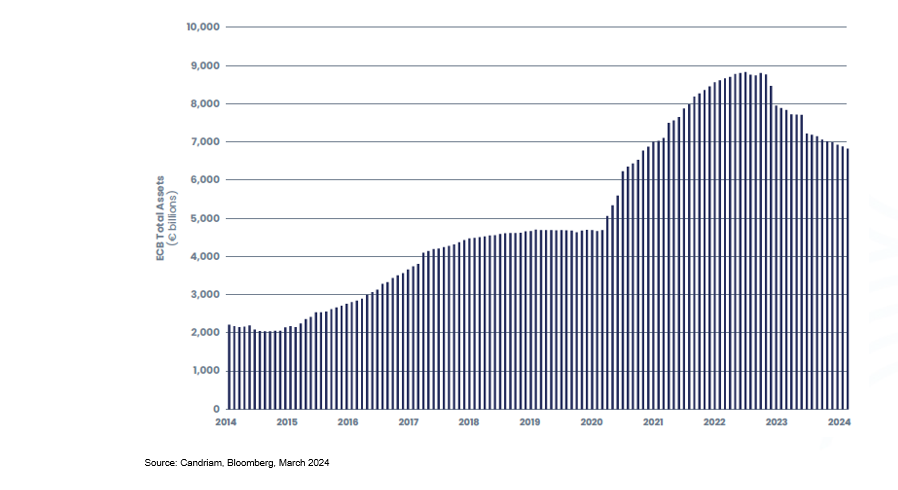

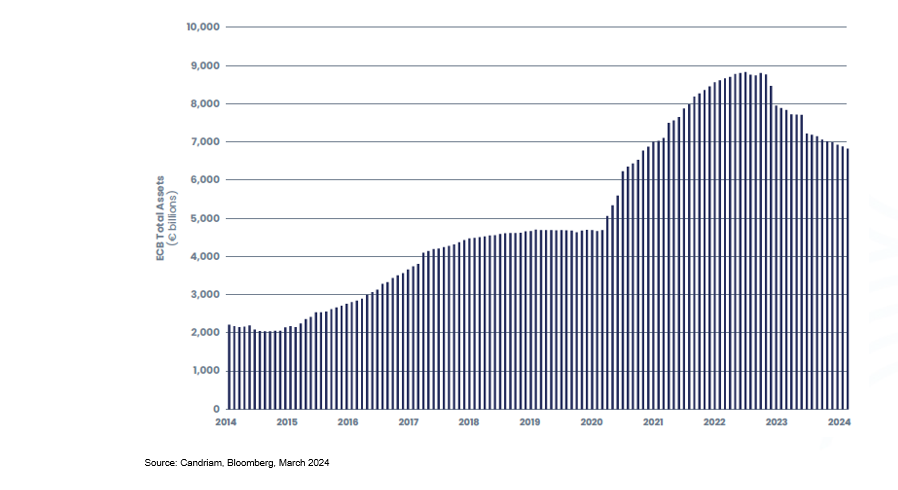

The European Central Bank (ECB)’s role has changed dramatically since its inception in the 1990s. Gone are the days of simply watching inflation. Now they're actively managing the financial health of the eurozone.

Remember the Great Financial Crisis of 2008? That's the turning point for the ECB, when it stepped in to prevent a financial meltdown. From there, the ECB created various tools to support the eurozone economy. This came at a cost: excess liquidity.

Eurozone Liquidity: A Trillion-Dollar Surge

That's the problem the ECB is facing now: how to reduce the excess cash that has flooded into the market as economic conditions no longer lend themselves to the unconventional measures it has implemented over the past decade. Now the Frankfurt-based institution has to find the right balance:

- Taming inflation without hurting economic growth

- Mop up excess liquidity without causing financial instability

The ECB's playbook? It's still being written. The ECB is exploring new approaches and rethinking how banks access liquidity.

The ECB's potential future options:

- A demand-driven system: could banks request liquidity on demand, shifting the dynamic?

- Hybrid approach: perhaps a mix of "corridor" and "floor" systems is the answer.

A Potential Resurgence of Money Market Funds?

The ECB's tightening grip on the money supply opens the doors for the revival of money market funds as a key player in the European financial system. These funds offer a compelling alternative to traditional bank deposits, particularly in light of a potentially more profitable yield curve. By professionally managing a pool of short-term, high-quality assets, money market funds can help investors weather market volatility and generate income from their cash holdings even in uncertain economic times.

;

;