of normalisation rather than a source of anxiety.

The Fed, however, finds itself easing into opacity. The record-long government shutdown and ensuing data blackout left policymakers without their usual compass. For the first time since 1919, no monthly CPI report will be released for October; the monthly jobs survey, continuous since 1948, has also gone missing. Who would have imagined a blank page in modern economic history?

In theory, such an absence should have strengthened the case for a December cut: no new evidence, no reason to alter the dovish bias set out at Jackson Hole and confirmed in the September dot plot. Yet the opposite has occurred. The October press conference revealed deeper division within the FOMC and recent Fedspeak has added to the cacophony. Chair Powell’s appeal to gradualism – his “driving in the fog” metaphor – implied that uncertainty now calls for patience, not action. The logic is counterintuitive but reflects the current dilemma Chair Powell finds himself in: while he has a majority of the 12 voters for December if he decides to deliver the cut, he risks three, four or even five dissents – just as he risks three governor dissents if he decides to skip.

This is quite unprecedented, as Fed policy – unlike that of the Bank of England – is shaped by the chairman in dialogue with individual FOMC participants and the Committee. This process builds a consensus, a central view most can live with. The markets, for now, are granting the benefit of the doubt – but the credibility of the easing path will depend on how quickly the Fed reclaims the narrative once data resumes. And, of course, this easing path will be necessary to ensure the smooth financing of the massive capex spending within the AI ecosystem.

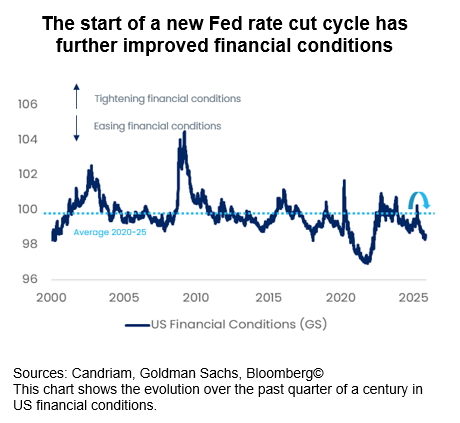

So far, however, renewed monetary easing has restored flexibility to the system. US financial conditions are now looser than their long-term average, reflecting the October rate cuts and stable credit markets. Liquidity is ample, volatility subdued, and the bond market’s message is consistent: the economy is cooling gently, not contracting.

Credit remains healthy: investment grade offers stable carry with minimal volatility; high yield has tightened beyond fair value, justifying our neutral stance. We continue to prefer quality over stretch – European IG over HY, EM debt over developed credit. Emerging-market debt, in particular, is benefiting from high real yields, falling US rates and a weaker dollar.

We also remain constructive on core-European duration, notably in Bunds, which continue to serve as both hedge and income anchor. We identify a structural story that remains one of balance: lower inflation, higher nominal growth and less policy interference.

Clarity returns elsewhere

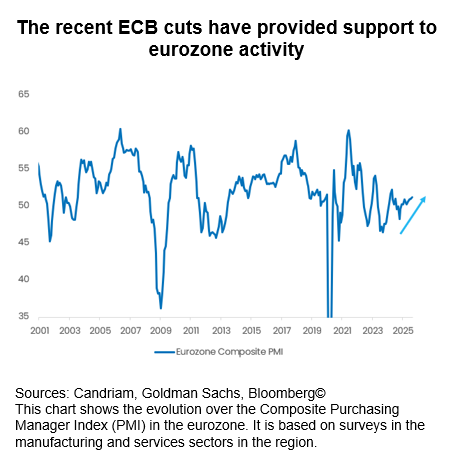

Beyond the Fed’s fog, visibility is gradually improving, as markets climb a wall of worry. Europe’s narrative is turning more optimistic, from outright negative. Economic uncertainty has peaked and has further room to normalise, while composite PMIs are back above 50 points, signalling a gradual expansion after two years of lacklustre growth. Manufacturing remains subdued but is no longer contracting, and services are regaining momentum. Fiscal policy – led by Germany’s stimulus and EU recovery funding – provides a tailwind. Inflation is back at target, allowing the ECB to stay patient without being defensive. Political risk, so prominent mid-year, has eased. Credit spreads have retraced, and Bund yields are trading in a narrow 2.5–2.8% corridor. Stability has returned as the region’s defining feature. The combination of policy visibility and improving earnings growth from negative territory make European equities an attractive overweight within global portfolios.

