European equities: The energy crisis continue to dominate the headlines

European equities closed September lower. In Europe, the energy crisis continued to dominate the headlines, as Russia completely halted gas flows through the key Nord Stream 1 pipeline at the beginning of the month.

However, what had been considered the worst-case scenario for Europe didn’t lead to new highs in gas prices, which after having reached more than EUR 300 per megawatt hour in August dropped back to around EUR 200 in September.

On the economic front, a recession now looks like the base case. Most economic data published in the quarter pointed to a slowdown, including the eurozone composite PMI business survey, which is now in contractionary territory.

Industrial production dropped sharply in July, and eurozone consumer confidence dropped to a new all-time low in September.

While growth is decelerating in Europe, this is not yet the case for inflation.

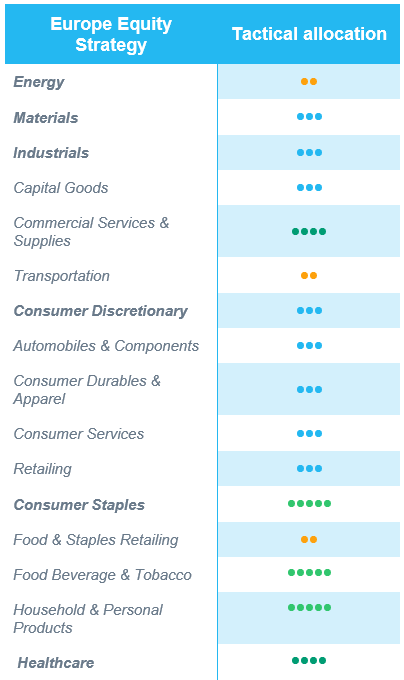

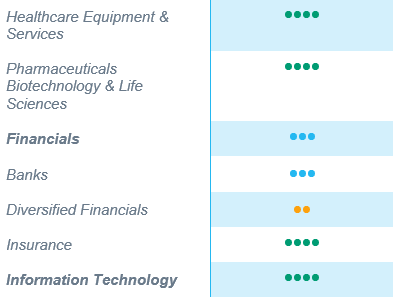

Styles & Sectors

Since the last committee – over the past four weeks – small caps have been the worst performers regardless of Value/Growth styles. This continues to bring smaller companies closer to some long-term distress levels.

It is also interesting to observe that the correlation between the real rates (10Y German real yield) and the outperformance of the Value style (MSCI Europe Value/Growth) has been less obvious in the last few months. However, the gap in terms of valuation (12-month forward P/E) between the Growth and Value styles remains quite substantial, with Growth above Value.

If we look at sector level, since the last committee, the worst performers have been communication services and utilities – sectors with high levels of debt – in which we are underweight. Meanwhile, the top performers in relative terms were the energy and healthcare sectors.

Earnings

Regarding earnings, we have seen the gap between earnings revisions and the performance of European equities increase. Indeed, even though the MSCI Europe has put in a negative performance over several months, earnings revisions remain quite “neutral” on average. However, we have not yet seen a lot of revisions in Europe, although more negative revisions are expected in the coming weeks.

Grades

We did not make any strategic changes in terms of grades. We are comfortable with our strong overweight on staples, within which we are investing in companies with strong pricing power and solid EPS momentum.

Regardless of whether we are overweight or underweight in a sector, more than ever in an economic slowdown, our watchword remains selectivity: strong discipline while picking stock.

US equities: A resilient labour market

US indices also closed September lower. The S&P 500 fell by 9.3%, its biggest monthly drop since March 2020.

The US labour market appears resilient, with the latest employment and JOLTS (Job Openings and Labor Turnover Survey) reports showing plenty of momentum.

For their part, confronted with the biggest inflation shock since the 1970s, central banks will probably continue to prioritise the fight against inflation over supporting growth.

The Fed’s tighter monetary policy is already cooling down some parts of the economy, such as the housing market, as 30-year fixed mortgage rates have risen to well above 6%, their highest level since 2007.

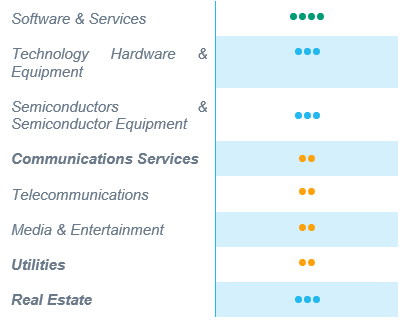

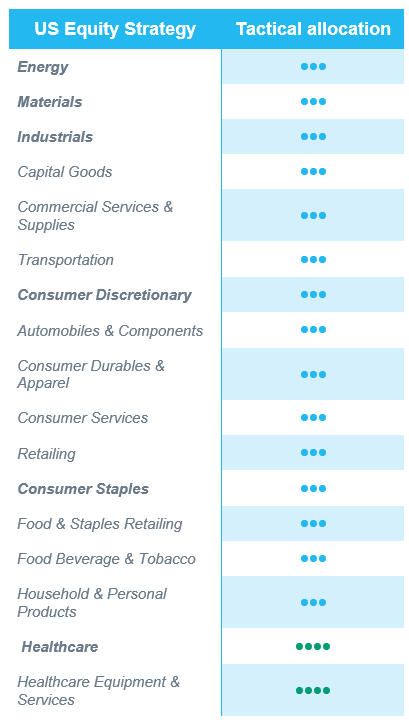

Styles & Sectors

Since the last committee – over the past four weeks – small caps have outperformed large caps. Within large caps, the worst performers were Growth stocks.

It is also interesting to observe, as is the case in Europe, that the correlation between real rates (10Y US real yield) and the outperformance of the Value style (MSCI US Value/Growth) has been less obvious in the last few months.

