From January through the end of May, European equities reclaimed leadership. In local currency, the MSCI EMU beat the MSCI World by roughly six to seven percentage points [1], and the quality of that advance was unmistakably value-tilted: banks and insurers led from the front, with telecom services, utilities and industrials providing consistent breadth.

Foreign exchange amplified Europe’s first-half appeal. The euro rallied from cycle lows into the mid-1.1s and then, over the summer, settled into a 1.15–1.18 range [2] while still up materially year-to-date, providing a tailwind for domestically oriented European equities. That currency strength coincided with a meaningful shift in flows: U.S. investors poured a record amount into Europe-focused ETFs in the first quarter [3]. Those flows reflected a search for diversification at more reasonable multiples, as well as growing interest in the region’s long-duration fiscal themes (defence and infrastructure) that were moving from speech to spend.

By June, however, the outperformance faded as Wall Street caught up, and since Jackson Hole on 21-23 August, the U.S. market has re-established a clear lead. The bond market tells the same story. Through the summer, the gap between U.S. and German yields narrowed from the U.S. side: softer U.S. labour data and a distinctly easier tone from Chair Powell at Jackson Hole pushed front-end Treasury yields lower and helped steepen the curve. That combination has been highly supportive for global equities in aggregate, but it temporarily handed the leadership baton back to the U.S. just as Europe’s relative run paused.

Where does that leave us as we head into autumn? We see three drivers shaping Europe’s next leg

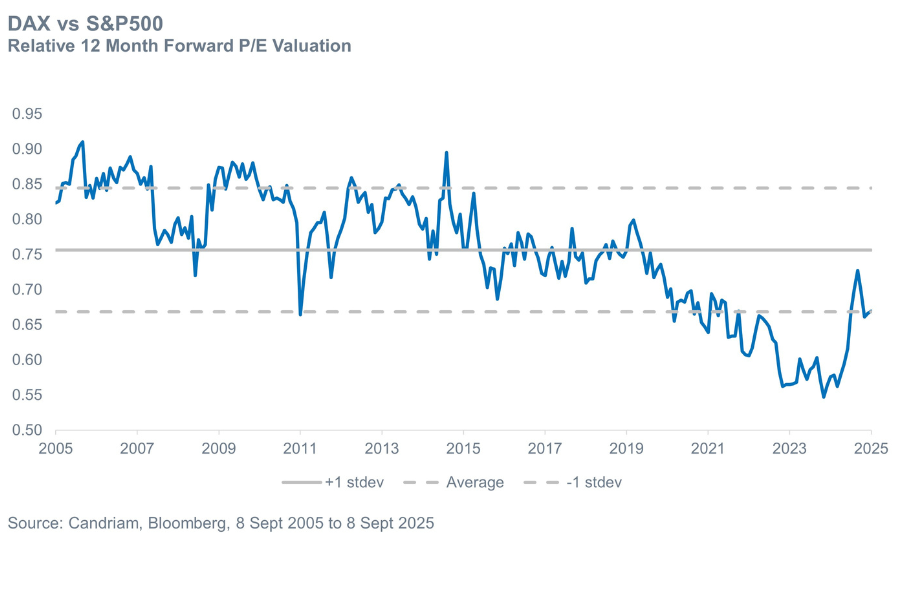

The first is Germany’s fiscal-industrial turn. The headlines have cooled, but the substance has deepened. Berlin’s budget committee has advanced an investment-heavy 2025 budget with record public investment and a clear prioritisation of defence. Delivery is the hinge: monitor the budget passage, procurement pipelines and the Finance Ministry’s monthly bulletin as high-frequency read-outs of execution. For equity investors, the takeaway is simple: the theme did not die when the headlines did. Investors’ positioning has reset [4]; the order cadence is expected to accelerate in the coming months ; and pullbacks in German infrastructure and defence suppliers continue to unveil attractive entry points. The DAX has a P/E of around 15 and still trades about one standard deviation below its historical average relative to the US [5] (see the graph). Growth-adjusted metrics support scope for further re-rating given the expected acceleration in earnings over the next two years [6]

The second is the evolving risk premium around Ukraine. August’s flurry of diplomacy and “talks about talks” produced only a short-lived rally, but the direction of travel matters for European assets. Any credible de-escalation would shave the macro risk premium and support a gentler profile for energy costs into winter. If progress stalls, the defence capex impulse we have described remains intact; if talks advance, domestically geared cyclicals and energy-intensive mid-caps should benefit disproportionately.

The third is France’s political cycle. Paris delivered the coup de grâce to the “Europe trade” in late summer as no-confidence dynamics and budget contention drove a spike in OAT yields and pushed the OAT–Bund spread above 80 bps [7]. That shock triggered de-risking in French equities and a noticeable uptick in shorts, while fund-flow snapshots showed investors mechanically shifting risk away from the region. The spread has since steadied, and market discussions are rightly focusing on how wide is “too wide.” Recent straw polls suggest the confidence threshold for international investors sits well above 100 bps [8]; in other words, current levels already price in substantial bad news. Our base case is less dramatic than the narrative: resignation risk feels over-owned, most other outcomes look manageable for markets, and France’s fiscal story is political rather than systemic. We would treat the emotional bear case as an opportunity to add selective risk in France and, more broadly, across Europe.

We therefore think it is time to re-engage in European equities while remaining selective.

What would change our mind? A renewed widening in OAT–Bunds signalling crisis territory; clear evidence that the German order cadence is slipping beyond year-end; or a meaningful deterioration in euro-area activity data that undercuts the small- and mid-cap thesis. Short of that, we see policy turning into backlog, backlog into earnings, and earnings into selective outperformance, at more attractive multiples than in the US.

Relative valuation, German vs US equities

[1] Source: MSCI©, Datastream, Bloomberg, between 31/12/2024 and 30/05/2025

[2] Source: Bloomberg, USD TO EUR exchange rate

[3] Source: Bloomberg

[4] Source: Bank of America Fund Manager Survey, August 2025

[5] Source: IBES Datastream, as of 9 September 2025.

[6] Source: IBES Datastream, Expected EPS growth in 2026 (+12.8%) and 2027 (+14.1%) vs 10-year average EPS growth (+8.9%)

[7] Source: Bloomberg, September 2025

[8] Source: Bloomberg, September 2025