The transatlantic debate on central banks’ monetary policy has evolved to being just a question of timing and magnitude as the odds remain undoubtedly in favour of a soft landing. The US labour market remains strong and forced us to re-assess inflation expectations, but the unemployment rate is moving in the right direction, even if slowly. Chairman Jerome Powell has confirmed cuts in 2024, while the European Central Bank has opened the door for cuts starting in June. Candriam’s central scenario lies on the expectations of 3 cuts in the Euro area starting in June, while 3 to 4 are on the table for the Federal Reserve Bank. Short-term yields have aligned with the European Central Bank and the Federal Reserve Bank interest rate cuts for 2024.

Not too hot and not too cold - for most

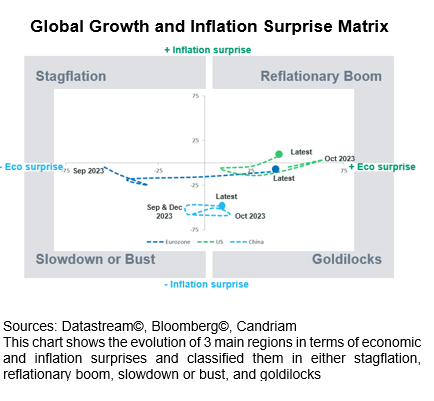

Within the past 4 weeks, inflation surprises have reached a point of stability and growth surprises appear to be more synchronised as we enter the beginning of Spring 2024.

Across all major regions, inflation surprises have stabilised. Price resilience in the United States has led to a slight upward surprise, marking the first time since April 2023 that all major regions have registered positive growth surprises.

Despite the persistence of "sticky" inflation in the US as witnessed by the latest PPI and CPI readings, it is unlikely to pose a significant threat to the economy given its recent trend. In the Euro area, both growth and inflation surprises continue to remain firmly within the "Goldilocks" quadrant, i.e. positive economic surprises and negative inflation surprises, a status last observed in November 2020. Meanwhile, China's data remains slightly unpredictable.

Geopolitics & Uncertainty

When the war in Ukraine started 2 years ago, natural gas reserves quickly became the Achilles’ heel of the Euro area. However, between mild winters, support from the European Union and EU members’ governments, gas storages have been built up to a level that is bringing some relief on short- and medium-term perspectives. Also, global LNG capacity is set to increase by 40% over the next four years as the Western world quickly aimed for the least possible dependence on Russian resources for the future.

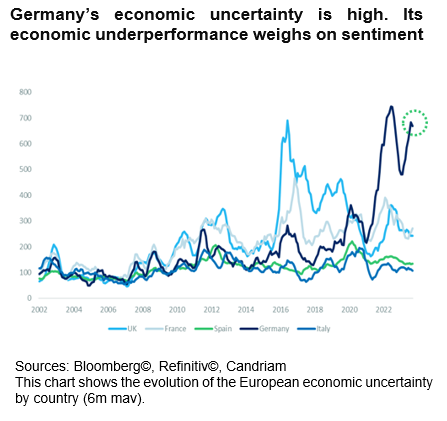

In the Euro area, the economic underperformance of Germany weighs on sentiment. Europe's biggest economy has been the weakest in the Union in the past 18 months as feeble global orders, record-high interest rates and a budget crisis took their toll.

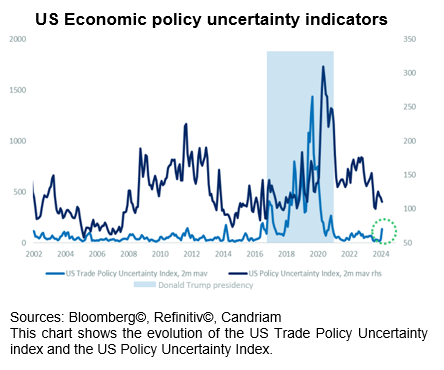

In the US, trade policy is on the rise although Donald Trump is “just” a candidate for nomination. In early February, the GOP frontrunner affirmed his intention to levy tariffs of 60% or more on Chinese imports should he secure a second term in office despite his legal trouble. This tariff approach may reignite the trade dispute he initiated in his initial term between 2016 and 2020 by imposing $250 billion worth of tariffs on Chinese products. Americans will cast their votes for the next president on November 5th. The leading candidates are expected to be the same as in 2020. Joe Biden, the incumbent president, is uncontested for the Democratic nomination. This sets the stage for a rematch election.