However, the gap in terms of the valuation (12-month forward P/E) between the Growth and Value styles remains quite substantial, with Growth above Value, although this is tightening.

Looking at sector level, since the last committee, the worst performer (by far) has been utilities – a sector with a high level of debt – followed by IT, consumer discretionary and communication services. Meanwhile, the top performers were the energy and healthcare sectors.

Earnings

The gap between earnings revisions and US equity performance is tighter than in Europe, since companies publish more regularly, and more profit warnings are already priced in by the market.

We thus observe a logical correlation between companies that have published a profit warning and those which have underperformed the most.

However, the MSCI USA has still shown a more negative trend over the last few months than the revisions we have observed: the markets seem to be anticipating further downward revisions.

USD impact

The strength of the dollar remains a headwind for Q3 earnings, mainly for IT and materials when looking at the estimated FX impact to quarterly year-over-year sales growth, which depends on the sector’s percentage of foreign sales.

Grades

We did not make any strategic changes in terms of grades.

We are comfortable with our overweight in the healthcare sector, which has made a positive contribution over the last few weeks. The sector played its role as a defensive segment well, and within it, the most defensive subsegments, such as large pharmaceuticals, performed the best.

We are still awaiting several profit warnings, especially in highly consumer-dependent sectors. We maintain our cautious approach.

Emerging equities: Regional divergence continues

September proved to be another volatile month for global equities. After starting the month on a relatively resilient note, EM equity markets soon turned bearish following higher than expected US CPI figures and the US FED reiterating its hawkish stance in addition to implementing a 75 bps rate hike, as well as an increasing risk of a global recession. As a result, the USD continued to strengthen against major EM currencies, and EM equities ended the month 11.9% lower (in USD terms).

At a regional level, the major markets to lose ground over the month were Korea and Taiwan, correcting as much as 18.5% and 16% respectively, as concerns of a slowdown in global demand and lingering uncertainties on the outlook for the semiconductor market weighed on market returns.

Index heavyweight China continued to face headwinds as the RMB weakened against the dollar, while there were no signs of a meaningful recovery in domestic demand, with Covid restrictions remaining in place in parts of the country.

Mexico (-0.5%) and Indonesia (-0.8%) posted a relative outperformance, thanks respectively to the support they received from their relative defensive nature and tailwinds from domestic demand.

Within the commodity complex, recessionary concerns weighed on most commodities, including oil, which ended the month close to US$86 per bbl (Brent), with the exception of silver that rose 7.2%.

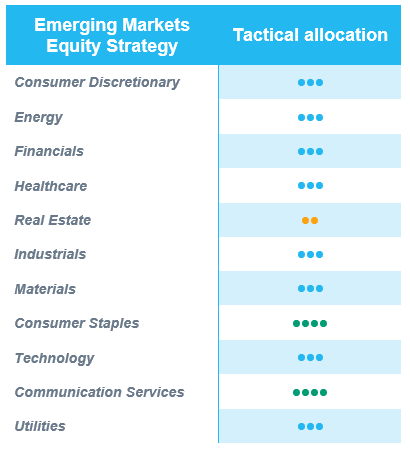

Changes to regional view

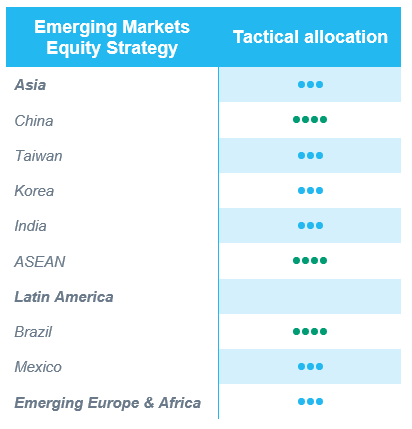

India: downgrade to neutral (0)

Profit taking after a strong rally, valuations remain expensive. India is still an attractive market in the current uncertain global outlook, given the continued resilience of domestic demand.

Brazil: upgrade to OW (+1):

Beneficiary of recovering domestic demand, resilient to global geopolitical risks, inflation under control and expectation of easing credit and liquidity support.

Changes in sector ratings:

Materials: downgrade to underweight (-1):

Global demand slowdown weighing on outlook, together with uncertainty on China’s recovery. Prefer metals needed for clean energy transition.

Software & Services: upgrade to overweight (+1):

Valuations becoming reasonable, quality and growth characteristics appealing heading into recessionary/slowing global growth environment.

Outlook

We continue to be cautious in terms of the outlook for EM equities, given the increasing risk of a recession in Europe and a significant slowdown in demand in the US, factors to which major EM exporting regions are not completely immune. The other key driver to monitor for the EM outlook is the prospects of a gradual recovery in China. While at the moment, there is not enough evidence to support prospects of broad-based stimuli to drive a Chinese recovery, given the benign inflation trend and already tightened liquidity conditions, the PBOC is relatively better positioned to drive a credit impulse recovery at some point going forward.

On the optimistic side, EMs could still surprise with a positive GDP growth differential (vs DMs), as DMs undergo a slow and rather prolonged downturn to tackle inflation. With most commodities having corrected meaningfully from their peaks, the domestic demand stories in EM could still continue to outperform on a relative basis, with commodities becoming affordable. And finally, the current positioning for EM exposure is closer to its lowest level in a long time, which could also create a meaningful recovery opportunity in the event of the headwinds discussed above receding.

The strategy holds a balanced exposure of sustainable growth thematic beneficiaries in EM, which could be relatively resilient to macro and geopolitical headwinds, complemented with a defensive tilt given the cautious outlook.

![]()