Looking for uncorrelated returns and controlled volatility to navigate credit markets?

Credit markets: a paradigm shift

In recent years, new structural trends have emerged, such as the polarization of the world, the re-localisation of supply chains, and the fight against climate change. These new trends are leading to higher inflation and lower growth. This new paradigm is having a significant impact on the financial situation of companies, and therefore on investment in corporate bonds. This calls for strategic adaptation on the part of investors. Adopting a strategy that aims to deliver a performance independent of credit market trends would therefore appear to be an investment solution worth considering in this new environment.

The implications of this new paradigm for credit markets are significant in terms of monetary policy, which can no longer be as accommodating as it was in the previous decade. As a result, we can expect more volatile credit spreads, more dispersion between "good performers" and "bad performers", even within the same sector, and higher default rates.

In the middle of difficulty lies opportunity

In such a context, for investors who wish - or have - to be invested in credit market, we believe an absolute return approach to be a viable solution.

At Candriam, our alternative strategy with low correlation to credit markets invests most of its assets in corporate bonds of issuers located in developed countries, with a rating equivalent to or higher than CCC /Caa2 from a recognized rating agency, or judged to be of equivalent quality according to our internal credit analysis. The credit alpha strategy is a pure long / short credit strategy with no bias that employs a high conviction, selective approach designed to deliver uncorrelated performance across all market conditions. The fund focusses on detailed bottom-up ESG-integrated research, allowing it to uncover long as well as short opportunities across credit markets. The long / short buckets seek to enhance the fund’s ability to deliver returns that are uncorrelated market, while the tactical overlay may enable the team to limit volatility and manage drawdowns in a flexible manner. The strategy operates in a wide investment universe (Investment Grade and High Yield) which provides diversification and is generally devoid of any specific bias. The track record since launch has been encouraging, with the fund delivering positive returns and controlled volatility in highly turbulent markets.

A process that flexibly Implements the best ideas of the High Yield Team

Our approach is primarily bottom-up driven and relies on rigorous credit research with the aim to generate outperformance. We also consider top-down (sectoral and regional) allocation as secondary sources of returns, while a material portion of alpha is also generated through our tactical overlay strategies that involve credit market exposure / hedging and duration management.

A preliminary filtering of the investment universe is applied based on ESG (controversial activities) and liquidity exclusion criteria. A detailed assessment of the economic, sector and industry framework is carried out in order to identify and select the best opportunities in the market. The investment teams establish a macro-economic scenario, identify opportunities as well as macro risks, top-down preferences in terms of sector, region, and rating.

The bottom-up analysis of issuers and issues forms the cornerstone of bond selection and is the main source of added value. This allows our portfolio managers to identify new investment ideas, to follow the credit quality of issuers over time, to gauge the impact of new information, and to determine optimal entry points. The High Yield Team at Candriam boasts of significant industry experience and a sturdy track record that goes back to 1999. The team also relies on quantitative tools to constantly monitor credit market valuations across sectors, ratings, regions, and instruments in order to generate ideas and eventually implement positions.

Portfolio construction is based on valuation, technical factors and market expectations, and is implemented by the key decision-makers: Nicolas Jullien, Head of High Yield & Credit Arbitrage and Thomas Joret, Senior Fund Manager, as part of a strong team of 4 credit analysts and 5 managers. Nicolas Jullien, as lead strategy manager, has final decision-making authority. Finally, positions are monitored in real time, and strict conviction-based selling discipline is applied.

A proven track record

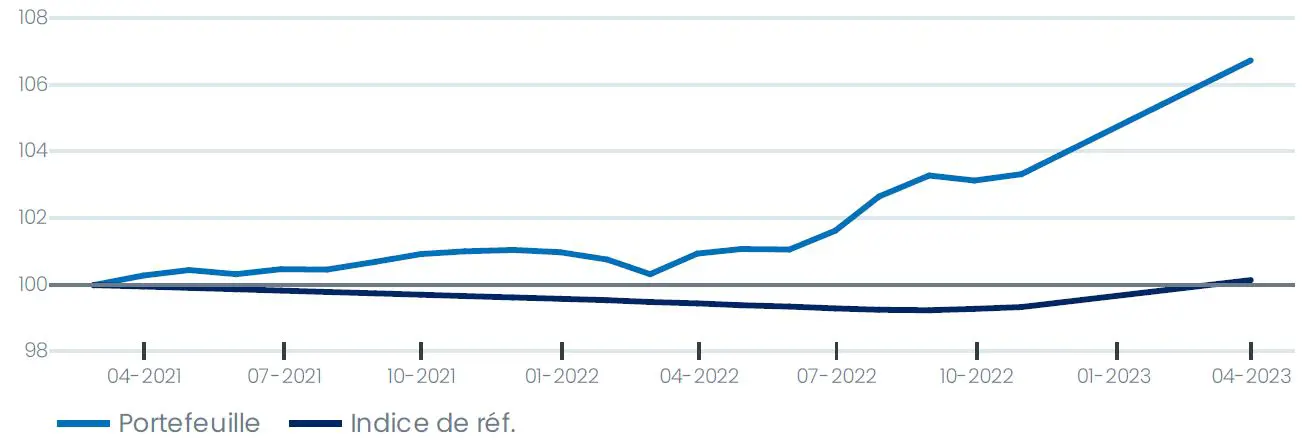

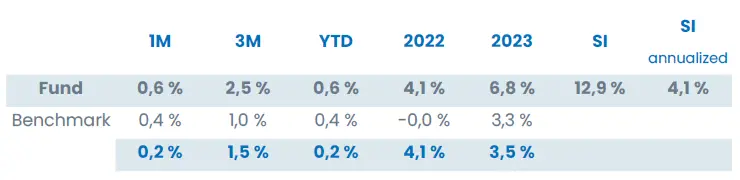

The Candriam Bonds Credit Alpha fund was launched in February 2021 and its objective is to use discretionary management to generate an absolute performance superior to the €STR© (capitalized) index with an ex-ante volatility target of less than 10% under normal market conditions. Volatility could nevertheless be higher, especially under abnormal market conditions.

