Last week in a nutshell

- Chip stocks tumbled on news of possible tighter US export controls on advanced semiconductor technology to China.

- The ECB kept interest rates unchanged despite a recent drop in inflation, opting to delay further monetary easing after its June cut.

- JD Vance, Donald Trump’s vice-presidential nominee, portrayed the Republican Party as the champion of working class Americans.

- In the UK, the King’s Speech outlined plans for the world’s sixth largest economy to boost economic growth without significantly raising taxes.

What’s next?

- US president Joe Biden will address the US nation as he is not seeking reelection and is officially endorsing VP Kamala Harris. While it will carry weight with delegates at the Democratic convention, it is not binding.

- Activity will be in the spotlight with the publication of the flash Global PMI giving investors the pulse of the manufacturing and services activity.

- In the US, investors will analyse the preliminary Q2 GDP growth rate, core PCE, and Q2 earnings from Tesla, Microsoft and Alphabet.

- The Euro Area will publish preliminary confidence data reflecting consumers’ views on their household’s intentions to make major purchases.

Investment convictions

Core scenario

- At this stage, our scenario that interest rates have peaked and that the Federal Reserve will begin its monetary easing cycle in September is gaining traction.

- Despite slowing growth, earnings are rising and profits remain resilient. In the US, growth forecasts are increasingly influenced by political factors. EU growth is dependent on a pick-up in consumer activity, while China's growth remains subdued.

- The cooling of inflation – and core inflation – is a synchronised global development. Supportive (i.e. lower) inflation news also paves the way for European central banks (e.g., ECB, BoE, SNB, Riksbank) to cut interest rates in Q3. With several emerging market central banks already cutting since 2023, the long-awaited global easing cycle is about to begin.

Risks

- Looking ahead, we caution against policy decisions that lead to higher tariffs and a tighter labour market in the US, which could ultimately lead to rising inflation again.

- A potential change in the White House and the reprioritisation of US economic policy could affect the speed and extent of monetary easing as a second Donald Trump presidency increases the odds of higher inflation in 2025.

- The recent snap elections have put France in an unprecedented situation: a coalition must be formed to provide political stability in a context of limited fiscal space to boost supply. Next year, we see a risk of downgrade or a negative outlook in all scenarios as the debt ratio rises.

- In China, economic activity remains fragile and price developments remain deflationary as consumer confidence remains low. Additional tariffs could jeopardise continued recovery.

- Geopolitical risks to the outlook for global growth remain tilted to the downside as developments in the Middle East and the war in Ukraine unfold.