The US central economic scenario that should unfold consists of a soft landing as high rates and tight lending conditions contribute to a slowdown in the activity. The unemployment rate should moderately increase as pressures on prices and wages continue to ease. In Europe, we expect economic activity to pick up moderately as inflation keeps receding, restoring some purchasing power and keeping consumer confidence stable.

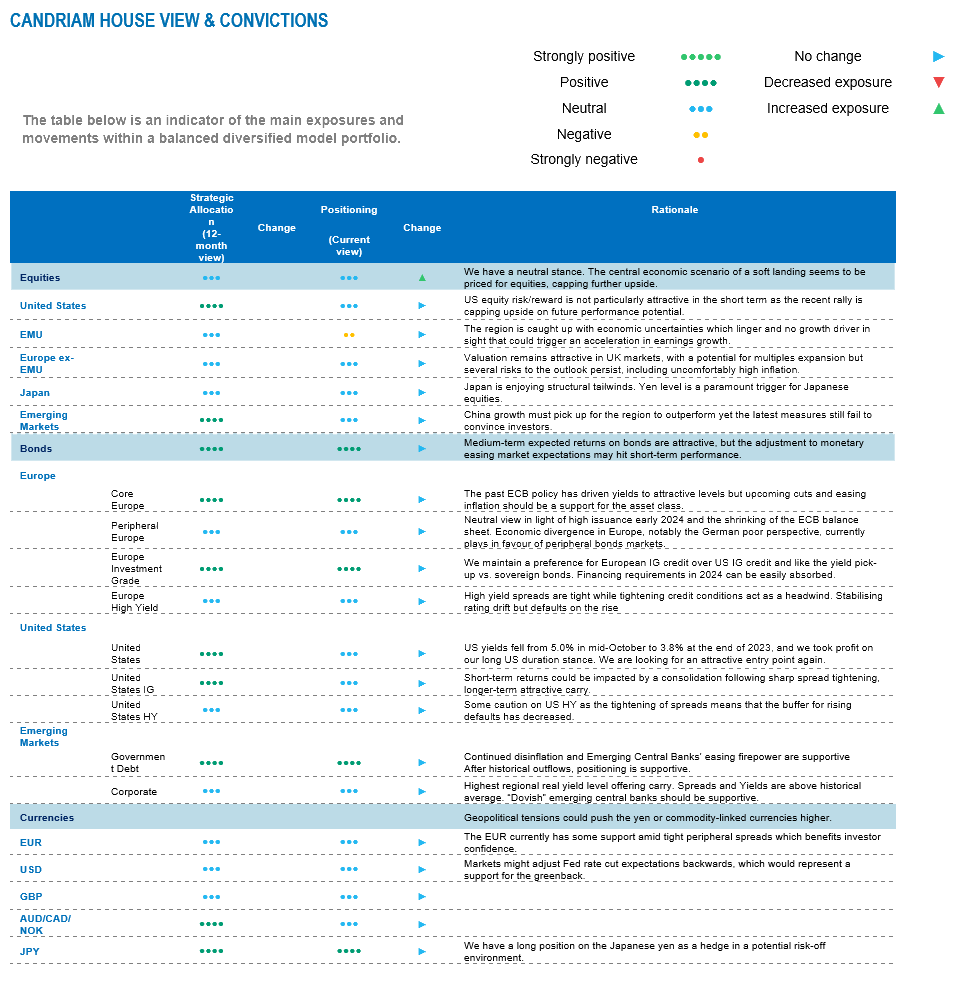

Our cross-asset strategy takes into account the main economic scenario as well as the identified risk factors.

Growth Expectations & Regional Equity Preferences

If some economic indicators are less pessimistic, EU growth expectations remain very low.

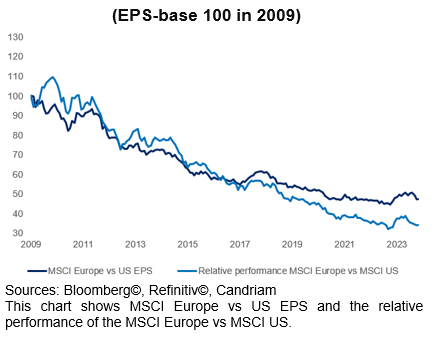

The tables would turn if economic growth picked up or if valuation was in line with the current economic conditions. In a nutshell, as of today, Eurozone economic uncertainties remain amid a lack of earnings support, not to mention institutional investors outflows.