Net Performance (as of 31/01/2024)

Data to 01/31/2024. Part I EUR. The fund is actively managed and the investment process involves reference to a Capitalized €STR© benchmark index. Performance expressed in a currency other than that of the investor's country of residence is subject to exchange rate fluctuations, which may have a positive or negative impact on gains. Where this document refers to special tax treatment, such information depends on the individual situation of each investor and may change

Since its inception, the fund has delivered a performance of 4,1% [1] (I-Share EUR ND) at end March 2023, outperforming the €STR© index, with a volatility that is well below 10%. It is important to note that this performance has been achieved under highly stressed credit markets, with investment grade and high indices posting negative returns. This demonstrates the fund’s ability to deliver uncorrelated and positive returns in highly unfavorable market conditions and place the strategy as a viable absolute return strategy.

Because navigating the credit market is likely to be complex in the coming weeks or months, adopting an absolute performance strategy seems to be a smart solution for informed investors.

Risks

All our investment strategies are subject to risks including the risk of loss of capital.

The main risks associated with the Candriam Bonds Credit Alpha fund are the following: Risk of loss of capital, Interest rate risk, Credit Risk, Liquidity Risk, Derivative risk, Counterparty Risk, Arbitrage Risk, Sustainability Risk.

This marketing communication is provided for information purposes only, it does not constitute an offer to buy or sell financial instruments, nor does it represent an investment recommendation or confirm any kind of transaction, except where expressly agreed. Although Candriam carefully selects the data and sources within this document, errors or omissions cannot be excluded a priori. Candriam cannot be held liable for any direct or indirect losses as a result of the use of this document. The intellectual property rights of Candriam must be always respected, contents of this document may not be reproduced without prior written approval.

Warning: Past performance of a given financial instrument or index or an investment service or strategy, or simulations of past performance, or forecasts of future performance does not predict future returns. Gross performances may be impacted by commissions, fees and other expenses. Performances expressed in a currency other than that of the investor's country of residence are subject to exchange rate fluctuations, with a negative or positive impact on gains. If the present document refers to a specific tax treatment, such information depends on the individual situation of each investor and may change.

In respect to money market funds, please be aware that an investment in a fund is different from an investment in deposits and that the investment’s principal is capable of fluctuation. The fund does not rely on external support for guaranteeing its liquidity or stabilizing its NAV per unit or share. The risk of loss of the principal is borne by the investor.

Candriam consistently recommends investors to consult via our website www.candriam.com the key information document, prospectus, and all other relevant information prior to investing in one of our funds, including the net asset value (“NAV") of the funds. Investor rights and complaints procedure are accessible on Candriam’s dedicated regulatory webpages https://www.candriam.com/en/professional/legal-and-disclaimer-candriam/regulatory-information/. This information is available either in English or in local languages for each country where the fund’s marketing is approved. According to the applicable laws and regulations, Candriam may decide to terminate the arrangements made for the marketing of a relevant fund at any time.

Information on sustainability-related aspects: the information on sustainability-related aspects contained in this communication are available on Candriam webpage https://www.candriam.com/en/professional/market-insights/sfdr/. The decision to invest in the promoted product should consider all the characteristics or objectives of the promoted product as described in its prospectus, or in the information documents which are to be disclosed to investors in accordance with the applicable law.

Notice to investors in Switzerland: The information provided herein does not constitute an offer of financial instruments in Switzerland pursuant to the Swiss Financial Services Act ("FinSA") and its implementing ordinance. This is solely an advertisement pursuant to FinSA and its implementing ordinance for financial instruments.

Swiss representative: CACEIS (Switzerland) SA, Route de Signy 35, CH-1260 Nyon. The legal documents as well as the latest annual and semi-annual financial reports, if any, of the investment funds may be obtained free of charge from the Swiss representative.

Swiss paying agent: CACEIS Bank, Paris, succursale de Nyon/Suisse, Route de Signy, 35, CH-1260 Nyon. Place of performance: Route de Signy 35, CH-1260 Nyon. Place of jurisdiction: Route de Signy 35, CH-1260 Nyon.

Specific information for investors in France: the appointed representative and paying agent in France is CACEIS Bank, Luxembourg Branch, sis 1-3, place Valhubert, 75013 Paris, France. The prospectus, the key investor information, the articles of association or as applicable the management rules as well as the annual and semi-annual reports, each in paper form, are made available free of charge at the representative and paying agent in France.

Specific information for investors in Spain: Candriam Sucursal en España has its registered office at C/ Pedro Teixeira, 8, Edif. Iberia Mart I, planta 4, 28020 Madrid and is registered with the Comisión Nacional del Mercado de Valores (CNMV) as an European Economic Area management company with a branch. CNMV: 266

[1] Data as of 04/02/2021. I Share Class EUR. The fund is actively managed, and the investment process implies referring to a benchmark index Capitalized €STR©. Performances expressed in a currency other than that of the investor's country of residence are subject to exchange rate fluctuations, with a negative or positive impact on gains. If the present document refers to a specific tax treatment, such information depends on the individual situation of each investor and may change.