Natural capital: private funding needed!

Natural capital is at the source of everything that surrounds us: plants, animals, air, water, soils, minerals… It is humanity’s greatest asset. However, at current consumption levels and without the invention and deployment of ground-breaking technologies, a large share of the resources essential to our lives today will eventually disappear altogether.

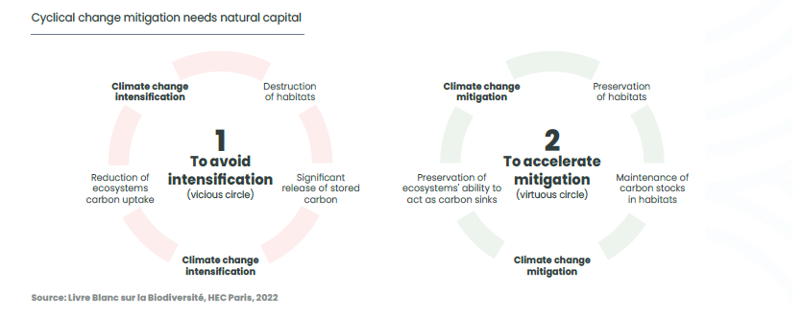

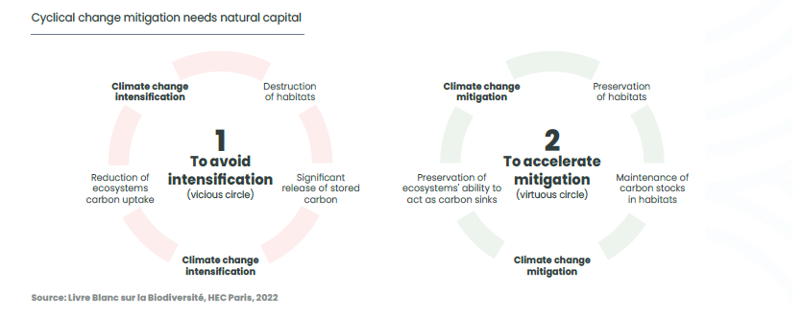

There tends to be a cyclical relationship between natural capital and climate change, that can be either virtuous or vicious. Natural capital is needed both to avoid the intensification of climate change, and to accelerate its mitigation. This is why our climate mitigation plans should not focus on carbon only but consider all planet boundaries.

In recent years, the push towards sustainability has mainly focused on decarbonization, leaving biodiversity and ecosystems with a huge financing gap. In 2021, the United Nations Environment Programme called for investments in nature-based solutions to triple by 2030 to meet climate change, biodiversity and land degradation targets[1].

While climate finance is distributed between public funds and private capital, it is still mostly the public sector that is allocating funds to nature-based solutions. How can private investors support this much-needed transition? Through its investments in both private and public financial markets, Candriam wishes to be among early movers of this shift.

Read our white paper to know more

[1] Source: United Nations Environmental Programme , State of Finance for Nature 2021 | UNEP - UN Environment Programme

;

;