Global manufacturers are navigating a highly challenging environment marked by tariffs, trade conflicts and new alliances, supply chain disruptions, and rising geopolitical tensions. In the US, this has triggered the start of a new era of reindustrialisation with a focus on “Made in America”, where supply-chain resilience, reliable efficiency and advanced technology are key. As a result, companies are rethinking their manufacturing strategies as they see advantages in reshoring back to the US. This shift should create attractive investment opportunities for long-term investors.

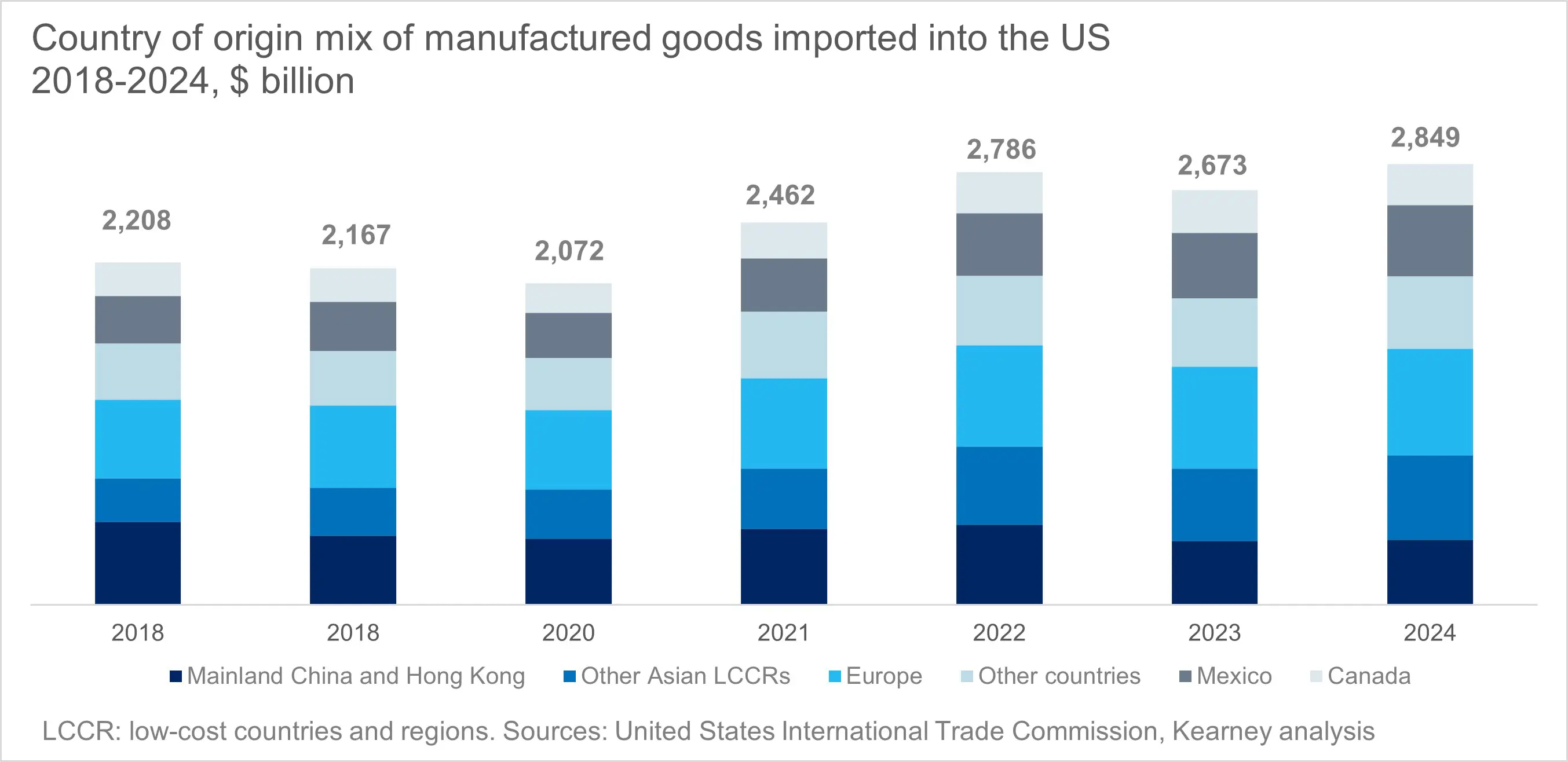

Over the past few decades, global economies have grown increasingly interdependent as globalisation transformed national production systems. According to data from the National Highway Traffic Safety Administration (NHTSA), more than half of the parts used in automobiles sold in the US now originate from countries other than the United States or Canada [1]. Increasing domestic demand has led the US to increase its imports, especially in product categories such as high tech. In 2024, the US imported more manufactured goods than ever in the past decade, from many regions of the world.

