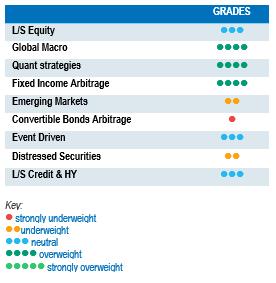

In 2022, the markets repriced risk premiums in financial assets, quickly adjusting to the inflation risk and to the interest rate hikes implemented by central banks that followed. The investment mantra shifted from TINA[1] to TARA[2], as bond yields and equity premiums started to price some interesting entry points. We would argue that we should not forget DIVA (Diversification is a valuable alternative). The markets’ current volatility and unpredictability is generating and will continue to generate opportunities for alternative strategies, which can nicely complement long-term investment allocations to equities and bonds.

In 2022, the markets repriced risk premiums in financial assets, quickly adjusting to the inflation risk and to the interest rate hikes implemented by central banks that followed. The investment mantra shifted from TINA[1] to TARA[2], as bond yields and equity premiums started to price some interesting entry points. We would argue that we should not forget DIVA (Diversification is a valuable alternative). The markets’ current volatility and unpredictability is generating and will continue to generate opportunities for alternative strategies, which can nicely complement long-term investment allocations to equities and bonds.

The markets continued to rally strongly throughout November, driven by, among other things, better than expected inflation prints, a quicker than expected re-opening in China and plummeting energy costs. Equity indices did well overall, with Chinese and Hong Kong equities leading the charge with high double-digit growth. Fixed income indices also did well, with sovereign yields on long-term maturities decreasing by over 50 bps and corporate credit spreads tightening significantly. The commodity futures market was mainly marked by falling prices on energy, as mild temperatures extended their stay in Europe. On the currency front, the dollar reversed some of the strong gains it had posted since the start of the year versus currencies such as the RMB, the pound and the euro.

The HFRX Global Hedge Fund EUR returned -0.04% over the month.

Long-Short Equity

Performances for long-short equity strategies were mixed over the month. The strong rally in equities did not benefit market neutral and low-net exposure strategies due to the strong outperformance of short books. In terms of positioning, US strategies were net buyers of cyclicals and sellers of defensive sectors. Managers with a focus on Asia added risk, buying Chinese and Hong Kong equities, and adding long exposure in consumer discretionary and financials. Flows to European and Japan equities were more muted. Gross and net exposures are stable, and far from the early-2021 peaks. During November, long-short funds with a focus on the Greater China region outperformed their American and European peers. However, since the start of the year, European long-short funds have posted the best average performances, returning slightly negative returns, whereas Asian and North American funds were on average down, offering negative mid-single returns. Market inflexion points are sometimes tricky for long-short equity strategies due to low intra- and inter-sector dispersions. However, challenges are pilling up for corporations in the world post-Covid and post-QE, and the number of safety nets is shrinking. We think a long-short equity strategy is an interesting approach to extracting alpha from picking the winners and losers in a world where fundamentals are gaining traction.

Global Macro

On average, global macro strategies were slightly negative over the month, as many were not positioned to ride a strong risk-on market movement. Funds were low on risk, as they waited to see how the market would react to the first positive signs of inflation slowing down. Many expected a rebound, but few expected such a strong rally. Overall, the contribution to performance from global macro funds has been positive since the start of the year. A good fund has managed to monetise moves on equities, rates and currencies during the repricing of risk premiums and limit losses during inflexion points. Going into 2023, some strategies have started adjusting their portfolios to an economic recession, adding short equity and long bond positions. We think that the opportunity set for Global Macro strategies has improved, and is expected to remain better for the foreseeable future.

Quant strategies

November was tough for the star performers of the year. Trend-following strategies generated negative returns across the board, accumulating losses in equities, rates, currencies and commodities. Despite this poor performance for the month, since the start of the year, trend-followers have been excellent diversifiers, contributing positively to portfolios monetising market moves on all the main asset classes. Multi-strategy quantitative managers printed on average negative, but modest, returns.

Fixed Income Arbitrage

While central banks across the world apart from Japan’s are maintaining their stance to tackle inflation, the pace and the magnitude at which they will act seems less clear than it was. Hence, the long end of the curve across countries is behaving more awkwardly. After last month’s significant risk reduction, managers stayed cautious and posted sub-average performances compared to previous months. However, as volatility remained high, fixed income RV managers benefitted from healthy opportunities both in Europe (France, Germany) and the US.

Emerging Markets

Hedge fund indices for Emerging Market strategies were positive for the month. Downward moves on US Treasury yields and China’s earlier than expected reopening were two important drivers that boosted market sentiment. However, performances were dispersed depending on the managers’ area of focus. This strategy offers selective investment opportunities, but we remain overall cautious for the moment, as decreasing growth expectations and rising interest rates in developed markets are warning indicators for the region.

Risk arbitrage – Event-driven

Merger arbitrage strategies had a difficult month due to the termination of the Rogers Corp / Dupont De Nemours deal. The deal was still subject to closing conditions, including regulatory approval by the State Administration for Market Regulation of China (SAMR). The merger agreement provided parties with the possibility to terminate it if it had not closed on or before 1 November 2022, and Rogers Corp announced its termination. Special Situation strategies or books were on average positive contributors to performance, helped by the market tailwind. Merger Arbitrage strategies are relatively well insulated from rising rates, since deal spread risk premiums tend to incorporate higher risk-free rates than sovereign issues, to compensate arbitrageurs for holding these equities until the deal closes. Deal volumes for 2022 are lower than levels experienced last year. This could be seen as a normal reaction from corporate board rooms in a period of greater uncertainty and rising financing costs. Nonetheless, strategic acquisitions in sectors such as healthcare, gaming and technology continue to be announced. Current deal spreads are wide, generating a potential low double-digit return opportunity far above this type of strategy’s long-term average return. However, there is no free lunch. There are higher risks of regulatory intervention, companies trying to walk away from a deal or the possibility that acquisition offers are shut down by shareholder vote. The current nervousness on equity and credit markets necessitates more caution when investing in Event-Driven strategies, due to a higher probability of deal breaks. On the other hand, Merger Arbitrage provides an interesting tool that is structurally short duration, where deal spreads are positively correlated to increases in interest rates.

Distressed

Bankruptcy headlines have captured the implosion of hedge fund strategies and financial intermediaries active in digital assets. The dramatic fall in the value of crypto currencies has put the spotlight on a specific number of crypto investors and crypto lenders. Fortunately, this concerns only a very niche segment of the hedge fund universe. Currently, default rates of sovereign and corporate issuers remain relatively low, but the rapid widening of credit spreads and the deterioration of economic fundamentals will lead to a rise in companies running into trouble. Leading managers are still waiting for further dislocations to happen before going on the offensive.

Long short credit & High yield

Long short credit managers have done well compared to traditional credit funds. Their short books and hedges have helped mitigate the impact of widening spreads on long holdings. Some managers think that the situation does not look particularly upbeat, but they need to focus to pick the right issues, with particular attention paid to corporate leverage levels and covenants. As markets are expecting rates to continue to rise and economic growth to decelerate, the best managers remain diversified, investing in quality longs and focusing on industries with higher pricing power.

[1] TINA – There is no Alternative

[2] TARA – There are reasonable alternatives