As the European Union (EU) gets tougher on recycling, investors can look forward to new opportunities in the push on making circular economy happen.

Europe is reading to head full steam ahead in the direction of a circular economy, which the EU hopes will not only help reduce carbon emissions but also boost global competitiveness, foster sustainable economic growth and generate new jobs. Recycling is important in “closing the loop” – creating a circular economy with the recovery of as much resources as possible. Investors will play an important role in making this transition happen.

In 2018, the EU agreed to tighten its targets for recycling waste, aiming to increase the level of recycled municipal waste to 55% by 2025, to 60% by 2030 and to 65% by 2035, while the Packaging and Packaging Waste Directive (94/62/EC) stipulated that EU Member States must recycle at least 70% by 2030[1].

Earlier in 2020, the European Commission launched its ambitious Circular Economy Package, which includes revised legislative proposals on waste. It had set clear targets for waste reduction as well as an ambitious plan for waste management, supported by a range of measures to address potential and current obstacles to its implementation in different EU member states.

Closing the gaps

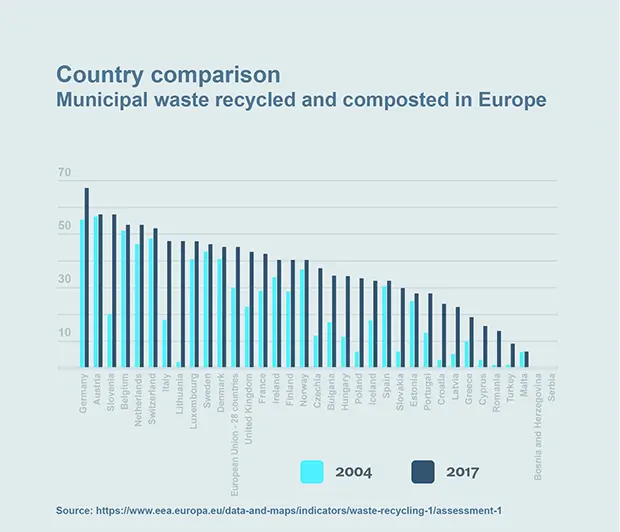

As the whole of the EU will be striving to meet these new standards, in the last few years some European countries have made much better progress in building their recycling capabilities than others. For example, the following chart shows how large is the difference in municipal waste recycling performance between different countries. In 2017, rates ranged from 68% in Germany to 0.3% in Serbia. Six countries (Germany, Slovenia, Austria, the Netherlands, Belgium and Switzerland) recycled 50% or more of their municipal waste.

In contrast, another five countries recycled less than 20%, with two countries less than 10 %.[2] Subsequently, some will have to work harder in order to meet the new EU goals and incentives than the top performers, and that is where many investment opportunities will ultimately lie. To close this gap, some countries will likely attract the assistance of companies that are regarded as circular economy enablers.

Note: Recycling rates indicate the percentage of municipal waste generated that is recycled, composted and anaerobically digested, and might also include that prepared for reuse. Changes in reporting methodology mean that 2017 data are not fully comparable with 2004 data for Austria, Belgium, Croatia, Cyprus, Estonia, Lithuania, Italy, Norway, Malta, Poland, Romania, Slovakia, Slovenia and Spain; 2005 data were used instead of 2004 data for Poland because of changes in methodology. On account of limited data availability, instead of 2004 data, 2003 data were used for Iceland, 2007 data for Croatia, 2006 data for Serbia and 2008 data for Bosnia and Herzegovina. For the EU-28, 2004 data were based on 2007 data for Croatia, and 2016 data were used for Iceland and Ireland instead of 2017 data. The 2017 data for Cyprus, Germany, France, Luxembourg, Poland, Slovenia, Spain, Switzerland, Turkey and the EU-28 include estimates.

Source: European Environment Agency, 22 Nov 2019.

More well-known examples of recycling successes have been in the collection of plastic bottles through reverse vending machines. Consumers in some of the “top recyclers”, have grown very familiar with these machines, which act as conduits for “deposit return schemes”. These schemes allow consumers to return their bottles for a reward, usually a monetary voucher which can be spent in store. The machine accepts bottles, optically pre-sorts them depending on plastic type, size and contamination levels, assisting the recycling process further down the chain.

In Germany, which is not only a European but also a global leader in recycling, reverse vending machines had given rise to a sort of national sport, with many teenagers and more grown ups engaged in collection of plastic bottles for money. This has resulted in an impressive 95% collection rate of polyethylene terephthalate (PET) containers nationally[3]. Needles to say, that providers of such machines have done very well, both in terms of their profitability and their share price.

More and more countries are introducing deposit schemes to encourage consumers to recycle. This is a trend that is likely to continue, given the tighter standards introduced in 2019 by the EU Single Use Plastics Directive[4]. The legislation mandates a 90% bottle collection target for all member states by 2029, with all plastic bottles having contain at least 25% recycled plastic (rPET) by 2025. The countries where single plastic recycling rates are not yet high enough, such as France, Portugal and Spain will need to encourage companies-enablers to help them meet the EU expectations in time. As with the municipal waste recycling gap, this will lead new commercial opportunities for providers, which asset managers will help their clients to identify, making the move towards a circular economy profitable for the environment, communities and investors.

[1] https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32018L0852&from=EN

[2] https://www.eea.europa.eu/data-and-maps/indicators/waste-recycling-1/assessment-1

[3] https://www.europarl.europa.eu/RegData/etudes/note/join/2011/457065/IPOL-AFET_NT(2011)457065_EN.pdf , https://www.petcore-europe.org/news-events/202-2017-survey-on-european-pet-recycle-industry-58-2-of-pet-bottles-collected.html

[4] https://ec.europa.eu/commission/presscorner/detail/en/IP_19_2631