European equities: Still on the rise

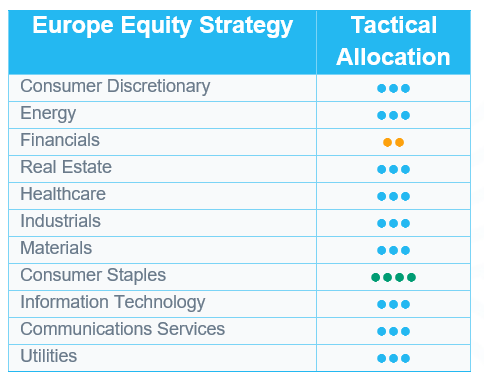

European equities rose in September, buoyed by broader global gains supported by the Fed’s rate cut. European macro data was mixed, with PMI indices continuing to point to moderate growth while demand remains sluggish. The best-performing sectors in Europe were Technology (driven by semi-conductors), Industrials (driven by defence, rallying on heightened Russia/Ukraine tensions after ceasefire talks failed) and Consumer Discretionary, while the worst performers were Consumer Staples, Energy and Communication Services.

European equities rose in September, buoyed by broader global gains supported by the Fed’s rate cut. European macro data was mixed, with PMI indices continuing to point to moderate growth while demand remains sluggish. The best-performing sectors in Europe were Technology (driven by semi-conductors), Industrials (driven by defence, rallying on heightened Russia/Ukraine tensions after ceasefire talks failed) and Consumer Discretionary, while the worst performers were Consumer Staples, Energy and Communication Services.

Outstanding IT performance

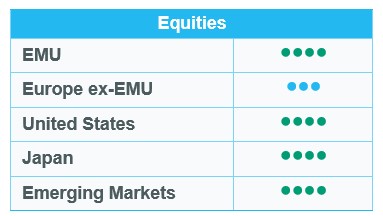

Since our last committee in September, European markets have continued to progress, in line with US equities. This good performance was driven by large caps, but small and mid-caps also followed a positive trajectory. Within large caps, growth stocks outperformed value stocks.

There was no clear performance dispersion between defensives and cyclicals.

Among defensives, the best performers were Healthcare (benefiting from improved US policy clarity) and Utilities. The Energy sector also improved, while Consumer Staples posted a negative absolute return (with the worst performances coming from the spirits segment, impacted by lower Chinese demand and higher US higher tariffs).

Among cyclicals, the best-performing sectors were Consumer Discretionary (driven by the luxury segment) and Industrials (driven by the defence segment). Financials remained on a positive trend, while Real Estate and Materials remained broadly stable.

Lastly, the IT sector posted a stellar performance, driven by ASML, which benefited from positive news regarding AI development. Conversely, Communication Services have been in the red in recent weeks.

Earnings expectations & valuations

EPS growth expectations in Europe for 2025 have been cut again and have now turned negative, at -0.2% (vs +0.3% four weeks ago). Consensus still expects 2025 EPS growth to be driven by Real Estate (+11%) and Healthcare (+9%), while many sectors are suffering on the back of negative earnings growth expectations (Consumer Discretionary, Energy, Materials, Communication Services, Consumer Staples, Utilities). However, consensus has revised its 12-month EPS growth forecast upwards to +9.4% (vs +8.4% previously).

Since our last committee, European valuation multiples have increased, with 12-month forward P/E now at 15.1x (vs 14.7x), at the high end of the historical range. IT and Industrials remain the most expensive sectors (27.9x and 21.6x, respectively), while Energy is still the cheapest (10.1x).

Several upgrades

We have implemented the following upgrades:

- Consumer Durables & Apparel (Level 2): from neutral to +1.

We are more constructive on the luxury segment (LVMH, Richemont): tariffs increase absorbed by pricing power, stabilisation of revenue growth and positive outlook for 2026.

- Pharma (Level 2): from neutral to +1.

Despite the low visibility on company deals with the US administration, we are turning more positive as this segment is under-owned and supported by the short-term strengthening of the USD. It also benefits from an attractive valuation following a significant underperformance year-to-date.

- Metals & Mining (Level 2): from neutral to +1

Positive trends in Mining (gold, silver, copper, aluminium). We favour Antofagasta, Anglo American and, to a less extent, Rio Tinto (mixed trend of iron ore).