China’s medium-term outlook is calmer too. The trade truce with Washington reached at the end of October has made the next year more predictable, while domestic demand has not yet shown signs of stabilisation. The structural rivalry with the US endures, but the focus has shifted from crisis containment to managed rebalancing. Even deflation remains a constraint, not a spiral.

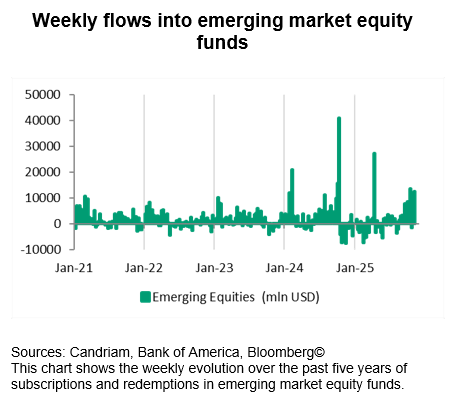

Emerging markets are seeing renewed inflows after a long period of hesitation. Capital has returned as the US dollar weakens and risk appetite broadens. Stronger current accounts and disciplined monetary policy provide a firm base. Asia leads, with Korea and India regaining traction, while Latin America continues to benefit from high carry, improving fiscal discipline and steadier trade flows.

These same dynamics support EM fixed income. Sovereign and corporate spreads offer attractive real yields relative to developed markets, while contained issuance improves technical factors. These factors justify our overweight on EM debt, complementing equity exposure in the same regions.

The Bigger Picture - clearer, not clear

The macro landscape at the end of the first year of the Trump II administration is strikingly ordinary – and that is precisely its strength. Inflation expectations stand at the same level as in November 2024; unemployment remains low; and growth in activity continues. The dramatic scenarios imagined earlier this year have not materialised. Tariffs have now stabilised (at high levels), fiscal policy has become more predictable, and global trade continues to adapt rather than fracture. The world feared a structural break, but has delivered only cyclical adjustment.

Markets have responded swiftly. Risk assets have rallied without exuberance. Outside the AI ecosystem, valuations reflect confidence, not euphoria. Credit spreads are tight, volatility low, and cross-asset correlations back to pre-pandemic norms. Investors are once again trading fundamentals, not politics. Familiarity has returned to market behaviour – and after years of shocks, that normalcy is probably its most notable achievement.

The coming months will test how far the new visibility extends. Data gaps and internal debate still cloud the Fed’s path, Europe’s recovery remains modest, and China’s growth trajectory is uneven. Given doubts about the Fed’s cautious easing, expensive valuations in the AI ecosystem and an ongoing market rally during the Q3 earnings season, we tactically trimmed the portfolio beta while maintaining a constructive outlook for equities. The medium-term macro direction is supportive: better growth, lower inflation and more stable, less erratic policy. We continue to position for this environment – overweight equities, long Bund duration, overweight EM debt, neutral high yield and a moderate underweight in the US dollar. Also, precious metals remain a useful hedge in a world where visibility has improved, but is not perfect.

Candriam House View & Convictions

Legend

-

Strongly Positive

-

Positive

-

Neutral

-

Negative

- Strongly Negative

- No Change

- Decreased Exposure

- Increased Exposure

| Current view | Change | |

|---|---|---|

| Global Equities |

|

|

| United States |

|

|

| EMU |

|

|

| Europe ex-EMU |

|

|

| Japan |

|

|

| Emerging Markets |

|

|

| Bonds |

|

|

| Europe |

|

|

| Core Europe |

|

|

| Peripheral Europe |

|

|

| Europe Investment Grade |

|

|

| Europe High Yield |

|

|

| United States |

|

|

| United States |

|

|

| United States IG |

|

|

| United States HY |

|

|

| Emerging Markets |

|

|

| Government Debt HC |

|

|

| Government Debt LC |

|

|

| Currencies |

|

|

| EUR |

|

|

| USD |

|

|

| GBP |

|

|

| AUD/CAD/NOK |

|

|

| JPY |

|