Contrarian voices grew louder in October while Nvidia’s Jensen Huang warned that “China will win the AI race”. Nonetheless, October proved positive for hedge funds, despite brief market volatility tied to US-China trade developments. US equities gained firmly, reaching new highs despite growing contrarian views on the AI trade. Hedge funds navigated this backdrop with more cautious positioning. Indeed, on average, US L/S net leverage fell to 56% and gross to 213% signalling a measured de-risking ahead of the year-end.

The rally broadened beyond mega-cap tech. While we saw heavy profit-taking after earnings, flows rotated into Health Care, Consumer Discretionary, Industrials and Financials, where net positioning remains near troughs.

On the macro side, US resilience persisted despite the endless shutdown reinforcing expectations for a 2026 easing cycle. In Europe, growth remained muted, with France and Germany near stagnation but Southern Europe showing relative strength, notably Spain. Chinese recovery showed early signs of stabilisation but remained fragile amid persistent property-sector stress.

The HFRX Global Hedge Fund EUR returned +0.50% over the month.

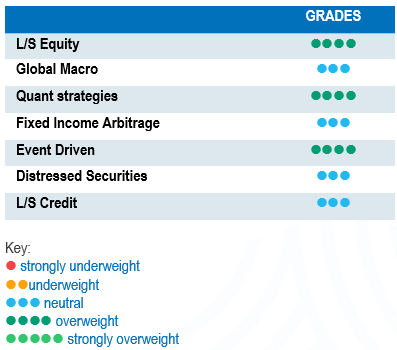

Long-Short Equity

October was a steady month for Long/Short Equity strategies. Regionally, Europe was the only market to end net bought, led by Healthcare and Financials. Asia saw divergent trends with China-focused L/S funds performing well, buoyed by stimulus headlines, while Japan and Asia ex-China saw smaller inflows.

Thematic rotation benefited managers with balanced exposures across Technology, Industrials and Consumer Discretionary, while Healthcare and Financials attracted renewed hedge fund buying according to Morgan Stanley Prime Brokerage. US funds were net sellers of TMT (AI Tech Beneficiaries, AI Power) but net buyers of Healthcare and Discretionary. In a nutshell, October confirmed a market still driven by the AI narrative but characterised by a narrative challenge.

Asian markets contributed positively, particularly Japan, while China remained more volatile. However, China-focused L/S funds are up the most in absolute terms across any cohort. Overall, dispersion across sectors and factors continued to offer a supportive backdrop for active stock selection, with funds preserving healthy risk-adjusted profiles.

Global Macro

Macro strategies navigated a complex month marked by renewed policy and political volatility. The US government shutdown and the collapse of the French government early in the month briefly revived market uncertainty. At the same time, the FOMC delivered a 25-bps cut and confirmed further easing. In Europe, the ECB stayed on hold, with the cutting cycle now seen resuming around March 2026.

Macro funds benefited from tactical positioning like long exposure to US Treasuries, selective equity beta in Asia, and relative-value FX trades. Regional divergences remained elevated with a still-resilient US labour market, a stagnating Europe and slow Chinese stabilisation. Overall, discretionary macro funds preserved strong YTD performance in the high single digits, maintaining disciplined risk budgets and elevated liquidity into year-end.

Quant strategies

Systematic and quantitative managers delivered stable results in October. After a volatile September marked by reversals in position, factor trends stabilised. On average, Quant hedge funds were up about +0.7% MTD and +10% YTD. Trend followers gained from long equity and commodity signals, while equity market-neutral funds recovered part of the September drawdown. Despite weak persistence in fixed income trends, dispersion across equity styles and regional indices provided opportunities for quantitative strategies. The environment continues to reward diversified quant portfolios with disciplined risk control.

Fixed Income Arbitrage

October was a very quiet month in fixed income. In the US, both the yield curve shape and levels were more or less stable. In the meantime, US swap spreads widened significantly across the curve and reached their highest level since April. In Europe, the overall dynamic was the same. Fixed income arbitrage managers posted modest positive returns.

Event-Driven

Event-Driven strategies extended their positive momentum as global M&A activity held firm and even re-accelerated. Managers posted average returns slightly positive during October bringing YTD to high single-digit returns. Morgan Stanley highlights that Q3 announced M&A volumes are up ~43% YoY, led by large strategic transactions, with global volumes expected to grow +32% this year, reaching around 7.8tn USD by 2027 across strategic, sponsor and buyback deals. Europe remains resilient, with M&A activity growing by ~5% YoY on a higher base, particularly in metals & mining, business services, telecoms and defence. Managers remain constructive heading into Q4, expecting paused or delayed transactions to re-emerge as CEOs regain confidence, sustaining a solid pipeline for merger-arb and special-situations trades.

Distressed

Distressed strategies delivered muted but positive results in October, against a backdrop where headline credit spreads remained tight. According to Morgan Stanley’s credit team, US HY spreads narrowed by 11 bps on the month. At the same time, US leveraged loans tightened by 3 bps but saw net outflows of ~780m USD. The top news was taken by the First Brands blow-out. Some hedge funds were hit hard as their top-ranking secured loans traded below 50 cents on the dollar. Moreover, a potential shutdown in SNAP benefits for 42 million Americans trimmed personal income and weighed on grocery and beverage volumes, a direct headwind for discretionary credits. In this environment, distressed managers remained highly selective, focusing on complex restructurings, asset-backed situations and jurisdictions with credible reform momentum. Argentina is a case in point example, Milei’s strong electoral result is perceived as increasing the probability of a genuine restructuring. Overall, the “big bang” distressed cycle has not yet begun, but the context suggests that a broader distressed universe is looming large for 2026.

Long-Short Credit

Long/Short Credit strategies remained broadly stable in October, in line with a market where beta still pays. Morgan Stanley notes that US Investment Grade spreads tightened by 3 bps, with 7-10Y bonds outperforming. IG funds attracted 4.1bn USD of inflows over the last month, and supply reached 10bn USD, bringing YTD issuance to 1.53tn USD. Long/Short Credit managers generally kept net exposure close to neutral, constructing books around Longs in resilient balance sheets (quality Financials, select Healthcare and Energy names) and Short in lower-quality cyclicals and issuers exposed to weaker low-end consumption. The Chinese market is particularly impacted by the consumption weakness, although some companies stood out by delivering strong results.