The beginning of the year provided some relief to global investors and allowed them to claw back some of the losses they suffered in the previous year. That said, the theme of strong stock-bond correlation continued to hold, as rates, credit and equities all posted positive returns. Within fixed income, risk markets outperformed, led by US High Yield, with EUR High Yield and Hard Currency Emerging Market Debt (HC EMD) trailing closely behind. Among major rates markets, the Antipodes (AUS and NZ) delivered the highest returns, followed by gilts and other non-eurozone European countries. Japanese Government Bonds (JGBs) and US Treasuries closed the field.

Appetite was strong in credit markets, with junior and subordinated issues outperforming. Similarly, the strongest gains came from the lowest-rated issuers. On a sector-by-sector basis, risk appetite was also visible. Defensive sectors like consumer, retail and healthcare were the weakest. Property was the strongest sector by some margin – likely reflecting that markets are increasingly pricing in central bank pivots and diminishing worries about financing conditions.

Lagarde – the last hawk still flying?

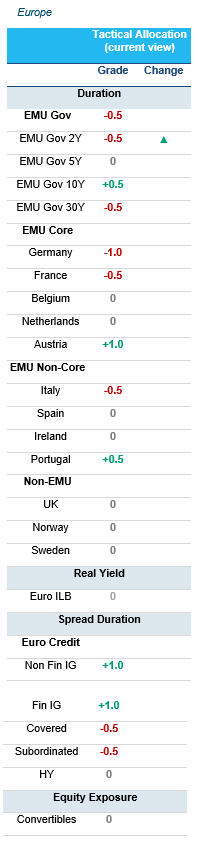

We are reducing our underweight on the short end of the EUR curve as the sustained downward trend in headline inflation should feed through to monetary policy. While in some ways Christine Lagarde struck a hawkish tone, promising another 50 basis point hike in March, she remained noncommittal on the further trajectory. The ECB’s own inflation forecast at the next meeting will be closely scrutinised by investors. After a long period of underestimating inflation, we expect the staff estimate will need to be revised downwards at the March meeting. While there will certainly be a convergence of headline and core inflation as energy prices recede, it’s worth remembering that as per its statutes, monetary policy should be driven by headline figures including energy prices.

In non-core rates, the Meloni government seems keen not to snub its European partners and avoid the impression of recklessness. However, the phase-out of the Asset Purchase Programme risks putting upward pressure on Italian yields and warrants continued caution.

The supply picture for 2023 is worsening, as APP reinvestments will be reduced gradually by EUR 15 billion per month from March, and the fiscal deficit needs to be financed. We maintain a steepening on EU 10s/30s.

Finally, although outside of developed market benchmarks, the European Monetary Union welcomed its 20th member state, Croatia, at the beginning of this year. Given the limited technical supply effects from inclusion in certain benchmarks, some support should be provided as this issuer enters certain indices at their next rebalancings.

“Soft” seems increasingly certain – but what about the “landing”?

What do the Boeing 747 and US unemployment have in common? The jumbo jet made its debut in 1969 – a year in which 7 out of 10 Americans alive today were not yet born – and the last aircraft of the series was delivered this year. 1969 was also the last time before 2023 that US unemployment fell below 3.5%.

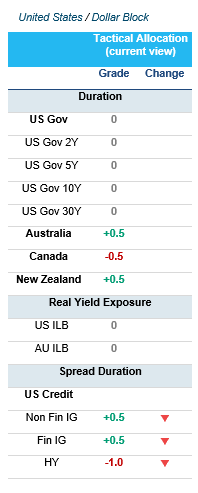

So far, the labour market has clearly shown remarkable indifference to the Fed’s rate hikes. The steepness of the Fed’s 2022 tightening is without recent precedent: this leaves a degree of uncertainty as to how long and pronounced the lag in the monetary policy follow-through will be. It’s worth remembering that less than a year ago, the policy rate was barely above 0. If the Fed hikes by another 75 basis points in the first half of the year; it will reach 5.25% – a level it last stood at in 2008 after a two-year tightening cycle. This means that investors should not dismiss the risk of a noticeable economic slowdown in the US. Our analyses do indeed indicate an increasing likelihood of a cooling in the business cycle. While most indicators are still growing overall, the rate of change has clearly slowed. The labour market remains an outlier in the overall picture and is something of a head-scratcher, not only for market participants but almost certainly the FOMC members themselves as well.