Despite a relatively attractive valuation in Europe, earnings dynamics is the main trigger of performance. However, EPS growth expectation remains too weak relative to other regions to expect a durable outperformance of European equities for now.

As a result, our neutral stance on equities remains, characterised by a preference for US equity while keeping an underweight on European equities.

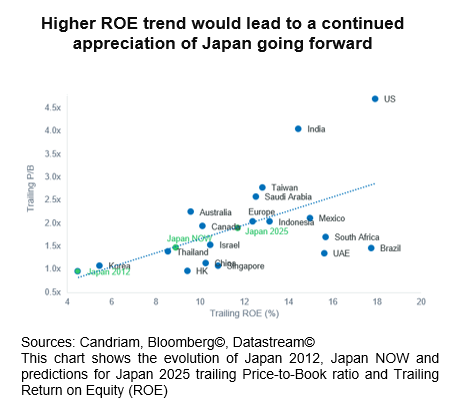

Japan appears to be undergoing a structural shift, with the evolution of the yen compared to equities serving as a key indicator in the coming months. Opportunities arise from recent performance largely attributed to the depreciation of the Japanese yen. Additionally, structural reforms are underway, promising potential benefits to return on equity (ROE) and aligning with other global regions.

However, the current level of the yen could pose a short-term obstacle, although this may be overcome if reforms persist. Main risks include the potential exit from the negative interest rate policy (NIRP), which could lead to losses on the yen if not managed smoothly. Furthermore, a scenario in 2024 involving China's continued underwhelming growth and a possible hard landing for the US could significantly impact Japan's earnings per share (EPS).

In Emerging markets, Latin America was in the driver’s seat in 2023 while China was struggling with a subdued re-opening, a real estate sector in crisis, and a depressed consumer. But so far this year, the performance of the Latin American equity market has been weaker and we no longer outweigh the region within Emerging markets. In the medium term, Latin America had several aspects working in its favour, including relative geopolitical calm, a wealth of commodities needed for the "green transition," and a shift in manufacturing from Asia to Mexico. But in the short term, Petrobras and Vale, Brazil’s equity market giants, face unpredictable political risk amid President Lula da Silva’s mandate. Fears over a recession in Argentina under the new government of Javier Milei is also contributing.

Meanwhile in China, the economic growth must pick up to see the broad region outperform. Chinese equities continue to mirror a low growth and deflationary environment due to the absence of a credible plan to achieve the government’s 5% GDP growth target this year. The current state of fragile stabilisation indicates a lack of sustainable confidence in Chinese equities. Moreover, there has been minimal improvement in Chinese consumer and producer price inflation, with both indicators showing only slight movement out of negative territory. We remain neutral on the broad region for the time being.

Bonding Opportunities

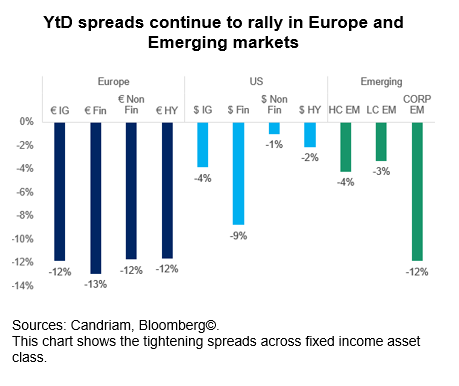

The realm of fixed income remains diverse, presenting ample opportunities for investors who are prepared to navigate its intricacies.

Within this landscape, US Treasuries and investment-grade bonds serve as a defensive anchor in investment portfolios, supported by the Federal Reserve's cautious approach to interest rates.

We however prefer European bonds, especially within the investment-grade category, which hold appeal as investors seek higher yields amidst anticipated policy adjustments from the European Central Bank.

Additionally, Emerging Market debt, buoyed by accommodative stances from local central banks, may present attractive returns for investors willing to endure potential fluctuations.

Tactical Shifts and long-term Vision

Candriam has developed a proprietary sentiment indicator. After hovering over the euphoria zone for weeks, no sell-signal was delivered. However, our analysis suggests that the equity market may be pausing and moving sideways, taking a moment to catch its breath. We therefore maintain a neutral stance on equities overall, with a preference for US over European equities where earnings per share and GDP growth prospects are weaker.

As we expect a rangier market for the next couple of months for the broad market and because consensus expectations on the Technology sector may be overly optimistic, we downgrade our views on the US technology sector to a neutral. Our long-term outlook, however, remains strongly positive.