US equities: Technology leads the equity rally

US equities extended their strong momentum in September, buoyed by continued investor optimism. The Information Technology sector once again played a pivotal role in driving market gains. Meanwhile, the Federal Reserve’s rate cut came on the back of signs of a cooling labour market, coinciding with surprisingly robust economic data.

Risk appetite remained firm

US equity markets have continued to perform well since the last committee, supported by sustained investor optimism and the Federal Reserve’s rate cut. Small and mid-cap stocks outperformed large caps, helped by easing financial conditions and improving growth expectations.

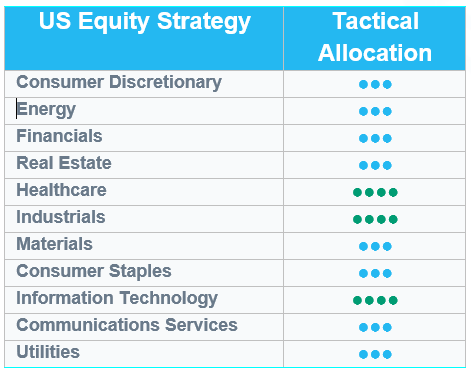

Performance was mixed at sector level. Healthcare, Industrials and Information Technology led gains, advancing strongly amid continuing momentum in the artificial intelligence theme. Healthcare benefited from increased policy clarity and reduced regulatory uncertainty. Utilities extended their strong run, supported not only by the rate cut but also by rising energy demand linked to AI data centres.

In contrast, Consumer Staples lagged sharply, while Real Estate also underperformed despite lower yields.

Strong earnings

US earnings growth remains solid, with expectations for the next 12 months still around 12%, supported by broad-based positive revisions. The strongest contributions continue to come from Information Technology and Communication Services, both benefiting from robust demand and structural trends around AI and digital transformation. Industrials and Financials also show healthy earnings trajectories, while Energy remains the key laggard amid declining profit forecasts.

Earnings revisions were positive, mostly led by Information Technology, reflecting strong earnings visibility. We also saw positive revisions in Financials and Healthcare, where improved policy clarity has reduced uncertainty.

Despite elevated valuations in some growth sectors, the overall S&P 500 12-month forward price/earnings ratio of 23 remains within its recent range and is supported by resilient profit growth expectations. It remains above its 10-year average.

No sector allocation changes

We have maintained our allocation unchanged, continuing to overweight Industrials, Technology and Healthcare. Both Technology and Healthcare remain supported by solid earnings momentum, strong fundamentals and attractive long-term growth drivers. Industrials are benefiting from companies’ reshoring efforts and expectations of accelerating US manufacturing activity.

Healthcare has performed very well since our upgrade in early September, benefiting from renewed investor confidence following greater policy clarity and easing regulatory concerns.

We see no reason to change our current positioning for the time being.

Emerging equities: Once again outperforming developed markets

In September, emerging market equities pressed higher (+7% in USD), outperforming developed markets (+3.1%). The Fed delivered a 25-bps cut, and oil slipped, creating a more accommodating environment for emerging market importers. At the same time, gold surged to another high – an expression of central bank demand and ongoing hedging against policy and geopolitical noise.

Asia (+7.3%) led the advance, fuelled by the continued strength in semiconductors and internet platforms. China (+9.5%), Taiwan (+9.2%) and Korea (+10.3%) all advanced. Multiple trends supported growth, such as heavy AI investment, quick AI adoption and China’s determination to seek technical independence. Meanwhile, India (+0.4%) was flattish. Expectations were initially boosted by a significant tax cutting programme, but sentiment was then dampened by geopolitical news from the US, including a large rise in application fees for talent visas (USD 100k), and more tariffs on pharma imports into the country.

Latin America joined the global risk rally in September on the back of domestic macro positivity and defensiveness against a volatile geopolitical context. Peru led convincingly (+12.8%), while Mexico (+9.6%) and Brazil (+5.2%) followed. In the Middle East, Saudi Arabia (+8.8%) contemplated easing restrictions on the foreign ownership of listed equities, which could trigger new inflows and a rise in its weight in the index.

Among commodities, gold and silver rose by 11.9% and 16.0% respectively. Copper also trended upwards, rising by 7.5%. Brent declined by 1.6%. US yields finished the month at 4.16%.