Today, the trend has reversed, as large US manufacturers are reevaluating their strategies and shifting to a more regional approach – bringing manufacturing and business operations closer to home in a trend known as reshoring. A recent study by Capgemini [2] revealed that nearly 60% of US company executives have invested in nearshoring or a combination of reshoring and nearshoring -relocating operations or manufacturing to nearby countries, typically those that share a border or are geographically close. For example, this includes shifting production from China to Mexico.

What are the reasons behind this trend? While cost control is the main motivation, CEOs also cite sustainability and geopolitical tensions as key triggers – the recent rise in external uncertainties having a noticeable effect on CEO priorities [3].

The Investment Case Behind “Made in America”

This shift is not only strategic but also economically significant. According to recent US government estimates, investments in reshoring, defense manufacturing, and infrastructure could inject up to $450 billion into the U.S. economy over the next five years [4]. These initiatives are expected to generate substantial demand across both industrial and technology sectors.

The broader push for strategic autonomy is also driving targeted industrial policy support in critical areas such as semiconductors, rare earth elements, and energy security - all essential to national resilience and technological leadership. For investors, this creates tangible opportunities.

For example, the global semiconductor market is projected to surpass $1 trillion by 2030 (Gartner), while over 70% of the rare earth elements used in the US are currently imported from China [5] , highlighting both the urgency and potential of building domestic capabilities. As governments and corporations align around supply chain resilience, the industrial and technology sectors are set to benefit from a multi-year capital expenditure cycle with strong investment momentum.

Smart Factories: The Backbone of Modern Industry

Companies will also seize the opportunity to step away from outdated industrial models and modernize through smart factory technologies. Robotics, automation, and data-driven processes are becoming central to manufacturing, with growing investments in robotic installations - up 12% in the US last year according to IFR Robotics -alongside intelligent assembly lines, self-learning machines, digital twin technology and IoT-enabled sensors that transmit real-time data.

This transformation demands major investment in AI software, cloud infrastructure, and edge computing. Artificial intelligence now plays a vital role in predictive maintenance, quality control, and inventory management, while cloud and edge solutions enable scalable data processing and coordination across production sites. At the same time, cybersecurity has evolved from a technical safeguard to a strategic imperative.

As companies reshore operations, they are not simply relocating -they are actively engaging in reindustrialisation by reimagining and modernising their production models. This transformation is powered by the adoption of advanced technologies such as automation, artificial intelligence, edge computing, and digital twins. According to Capgemini, 68% of executives are confident in the potential of reindustrialization to drive innovation and technological progress, particularly through these emerging technologies. These innovations support more agile and efficient manufacturing processes, enhancing operational efficiencies and cost savings, and potentially improving profitability over time.

Altogether, this industrial evolution is driving demand across several high-impact innovation themes:

- Robotics and automation for both physical operations and smart process optimisation software

- Cloud and AI technologies to power the digital backbone of smart factories

- Cybersecurity solutions essential for operational resilience and data protection in an increasingly connected environment.

Europe’s Turn to Strategic Autonomy

While the US leads the reshoring narrative, Europe is facing a similar wake-up call. The continent’s heavy reliance on external partners – particularly for energy, raw materials and semiconductors - has revealed critical vulnerabilities in its supply chains. In response, the European Union has launched a series of strategic initiatives aimed at strengthening its industrial and technological sovereignty.

Programs like RePowerEU, the European Chips Act, and InvestEU are designed to reduce foreign dependency, boost domestic production capacity, and support innovation across key sectors. These efforts mark the beginning of a long-term investment cycle focused on the energy transition, digital infrastructure, and strategic materials, laying the groundwork for a more resilient and future-proof European industry.

Ultimately Europe’s strategic shift aligns with and reinforces the broader industrial innovation themes mentioned above - such as robotics and automation for both physical systems, smart factories, cloud and AI technologies, and cybersecurity – creating a unified front in the race for technological leadership and supply chain resilience.

[1] Source: USA Today, analysis of reports released by the National Highway Traffic Safety Administration. For all models assembled and available for sale in the U.S., 47% of the parts (by value) originated from the U.S. or Canada.

[2] Source: Capgemini Research Institute, The resurgence of manufacturing, Reindustrialization strategies in Europe and the US - 2025.

[3] Source: Kearney, 2025 Reshoring Index: The great reality check

[4] Source: White House estimate, Modernizing defense acquisitions and spurring innovation in the defense industrial base, 9 April 2025

[5] Source: Statista, April 2025