Last week in a nutshell

- French President Emmanuel Macron’s decision to dissolve his own legislature in response to the European Parliament elections increased volatility on French and European assets.

- “Lacking sufficient progress on inflation” prevented the Federal reserve bank to cut rates according to Chair Jerome Powell.

- Ironically, the US producer prices fell by 0.2% in May, vs. an expected 0.1% increase, while the monthly advance in CPI was the slowest since July 2022.

- Speaking about cooling, the US labour market showed signs of moderation with the addition of 242K initial unemployment claims

- The EU announced new tariffs on Chinese EV’s. This will likely opens a new chapter in a tit-for-tat retaliation.

What’s next?

- Financial markets will continue to figure out the impact of the French snap elections on June 30th and July 7th.

- Flash global PMI on manufacturing and services activity will provide an early indication of the economic health at the start of the summer.

- A handful of central banks throughout the world are meeting: Indonesia, Brazil, England, Switzerland, Norway and Australia.

- The upcoming Flash euro zone consumer confidence will constitute a baseline for the aftermath of the European elections.

Investment convictions

Core scenario

- The US news flow remains at odds with Europe and China: weaker-than-expected economic data in the US is so far compensated by positive surprises in the other regions. The hawkish repricing regarding Fed rate cuts has likely run its course.

- Beyond the election uncertainty in the euro zone, the activity pick-up from quasi-stagnation should represent a support for equity valuations. Forward-looking indicators undoubtedly point into that direction.

- Global disinflation trends have been confirmed by the most recent inflation data and the decline in the price of oil. At the current juncture interest rates have likely peaked and growth remains resilient.

- In China, economic activity has shown some fragile signs of stabilisation while the evolution of prices remain deflationary.

Risks

- Gains for the far-right in the European Parliament elections have prompted French President Emmanuel Macron to call for a national vote. This development has brought political risks back into focus for financial markets, especially for French stocks and government debt.

- An overshooting in US yields, the price of oil and the US dollar are key variables to watch. Geopolitical risks to the outlook for global growth remain tilted to the downside as developments in the Middle East and the war in Ukraine continues.

- Bond yields are to be monitored especially given the diverging paths taken by the US central bank and its European counterpart.

- A stickier-than-expected US inflation while economic growth slows down too much and unemployment rises, could force the Federal reserve to reconsider its course.