Outlook and drivers

Emerging market equities have enjoyed a strong year so far, marking one of their best performances in recent memory. This rally has been supported by a weaker US dollar and a shift towards global monetary easing, both of which have improved liquidity conditions and investor appetite for risk assets. After several years of relative underperformance, emerging markets now appear to be entering a more constructive phase, with the potential for a sustained reversal in sentiment. The technology sectors in Taiwan and Korea have been key performance drivers, benefiting from the global AI and semiconductor upcycle, while signs of stabilisation and renewed policy support in China are also contributing to a more optimistic outlook.

The US and China are showing more willingness to re-engage after a prolonged period of strained relations. In Washington, President Trump signalled progress on the TikTok issue. While the deal has not yet closed, the cooperative tone marks a shift towards pragmatism on a highly visible dispute. Regarding high-level diplomacy, a Trump-Xi meeting could be arranged at the APEC summit in late October, which would represent their first face-to-face encounter in several years.

China’s household savings rate remains high. The result is a systemic tilt towards production rather than consumption. Yet this vast pool of savings also represents an untapped reservoir of domestic demand for stocks. Unlocking it through welfare reform and stronger social protections could gradually shift the balance towards consumption, providing a durable source of growth, while reducing the economy’s vulnerability to investment-driven cycles. The topic could be a focus on the upcoming Fourth Plenum in October, where any concrete steps towards social welfare reform and household rebalancing could provide early signals as to whether this long-anticipated transition is finally being set in motion. Trade negotiations continue, with US-China meetings in Madrid and a possible Xi–Trump encounter at the APEC summit in South Korea.

In Korea, the Democratic government is strongly committed to further implementing the “Value-up” programme. This could significantly strengthen minority shareholder rights and curtail related-party transactions and opaque accounting practices. Such a change would represent a structural improvement, moving governance reform from reactive oversight to embedded accountability, which will ultimately offer the prospect of a more durable re-rating cycle, positioning Korea’s market on a firmer, more sustainable footing. In the meantime, thriving investment themes in Korea are also helping to lift sentiment, including electricity grids, nuclear infrastructure and “K-culture”, including Korean specialty food and beauty products, etc. After a brief consolidation, the KOSPI hit fresh all-time highs, driven by renewed foreign buying in Samsung Electronics (SEC) and SK Hynix, as sentiment shifted from HBM qualification risks towards a broader DRAM (dynamic random-access memory) upcycle.

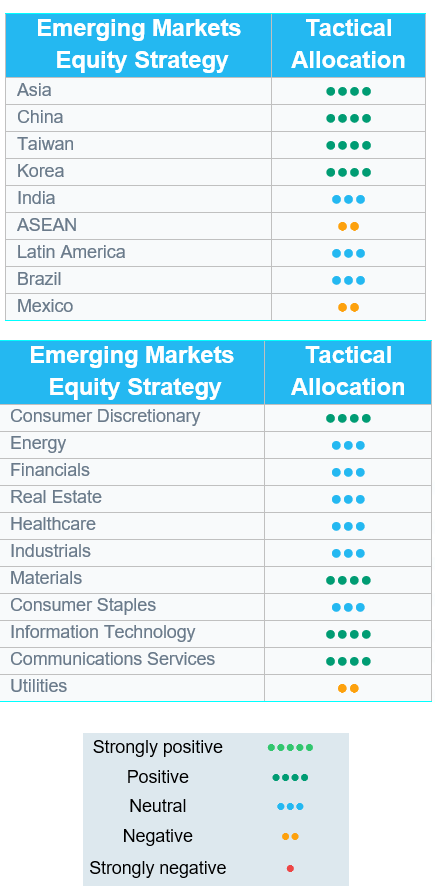

Positioning Update

For regional ratings, we upgraded Korea from neutral to overweight for several attractive investment themes: technology uptrend, industry revitalisation (shipbuilding, defense and nuclear), and the Value-up programme. We downgraded ASEAN from neutral to underweight, due to the continued weakness shown in the region.

For sector ratings, we downgraded utilities from neutral to underweight owing to weak fundamentals. We downgraded software & services, a sub-sector in Technology, from neutral to underweight. President Trump’s announcement of a significant rise ($100k) in H1-B application fees impacted sentiment.

