An irresistible momentum is shaping global markets, as investors face a paradox of rising risk perception alongside rallying assets. Economic data releases, trade tariffs and geopolitical signals remain noisy – yet financial markets continue to advance. As underlying fundamentals grow more complex, we expect the coming weeks to bring clarity on corporate earnings, the new trade regime and expected monetary policy inflections.

We maintain an overall balanced equity stance, but we identify compelling tactical opportunities across selected geographies and sectors. The Trump administration has so far delivered on election promises – the aggressive tariff agenda and the so-called “Big Beautiful Bill” are already reshaping forex markets, inflation expectations, and earnings visibility. At the same time, central banks remain cautious, providing support while inflation data begin to surprise on the downside. The result? A landscape where volatility is muted, valuations are stretched, and market direction depends on political timing as much as macro data.

The Forces Defining This Moment

Financial markets are drawing support from the resurgence of U.S. tech leadership and growing investor optimism around President Donald Trump’s economic agenda. Both internationally and domestically, the President has been forcefully advancing his agenda. His influence has become, in many ways, irresistible. Few countries have successfully pushed back against the higher tariffs introduced by Washington, and only a handful of members of Congress have opposed the bill. The Trump agenda is delivering and investors are taking note:

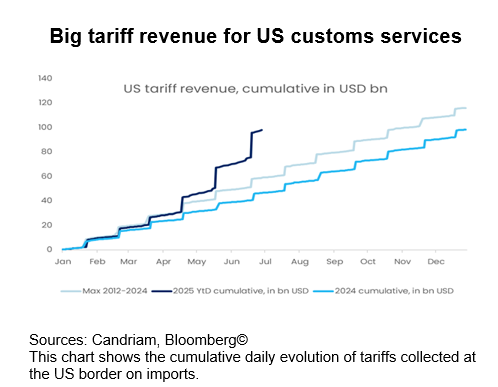

- The implementation of a new trade regime. Revenue collection at the border is rising sharply. The various hikes in sectoral and country-specific trade tariffs since Inauguration Day in January is are now reflected in customs revenues. As of the end of June, US Treasury data shows that this year’s revenue has already surpassed the total collected by US customs during the whole of 2024. Ahead of anticipated tariffs to be implemented next August, the latest annualised monthly revenue now exceeds USD 300bn – a partial but significant source of funding for the costly fiscal package, dubbed the “One Big Beautiful Bill Act” (OBBBA).

- The "Big, Beautiful Bill", a multi-trillion-dollar fiscal package. Estimates suggest that the economic stimulus effect may be smaller than during President Trump’s first term. New tax reduction measures (e.g., no tax on tips, no tax on overtime) are expected to total USD70bn per year. Beyond the immediate economic stimulus, the key takeaway for investors is this: Congressional approval of such a major fiscal bill within the first six months of the presidency underscores the significant political capital currently held by the White House.

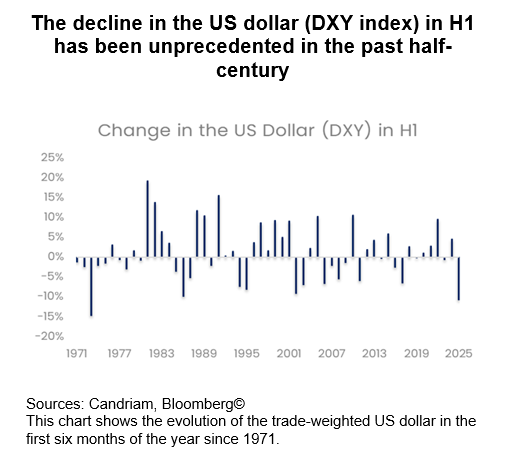

- The US dollar recorded its worst first-half performance since 1973. This striking outcome reflects the shift in US economic policy under the new administration - one clear consequence of which has been a pronounced weakening of the dollar. Notably, a weaker currency was one of Trump’s stated campaign objectives. The dollar had remained too strong for too long, making American goods less competitive abroad while encouraging cheap imports. That trend has now reversed. In many respects, the dollar’s decline can be seen as a policy success: it enhances the global price competitiveness of U.S. exports

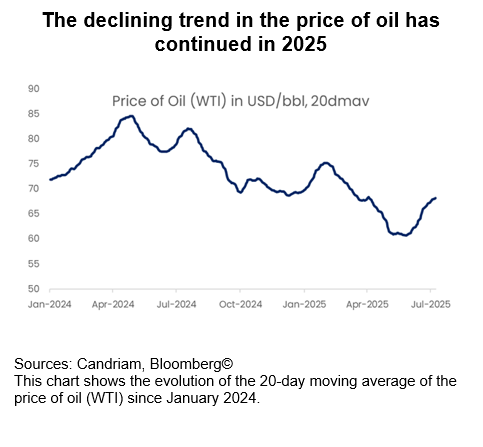

- Oil prices are trending lower. Another stated campaign goal was to bring down oil prices. This aim has also been achieved, and consumer and production prices have been trending lower in the first half of the year, supporting consumption and economic activity. Notably, the decline in oil prices has resulted from higher output by OPEC+ countries rather than a rise in US drilling. In this context, it is worth noting that President Trump’s first major international trip of his second term included visits to Saudi Arabia, Qatar, and the United Arab Emirates.