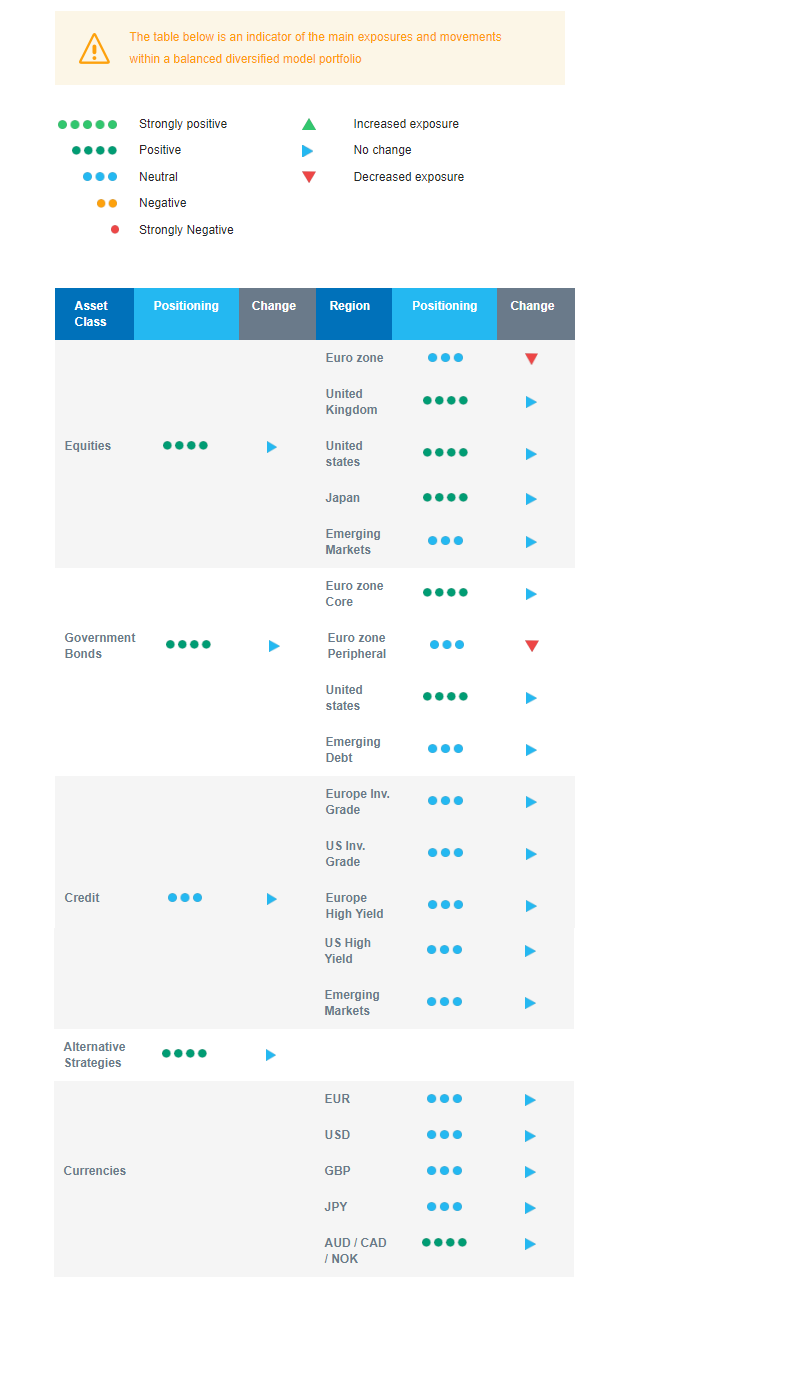

Cross asset strategy

- Our global view on developed market equities remains constructive as we further reinforced our overweight on US technology but lowered our exposure on EMU equities via our position in banks operating in the region. French President Emmanuel Macron’s decision to dissolve his own legislature in response to the European Parliament elections increased volatility on French and European assets. Facing a rise in political uncertainty, a higher risk premium appears justified.

- We have the following equity investment convictions:

- Slight overweight US

- Slight overweight developed markets ex-US, i.e. Europe via the UK and Japan.

- In Japan, exiting the multi-decade long deflation as well as corporate governance reforms bearing fruit should more than counterbalance a less dovish Bank of Japan.

- In the fixed income allocation:

- We prefer carry to spreads, but focus on quality issuers.

- We downgrade our views of peripheral European bonds to neutral.

- We seized an attractive entry point on US government bonds as yields shot back up to 4.7% in April.

- We have a relatively small exposure to emerging markets sovereign bonds amid very narrow spreads and a strong US dollar.

- We are neutral on investment grade and high yield bonds, regardless of the issuers’ region.

- In our forex strategy, we are positive on commodity currencies as the global manufacturing cycle picks up and have reduced our long position on the Japanese yen as the BoJ appears overly careful.

- We expect Alternative investments to perform well as they present some decorrelation from traditional assets and keep an allocation to gold.

Our Positioning

Our outlook on equity remains positive but we lowered our exposure to global equities via the allocation to the euro zone, impacted by the recent rise in political uncertainty that spilled over into financial markets and French assets. We are overweight US, UK and Japanese equities. We are neutral Emerging equities. On the bonds side, pending rate cuts, we are positive on duration but are less confident in European peripheral sovereign debt. In credit, high yield and emerging debt, we remain neutral amid very narrow spreads and a strong USD.