Regions

China overweight

Our China overweight continues to work: equities have risen approximately 40% YTD (USD), even as the market remains the largest underweight in EM portfolios. Support comes from improving sentiment, liquidity inflows and selective earnings strength. Valuations are edging above the long-standing 8–12x band, hinting at a structural re-rating anchored in tech self-sufficiency and AI leadership. The AI narrative has shifted towards China on semiconductor localisation and platforms such as DeepSeek.

Recent field trips to China and Korea confirm rapid gains in EVs, AI, robotics and humanoids. Despite soft macro data, earnings momentum and liquidity dominate market behaviour. Major internet names, such as Tencent and Alibaba, are leading the way. Alibaba’s move to in-house AI inference chips reinforces the turnaround.

Policy support remains incremental (focus: October Politburo, 4th Plenum). Active US–China talks in Madrid and a potential Xi–Trump meeting at APEC could lift sentiment.

Korea raised to overweight

After a brief consolidation, Korea’s KOSPI has surged to record highs, supported by renewed foreign buying in Samsung Electronics and SK Hynix. Investor sentiment has shifted from fears of HBM (high bandwidth memory) qualification risks to optimism about a new DRAM (dynamic random access memory) supercycle. Industry checks confirm record-low inventories and tight supply, with capex redirected toward high-bandwidth memory lines, driving DRAM spot prices higher than anticipated.

Beyond semiconductors, Korea’s “sexy cyclicals” (shipbuilding, defence and nuclear power) are also enjoying a valuation re-rating. President Lee’s “KOSPI 5000” vision, coupled with stronger corporate governance and rising shareholder payouts (the “Value-up” programme), further enhances Korea’s investment appeal.

India tactical underweight

We remain cautious on India. Valuations are demanding, and sentiment appears overextended relative to earnings growth.

Latin America tactical underweight

In Latin America, our stance is more nuanced. Brazil has been rangebound, recently underperforming despite favourable tailwinds from a weaker USD and the central bank’s easing cycle. Local politics remain the key swing factor, while valuations are fair but lack a strong catalyst. We continue to favour domestic cyclicals and rate-sensitive names pending clearer macro momentum.

Mexico, by contrast, continues to underperform, in line with our underweight call. After an early-year rally left valuations stretched, fading growth data and weak US demand have tempered enthusiasm. Until we see tangible policy or macro improvement, we remain defensive.

ASEAN downgraded to underweight

We downgraded the region as we prefer other choices in emerging markets. The ASEAN region (Philippines, Malaysia, Indonesia and Thailand) shows continued weakness.

Sectors

Utilities downgraded to underweight

We downgraded Utilities from neutral to underweight. The sector’s fundamentals remain soft, with negative earning revisions.

Industrials – Capital goods

Within the sector, we prefer defence names, which continue to grow amid rising demand for European autonomy. Emerging country partners, such as South Korea, benefit from strong expertise and advanced production capabilities, positioning them to capture significant potential. Additionally, several robotics companies within the sector are leveraging technological development to deliver innovation and performance.

Software & Services (sub-sector in Technology) downgraded to underweight

We downgraded software & services, a sub-sector in Technology, from neutral to underweight. The US administration has imposed a $100,000 fee on each new H-1B application. This materially undermines the offshore/onsite delivery model: new projects face higher all-in costs, tighter staffing and travel constraints, and greater execution risk. With the US typically contributing roughly up to half of revenues for leading Indian IT vendors, the policy directly compresses margins and complicates delivery, and has already pressured share prices. Tactically, the downgrade reduces our beta to this policy risk, because Indian IT names constitute a large share of this sub-sector within Technology.

We already moved the sub-sector from overweight to neutral a few months ago. The new fee is the catalyst to move to underweight, and we will remain defensive until the visa framework stabilises.

Our most important call this year has been the overweight in Technology, initiated in April when policy clarity emerged following President Trump’s shift on tariffs. Since then, the sector has entered a period of explosive growth. The current rally is underpinned by trillions of dollars in real investment and tangible productivity gains.

AI has moved beyond hype into structural adoption. We believe this is not merely a cycle but a multi-decade investment theme, reshaping capex priorities globally. Hardware innovation, semiconductor localisation and the race for computational efficiency all continue to support earnings revisions and valuation reratings across Korea, Taiwan and China.