Since last Sunday (October 5), France has been plunged into a new political crisis — unprecedented under the Fifth Republic. Prime Minister Sébastien Lecornu resigned just a few hours after forming his government, due to partisan deadlock and his inability to build a stable majority.

The President of the Republic has since tasked him with leading consultations among the various political forces in order to establish a “platform for action and stability” that would make it possible to pass the 2026 budget before December 31. Negotiations are still ongoing, with the National Rally party refusing to take part. The likelihood of forming even a fragile new coalition appears low. In the absence of an agreement in the coming days, another dissolution of the National Assembly could soon be announced.

Early parliamentary elections could then take place as early as November (20 to 40 days after dissolution). However, opinion polls suggest no clear majority, pointing to a continued period of institutional paralysis. As a result, the risk is high that the 2026 budget will not be approved before year-end. The government would likely resort once again to a “special law” extending the previous year’s expenditure levels — a measure that could slightly worsen the fiscal deficit in 2026 (+0.1% of GDP). [1]These political uncertainties are also expected to weigh on growth forecasts, now projected to fall below 1% by the end of 2025 and in 2026. [2]

Why are financial markets remaining relatively calm amid France’s current political uncertainty?

One reason is that this uncertainty is not new. French equities and bonds have carried a higher risk premium since the surprise dissolution of the National Assembly in June 2024.

On the equity side, the CAC 40 has underperformed the DAX by 28% and the Ibex by 40% since June 9, 2024 [3] — the date of the dissolution. This underperformance cannot be explained solely by political events. Earnings revision momentum has been significantly weaker for the CAC 40 than for European equities overall: earnings per share (EPS) for the CAC 40 are expected to fall by 9% in 2025 [4] compared to 2024, whereas growth of more than 5% was still anticipated six months ago.