Nonetheless, bond investors should feel reassured by an inflation picture that is much less ambiguous, with most signs pointing to a sustained dampening. Fed Chairman Jerome Powell’s statements were more dovish than anticipated by many, and contrary to Christine Lagarde, he did not openly challenge the amount of future rate hikes priced in by markets. We believe that in this context, any future temporary weaknesses could provide a good entry point into buying US duration.

Clear opportunities in the other dollar curves and emerging markets

Australia may buck a decades-long trend of relative immunity to economic slowdowns when compared to other developed economies. This year, however, economic growth is not a foregone conclusion despite China’s re-opening. Both in Australia and New Zealand, current and forward-looking indicators are looking quite negative. Given the housing markets in these countries with their high interest sensitivity and the slightly more flexible inflation target (a band going up to 3%), we continue to believe that rates in these countries are likely to come back down.

In Canada, we take the opposite view: while the Bank of Canada has for the time being shelved its markedly dovish stance in light of a strong economy, extensive cuts remain priced into forward markets.

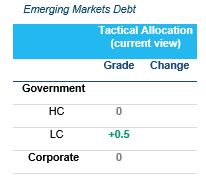

Hard Currency EMD remains richly valued. In HC Sovereigns, spreads are at historically low levels. However, certain local currency markets are offering value. In rates, Brazil is still very attractive given nominal yields of 13% and inflation below that of most developed markets. In currencies, China’s reopening should provide support to BRL, KRW and MXN.

European IG has performed strongly, but the technical picture should remain supportive

Despite the strong performance, we remain constructive on European Investment Grade credit as the carry remains interesting. The asset class rallied despite very active primary markets: nearly one quarter of expected 2023 issuance came to the market in January alone. Therefore, we expect some moderation in the next few weeks as European companies will enter the blackout period. In terms of fundamentals, both the macro- and microeconomic backdrop are conspiring to create near-ideal conditions: the recession risk is fading, inflation is easing, and financing conditions are unlikely to continue to tighten materially from here. While earnings are indeed decelerating, the contraction is less pronounced than feared. The earnings season also indicated a strong start to the year for eurozone banks.

On US Credit, the strong January rally compels us to return to a less bullish view. We prefer EUR risky assets. The US High Yield risk premium is clearly less attractive than the EUR: spreads are below 400 bps and taking into account fundamental quality, US HY appear expensive.

While we believe that 2023 will offer real investment opportunities in the credit market with attractive yields, we are also convinced that dispersion will increase. Financial health, operating performance and cash flow generation are key factors in the choice of issuers. Taking climate ambitions into account has also become a must.

Strategy & positioning

Slowdown, but recession will be avoided

Energy prices have fallen, and gas storage is high. Fiscal measures, solid employment growth and large excess savings support the economy, which appears to be more resilient than expected.

While the ECB is still hawkish short term, suggesting 50 bps for the March meeting, rate hikes afterwards will be data dependent. The new ECB staff macroeconomic forecasts in March will give an important indication on further steps. Near-term inflation is more balanced and needs to be further reassessed after months of upwards growth. We reduce our underweight on the 2Y segment.

The supply picture for 2023 is worsening, as APP reinvestments will be reduced gradually by €15 billion per month from March and fiscal deficits need to be financed. We maintain a steepening on EU 10s/30s.

We continue to see value in Austrian Bonds compared to French bonds. Taking into account the current valuations and their respective credit solvency and ESG profile, the deficit and supply picture is more challenging for France.

