Public awareness has risen on the risks posed by PFAS on health and on the environment. Business-wise, companies are facing increasing regulatory and market risks. Investors however should also be open to the potential opportunities offered by the PFAS market.

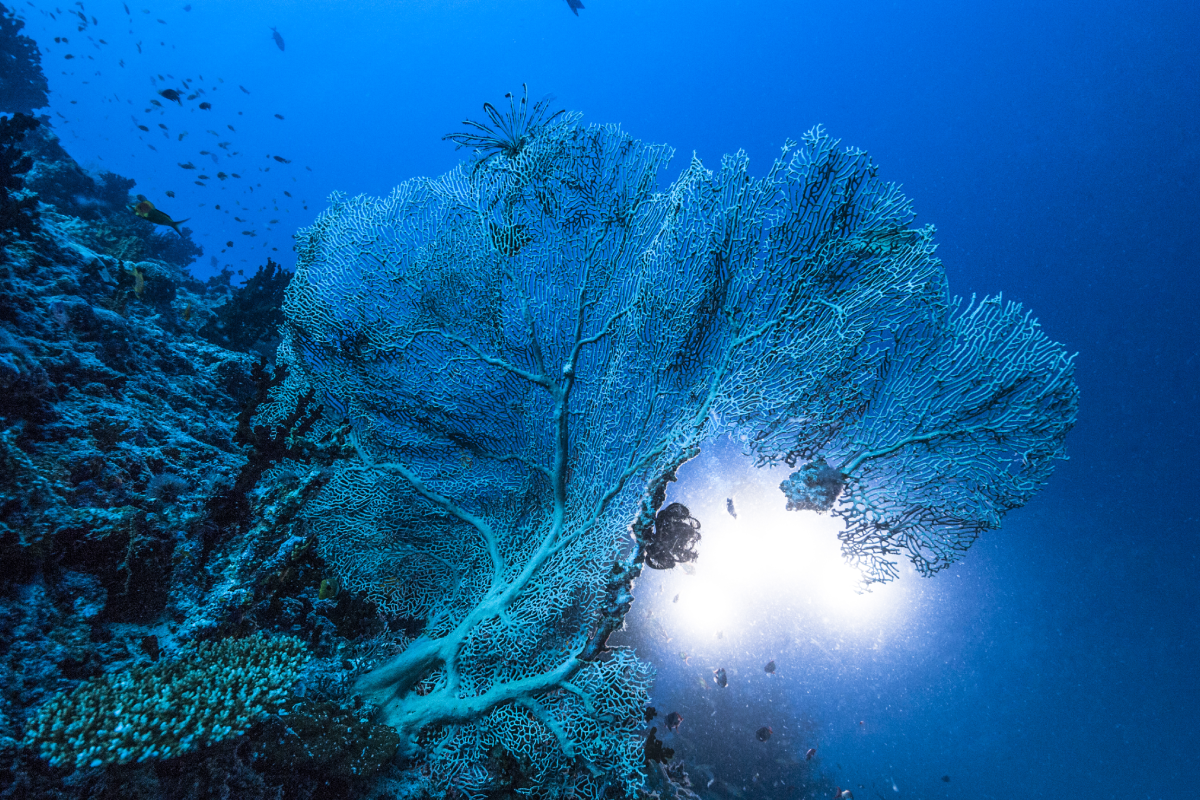

PFAS, or Per- and Polyfluoroalkyl Substances, commonly known as "forever chemicals," have been widely used since the 1940s due to their unique properties like resistance to water and oil. These chemicals are found in everyday products such as non-stick cookware, water-resistant clothing, cosmetics, and more. Their persistence in the environment and resistance to degradation have led to widespread environmental and health concerns. They are potentially present in the blood of 95-100% of the US population[1]! Most PFAS are considered to be moderately to highly toxicfor humans[2], and linked to thyroid disease, fertility issues, and various cancers. Environmentally, PFAS accumulate in ecosystems and water sources, affecting biodiversity and posing risks to wildlife. Big chemical companies have been sued for contamination of water systems.

A fragmented regulatory landscape with Europe at the forefront

Regulators, particularly in Europe, have recognized the risks associated with PFAS, and issued stringent regulations and restrictions on their use. The Stockholm Convention, adopted in 2009, designates three subgroups of PFAS as industrial Persistent Organic Pollutants and prohibits their use in the EU. Some other PFAS, designated as Substances of Very High Concern (SVHC), have seen their use restricted and submitted to transparency requirements. In April, France issued a bill to ban the manufacture, import and sale of products containing PFAS.

In the U.S., the regulatory response has been more fragmented, with some states like California or Colorado taking the lead on imposing restrictions. The Environmental Protection Agency (EPA) has recently proposed national drinking water limits for PFAS, marking a significant step towards federal regulation.

Countries like Japan, the UK and Canada are also contemplating PFAS regulations. Despite varying restrictions worldwide, the trend overall points towards tightening regulations.

