Last week in a nutshell

- Data dependent central banks have registered a solid US job report for March, demonstrating again the robustness of the world’s largest economy.

- Eurozone inflation estimates came in softer than expected, strengthening the current Goldilocks environment, and opening the way for an ECB cut this quarter.

- Comments from various ECB members, including the more hawkish Robert Holzmann from Austria, pointed to the upcoming rate cut.

- Of note, oil prices picked up due to rising tensions in the Middle East with Brent prices crossing USD90/bbl, its highest level since October.

What’s next?

- Investors will focus on central banks’ reaction function: the European Central Bank meets, likely further cementing expectations for a rate cut at the next meeting on 6 June.

- Following better activity and labour market data, the focus will turn to the inflation report in the US. Investors will also keep an eye on the March FOMC minutes.

- China will publish monetary aggregates and inflation figures, as the country struggles to find a turnaround from a deflationary trend.

- US banks kick off the Q1 earnings season on Friday.

Investment convictions

Core scenario

- Supported by central banks’ rhetoric on pending rate cuts, the goldilocks environment characterised by positive growth surprises and negative inflation surprises is spilling into the euro zone.

- A soft-landing/ongoing disinflation scenario in the United States remains our most likely scenario, implying no rush for the Fed to deliver monetary support.

- 2024 should bring better visibility with a narrowing economic growth gap between countries while most central banks have restored room for manoeuvre.

- In China, economic activity has shown some fragile signs of stabilisation while the evolution of prices remain deflationary.

Risks

- Geopolitical risks to the outlook for global growth remain tilted to the downside as developments in the Red Sea unfold and the war in Ukraine continues. An upward reversal in the price of oil, US yields or the US dollar are key variables to watch.

- A risk would be a stickier inflation path than expected which could force central banks to reverse dovish rhetoric. In our understanding, it would take more than just the bumpy data registered since the start of the year.

- Beyond commercial real estate exposures, financial stability risks could return as a result of the steepest monetary tightening of the past four decades.

Cross asset strategy

- Our strategy increasingly reflects the latest development on the euro zone: economic surprises are positive as sentiment and flows may have turned a corner. Investor interest seems to be on the mend, and with a broadly attractive risk premium, the potential for a catch up by laggards is increasing. We are willing to add some beta and cyclicity to the strategy to benefit from increasingly supportive central banks rhetoric on pending rate cuts.

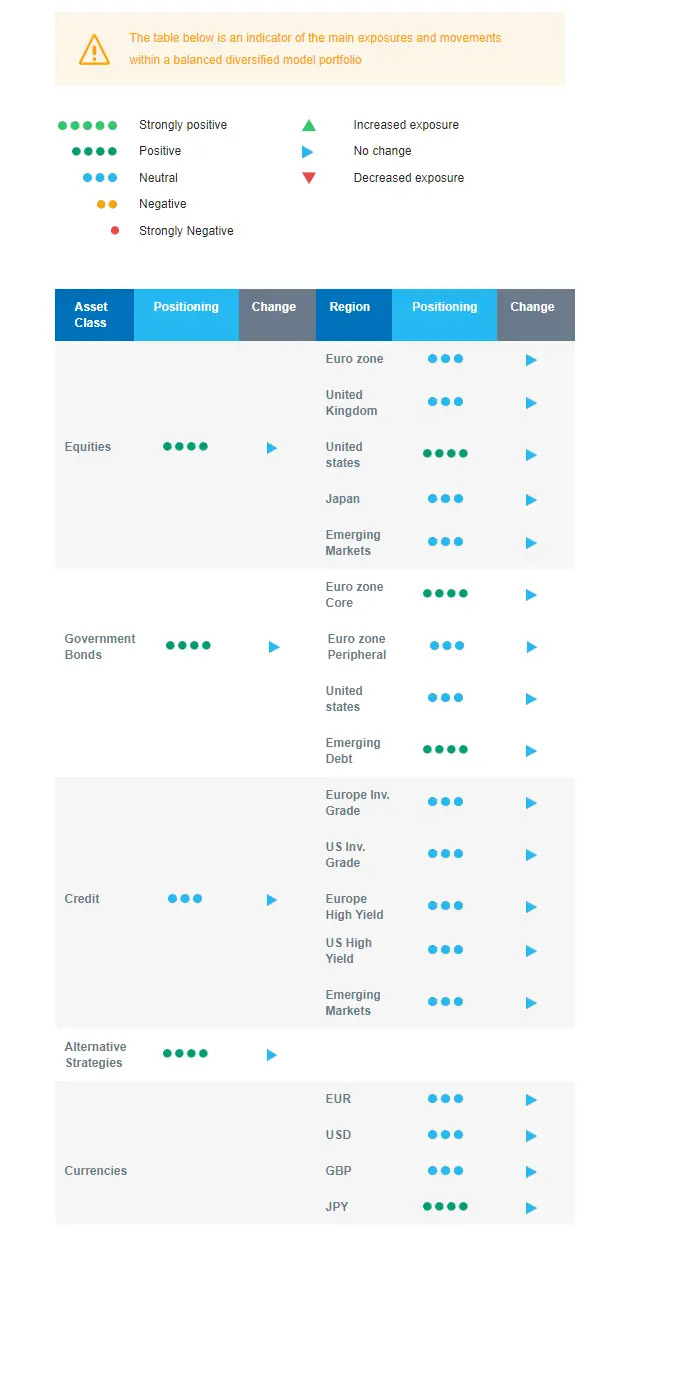

- We have the following investment convictions:

- Our equity allocation has become slightly overweight, via a more constructive view on the euro zone equity market.

- In addition, we remain buyers of Health Care. We have been looking for opportunities in beaten down stocks in small and mid-caps and are now starting to add in this segment.

- In the fixed income allocation:

- We have a positive stance on European duration and aim for the carry in a context of cooling inflation.

- We remain exposed to emerging countries’ debt to benefit from the attractive carry.

- We maintain a neutral stance on US government bonds, looking for a new, more attractive, entry point.

- We take profit and downgrade our views on European Investment Grade credit to make room for the added beta on the equities side.

- We hold a long position in the Japanese Yen and have exposure to some commodities, including gold, as both are good hedges in a risk-off environment.

- We expect Alternative investments to perform well as they present some decorrelation from traditional assets.

Our Positioning

In our opinion, it is time to add cyclicity to the portfolio to benefit from a broadening of the goldilocks environment. In Europe in particular, economic surprises are positive, leading to improving sentiment and flows. We note that investor interest is returning somewhat, and with the risk premium attractive overall, laggards could perform better in a context of economic improvement and catch up. Beyond the dataflow, we were reassured by the recent central bank meetings and think that the expected upcoming central bank rate cuts are an additional element which should act as support while capping long-term bond yields, underpinning our positive view on duration. We keep a supportive stance on US equities and are neutral on Europe, Japan and Emerging markets. We also continue to harvest carry via Emerging Market debt.