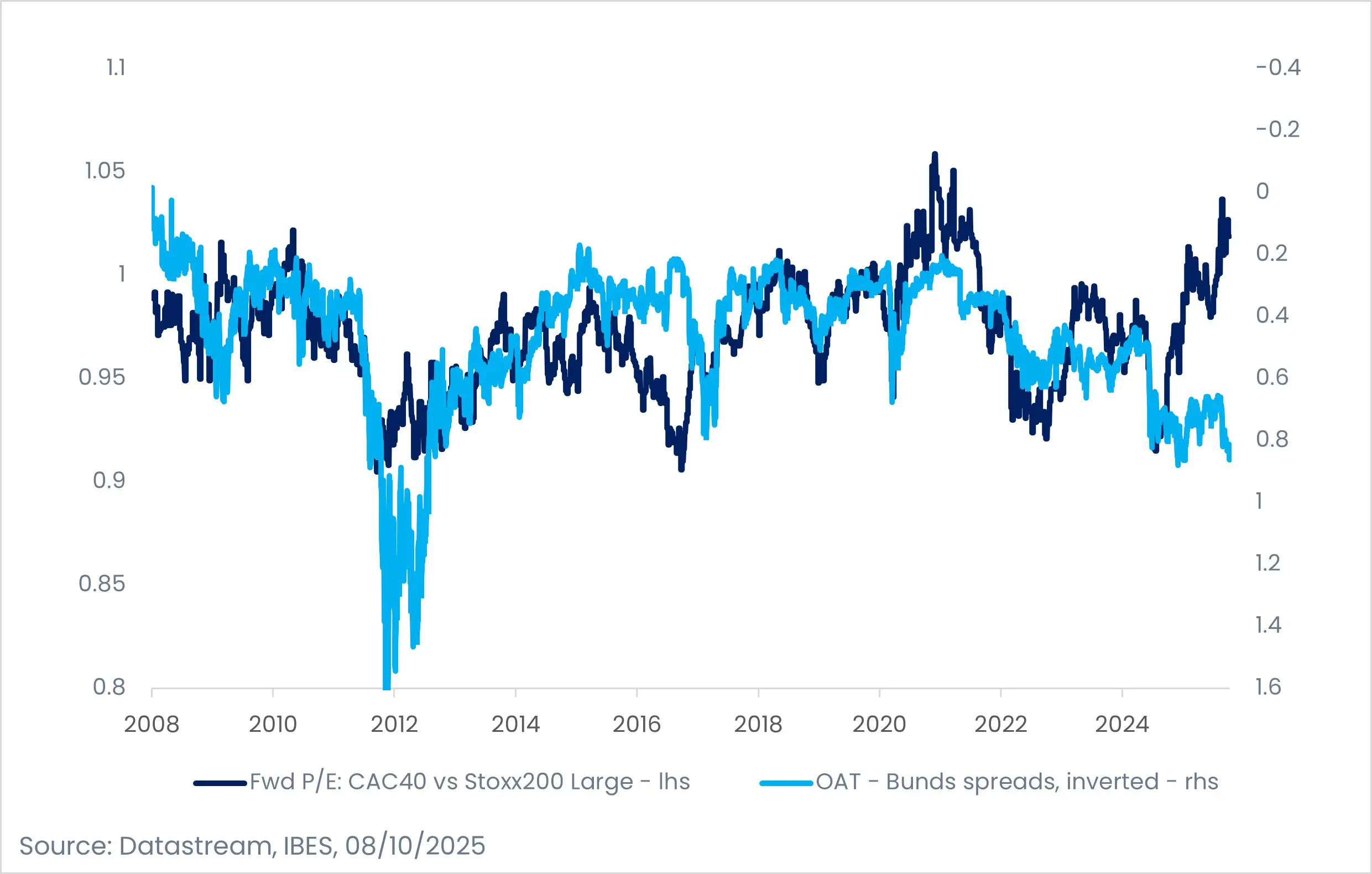

Valuations for French equities remain close to their historical average (12-month forward price-to-earnings ratio of 15), slightly above that of the Eurozone index (14.7).[5] The underperformance of French stocks therefore reflects more the weak economic performance of companies than a discount driven by political events. This is partly explained by the limited domestic exposure of CAC 40 companies — only about 14% of their revenues come from France.

Caution remains warranted for certain equities and French sovereign bonds

The French equity market is not entirely immune to political risk. Regulated sectors (financials, utilities, telecommunications, toll roads) and companies in which the state holds a stake account for about 36% of the index. Moreover, small- and mid-cap stocks have been hit hard by ongoing political instability, trading at a roughly 15% discount compared to their European peers.[6]

Investors should therefore remain cautious on some French equities — particularly domestic-oriented names and sectors most correlated with OAT-Bund spreads. This includes the financial, construction, and utilities sectors, which are most sensitive to movements in French sovereign spreads. Banks, in particular, are suffering from higher capital costs as long as uncertainty persists. Conversely, any reduction in political uncertainty could provide upside for these currently-penalised sectors.

On the bond market, French government bonds (OATs) have seen their spread against Bunds widen to around 85–90 basis points, near recent highs.[7] The risk premium built in since June 2024 has yet to normalize. A further widening could occur in the event of fiscal slippage or — in a less likely scenario — the resignation of President Emmanuel Macron.

Relative Valuations – French Equities and Bonds

To what extent does the European Central Bank’s (ECB) action limit French risk? We do not expect any impact on policy rates — the ECB remains guided by inflation and growth, not by national political risks. In the event of a sharp widening in French spreads, ECB support mechanisms (TPI/OMT, ESM) would be activated only as a last resort, with delays and under strict austerity conditions — making such assistance recessionary and politically difficult to implement. True to its historically cautious approach (outside the Draghi era), the ECB would only act ex post, and only in the event of systemic risk to the Euro Area.

The value of the euro is also partly tied to France’s situation. With the US government shutdown preventing the release of recent US economic data, the euro has weakened against the dollar. Between American uncertainty and Europe’s own lack of clarity, the EUR/USD exchange rate has declined.

Conclusion

Markets appear increasingly tolerant of political risk, absorbing events that in the past might have triggered sharp corrections. The true driver of European equity performance will ultimately be the growth momentum Europe manages to generate in 2026 — and above all, that of Germany, which must successfully implement its investment plans.

A reduction in the risk premium on European assets could provide an additional source of performance — provided Europe regains greater political visibility, both domestically (with a stabilized France) and internationally, by asserting a united and credible stance among the world’s major powers.

[1] Source: Candriam estimates

[2] Source: Candriam estimates

[3] Source Bloomberg, Performance as at 08/10/2025. Past performance does not predict future returns.

[4] Source : LSEG Datastream, 08/10/2025

[5] Source : LSEG Datastream, 08/10/2025

[6] Source : LSEG Datastream, 08/10/2025

[7] Source: Bloomberg, 08/10/2025