Among peripherals, we prefer Portugal to Italy. We are monitoring fiscal developments in Italy and will assess the impact of QT.

We maintain a positive view on € Investment Grade Credit. Despite the impressive spread rally, European credit markets continue to offer an interesting carry of 3.75%. Disinflation is underway and the recession risk is receding. Earnings are decelerating but more resilient than expected. Technicals remain supportive as February will be quieter in terms of supply. We maintain high selectivity amid a still challenging environment. We have a preference for € High Yield to $ High Yield. Even after the rally, the carry on the EUR is higher on a currency-adjusted basis and credit quality is better.

We maintain a neutral view on € Convertibles following the strong equity rally, and are waiting for a better entry point.

US disinflation is underway

The ongoing slowdown in the US economy is visible as manufacturing indicators and residential investments are trending downwards, but consumption and the labour market continue to provide support.

Disinflation is underway and after the unprecedented FED monetary tightening, we can expect the FED to stop hikes in H1. We maintain a neutral stance on US duration and any rebound in rates could be an opportunity to buy duration.

We continue to favour Australian bonds over US treasuries, especially in the long end, as they provide the best carry outside Japan. In NZ, the market is starting to appreciate the weaker domestic growth picture, and we are comfortable to be long on NZ. Conversely, Canada appears quite expensive, with negative carry and most cuts largely priced. We have a short recommendation on CA.

We reduced our overweight recommendation on $ IG after the impressive rally and prefer € risky assets. The US High Yield risk premium is also less attractive. We took profit after an impressive rally in January. The spread is below 400 bps and taking into account fundamental quality, $ HY appear expensive.

China reopening

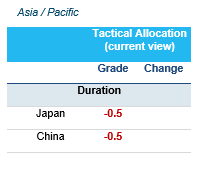

We maintain an underweight on Japanese bonds as the 10Y segment is most at risk in case of change in monetary policy, as a new Governor will be appointed and inflation is rising well above their target.

We maintain an underweight on Japanese bonds as the 10Y segment is most at risk in case of change in monetary policy, as a new Governor will be appointed and inflation is rising well above their target.

China is reopening and mobility indicators point to a strong rebound. Chinese bond valuations are expensive.

Preference for EM local rates

The global backdrop has improved for EM following the easing in US growth, inflation and the reopening of China. Hard currency valuations look very tight, especially for IG sovereigns. Local rates and EM FX offer the best perspectives, as inflation is peaking and central banks are ending their tightening cycle.

The global backdrop has improved for EM following the easing in US growth, inflation and the reopening of China. Hard currency valuations look very tight, especially for IG sovereigns. Local rates and EM FX offer the best perspectives, as inflation is peaking and central banks are ending their tightening cycle.

Relative approach on currency view

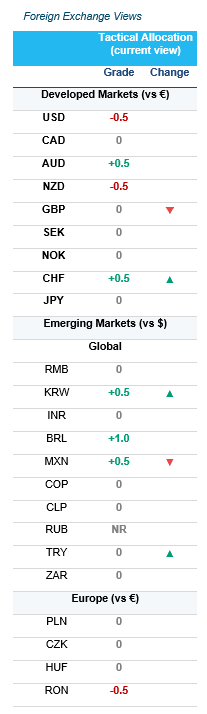

The USD peaked in 2022.

The USD peaked in 2022.

Fundamentals indicate AUD/NZD should be higher, given the strong prices of Australia’s key commodity exports. China’s reopening could provide slightly more help to the AUD.

We took profit on our GBP short.

Small long in CHF. Protection in case of risk-off.

We prefer to buy EMFX vs USD as the FED is less hawkish, which could favour carry trades in a soft-landing scenario.

Small long on KRW

Small long on MXN. Taking partial profit, but could re-enter at a better level.

BRL should benefit from China’s reopening.