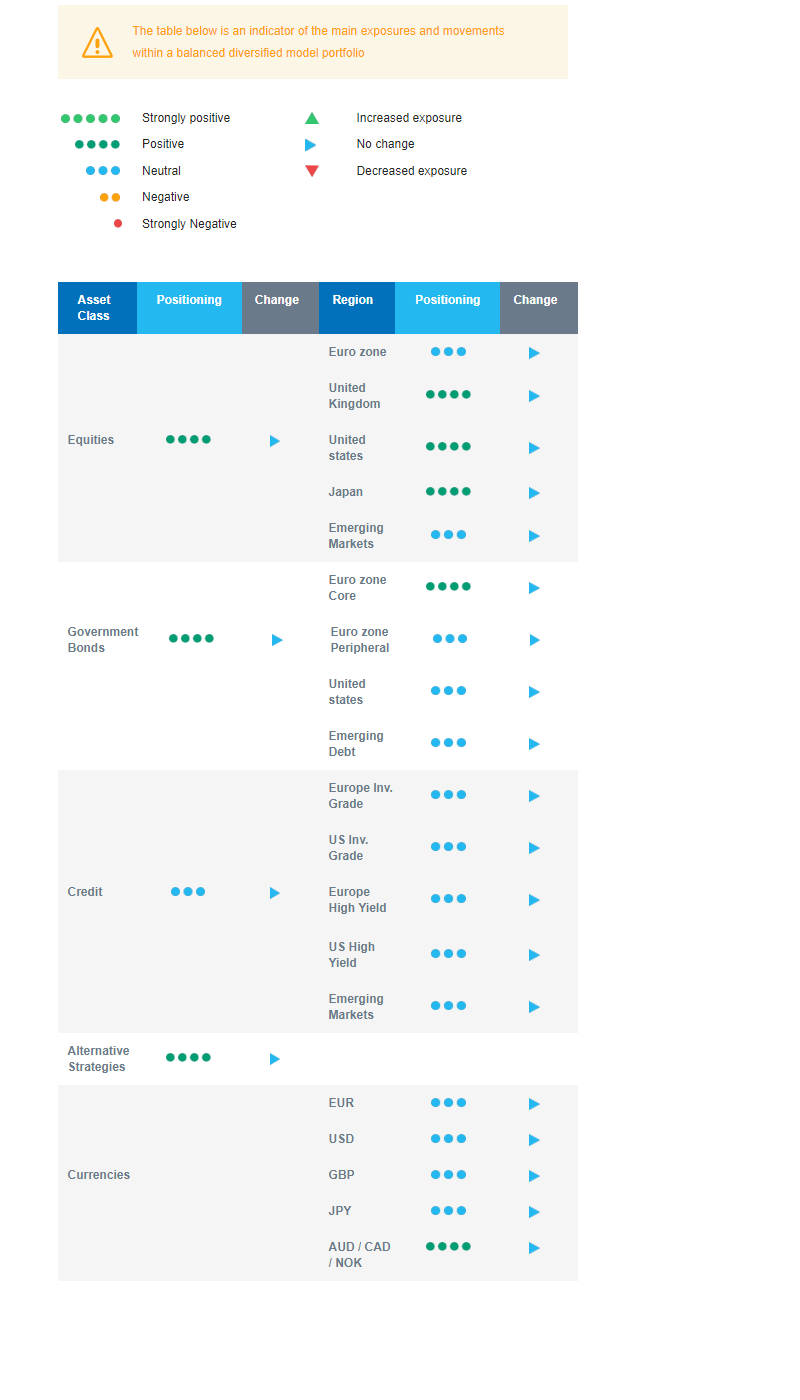

Cross asset strategy

- While we are cautious about recent political developments on both sides of the Atlantic, the upcoming policy actions support a constructive view on developed equity markets.

- We are slightly overweight US, UK and Japan but neutral on eurozone equities:

- In the US, the Q2 earnings season is already showing strong EPS growth, which should continue to be supportive, while a narrowing growth gap should be a catalyst for the market to broaden out beyond the mega-caps.

- In the UK, valuations remain attractive with the potential for multiple expansion and the BoE poised to cut interest rates.

- In Japan, exiting the multi-decade long deflation as well as corporate governance reforms bearing fruit should more than counterbalance a less dovish Bank of Japan.

- In the eurozone, while tail risks in France have diminished, the surprise victory of the left-wing alliance and a hung parliament imply political uncertainty. A higher risk premium seems justified.

- In the equity sector allocation:

- We have a positive view on the Tech sector: good earnings and guidance, peaking long-term yields, reasonable valuations, broad market leadership within IT and the industry’s relative insensitivity to the upcoming US presidential elections.

- We continue to focus on pan-European small caps, which will benefit from the monetary policy easing and higher-than-expected growth. This bias, particularly in the euro area, anticipates a revival in consumer spending, while UK small and mid caps should benefit from rising consumer confidence.

- In the fixed income allocation, with monetary policy easing and political uncertainty on the rise, safe bonds are an attractive investment, while we see little room for credit spreads to tighten further:

- We favour carry over spreads, with a focus on quality issuers: we maintain our long duration bias via Germany and the UK.

- We are now neutral on US duration.

- We have a relatively small exposure to emerging markets sovereign bonds amid very narrow spreads.

- We are neutral on investment grade and high yield bonds, regardless of the issuers’ region.

- In our forex strategy, we are positive on commodity currencies, such as the Australian dollar, as the global manufacturing cycle is gradually picking up. Contrary to the ECB in Europe, the RBA has become more hawkish amid higher than expected inflation and strong economic data.

- We expect Alternative investments to perform well as they present some decorrelation from traditional assets and keep an allocation to gold.

Our Positioning

With a constructive view on developed equity markets while taking into account the political risk, our positioning is slightly overweight equities across the US, Japan and Europe ex-EMU, while being cautious and remaining neutral on EMU. We are also neutral on emerging market equities until consumer confidence picks up. Sectors such as US Tech and pan-European small and mid caps reflect our recognition of strong earnings momentum, broadening performance, and our belief in lower inflation, lower central bank rates and gradually improving economic growth. On the fixed income side, we are positive on Core European duration as a safe haven and UK duration. The objective is to benefit from the carry in a context of cooling inflation and pending rate cuts by the ECB and BoE. In credit, we remain neutral - high yield and emerging debt - amid very narrow spreads and a strong USD. In our forex strategy, we hold some Australian dollars.