What would lead us to add or to reduce risk?

Beyond the uncertainties linked to the armed conflicts in Ukraine and the Middle East, we have identified three major risks that could have an impact on financial markets in the short term:

- Trade transformation, again: Markets are coming to terms with the breadth of the U.S. tariff agenda. July's soft deadline has now been extended, but the direction of travel remains clear. Sector-specific tariffs on pharmaceuticals, semiconductors, and autos may persist longer than anticipated. While markets have so far responded calmly, the economic effects – via margins, pricing, and investment intentions – are likely to play out later. Conversely, we would be inclined to increase risk if the U.S. and EU were to strike a concrete and credible trade truce, thereby reducing uncertainty and supporting margins.

- Valuations and earnings resilience: The S&P 500 and Nasdaq are trading near cycle-high P/E ratios, and earnings optimism is holding up, even as leading indicators such as ISM new orders begin to fade. Discrepancies are evident: cyclicals continue to outperform defensives, despite softening survey data. This asymmetry between fundamentals and flows creates a delicate tension that can persist only as long as the growth narrative remains unchallenged. A strong Q2 earnings season in July and August could be a catalyst to lengthen the investment horizon and increase the risk budget.

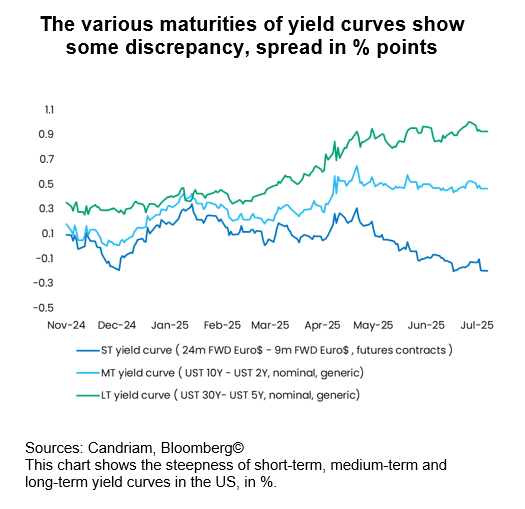

- Rate expectations vs. central bank posture: In the U.S. and Europe, policy expectations are more dovish than policymakers themselves. Real yields have softened, breakeven rates remain well-anchored, and volatility is subdued. However, this market calm masks an environment where the Fed is under political pressure and the ECB is navigating both a slowing economy and fiscal expansion in Germany. We note that market expectations of a Fed rate cut in the foreseeable future have led to an inverted short-term yield curve, which has clearly diverged from the rest of the curve. Beyond the Fed and ECB meetings at the end of July, investors should analyse the outcomes of the Central Bank and Economic Policy Symposium in Jackson Hole in August.

Investment Implications

Overall, we observe a market drawn by irresistible forces: fiscal largesse, trade drama, dovish central bank expectations, and political capital. The apparent calm of tight spreads, anchored rates, and rallying equities masks an underlying instability. As risks shift from inflation to growth and from policy to politics, active portfolio management will remain essential.

In Equities, we stay neutral and well-diversified, with a preference for technology and AI, German mid-caps, and European industrials. These offer better earnings momentum and political visibility than US cyclicals, which we believe are pricing in an overly optimistic scenario. Japan remains a structurally attractive market, though a stronger yen and trade frictions are near-term headwinds.

In Fixed Income, our positioning is slightly long duration in European sovereigns, and neutral on US Treasuries. Credit remains a key allocation: We prefer Investment Grade over High Yield, particularly in Europe where fundamentals are stronger and spreads more attractive. We keep diversifying via EM debt, supported by positive real yields providing attractive carry and a weakening USD.

In currencies, we favour the Japanese yen and maintain selective long positions in EM currencies where real rates and fundamentals align. We remain underweight US dollar.

Precious metals, Alternatives and Market-Neutral Strategies: Gold and Silver represent a strong hedge in a world of geopolitical complexity and real rate volatility. In addition, central bank, retail and ETF demand has strengthened as investors seek protection from macro tail risks. In light of persistent volatility and asymmetric market risks, we continue to maintain our allocation to alternative strategies. These approaches provide portfolio stabilisation and complement more traditional and directional exposures.

Candriam House View & Convictions

Legend

-

Strongly Positive

-

Positive

-

Neutral

-

Negative

- Strongly Negative

- No Change

- Decreased Exposure

- Increased Exposure

| Current view | Change | |

|---|---|---|

| Global Equities |

|

|

| United States |

|

|

| EMU |

|

|

| Europe ex-EMU |

|

|

| Japan |

|

|

| Emerging Markets |

|

|

| Bonds |

|

|

| Europe |

|

|

| Core Europe |

|

|

| Peripheral Europe |

|

|

| Europe Investment Grade |

|

|

| Europe High Yield |

|

|

| United States |

|

|

| United States |

|

|

| United States IG |

|

|

| United States HY |

|

|

| Emerging Markets |

|

|

| Government Debt HC |

|

|

| Government Debt LC |

|

|

| Currencies |

|

|

| EUR |

|

|

| USD |

|

|

| GBP |

|

|

| AUD/CAD/NOK |

|

|

| JPY |

|