For companies, risks are increasing

The economic implications for businesses involved with PFAS are substantial. Companies face increasing regulatory and market risks, including environmental liabilities and costly lawsuits, with significant financial settlements impacting the industry. This trend is expected to continue as awareness and regulations increase. Sectors such as Semiconductors, Electronic Components, Industrials, waste management, transportation of PFAS-containing products, and Retailers selling clothing containing PFAS, may face increased litigations as well as evolving consumer purchasing habits.

Opportunities for investors

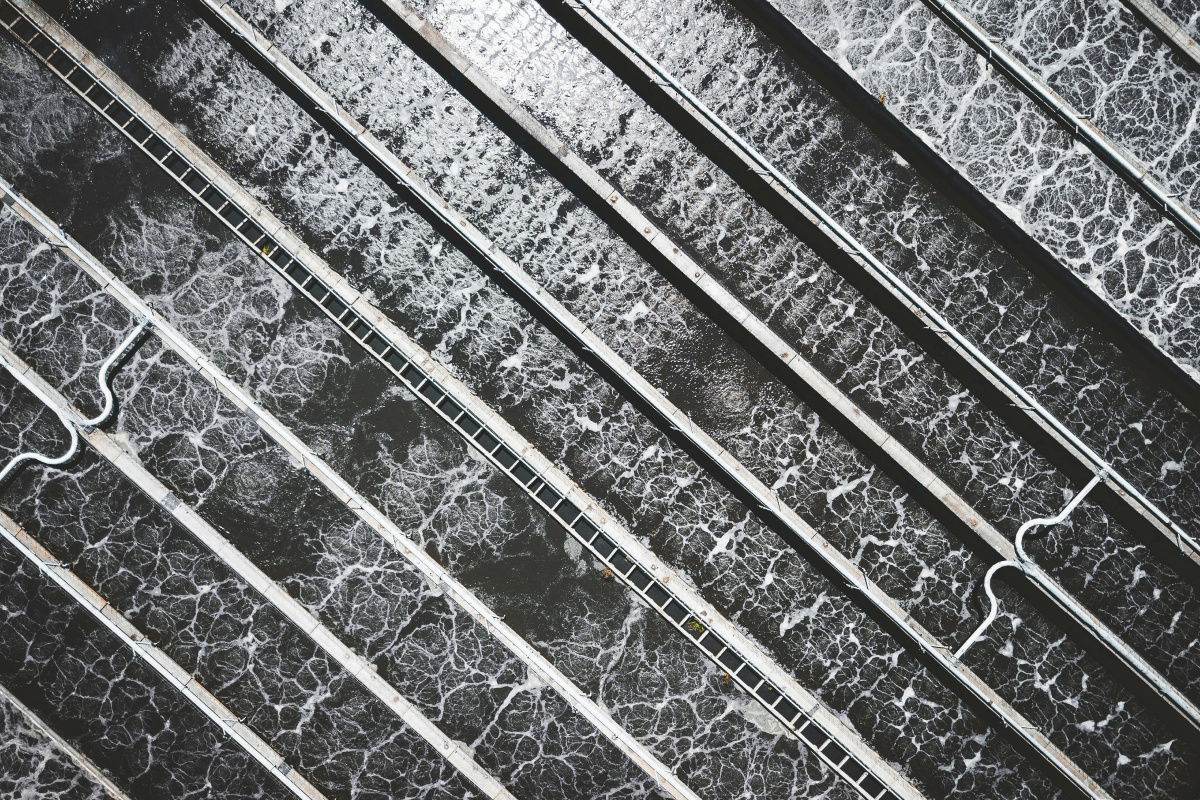

Despite these challenges, there are significant opportunities in the PFAS market, particularly in developing less harmful alternatives as well as remediation technologies. The global market for addressing PFAS contamination is estimated at over $250 billion[3]. Wastewater treatment reflects the largest addressable sub-sector, followed by industrial remediation. Innovations in water treatment technologies, such as Granular Activated Carbon and Anion Exchange, enable a reduction of PFAS levels in water supplies. UV-based treatment solutions are academically proven but still in development. With more stringent rules about PFAS concentration, large investments will be needed from Water utilities to address new requirements. Firms involved in consulting/ engineering will also benefit from increased capital spending in PFAS remediation.

Understanding risks is key to making informed investment decisions. The shift towards PFAS-free products present both challenges and opportunities. As public awareness increases and regulations tighten, companies that proactively address PFAS issues are likely to benefit from a competitive advantage. Staying informed about these developments will be key to navigating the risks and capitalizing on the potential growth areas in the PFAS market.

[1] Source: US Centers for Disease Control (CDC)

[2] The US Environmental protection Agency recognizes PFAS an “urgent public health and environmental issue”. https://www.epa.gov/pfas/our-current-understanding-human-health-and-environmental-risks-pfas

[3] Source: AECOM, What is the addressable PFAS market, 2023