Although the Federal Reserve slightly opened the door to rate cuts during the last quarter of 2023, the latest economic data points were solid, leading the Fed to indicate that rate cuts may come later rather than sooner. Since the start of the year, the market had already adjusted to an expectation of fewer rate cuts during 2024. The anticipation of rate cuts led investors to oversubscribe new issuances, leading to spread compression.

Equity returns were dispersed in January. Japanese equities, US and European large cap stock and technology stocks returned positive mid-single digit returns, outperforming China, Hong Kong and UK equities, as well as European and US small-cap stocks, which started the year with negative returns.

Yields of medium to long-term maturities of European and American sovereign issues were volatile during the month but ended the period only slightly above end-of-December levels. Corporate spreads remained very tight as new issues were well bid.

The HFRX Global Hedge Fund EUR returned +0.21% over the month.

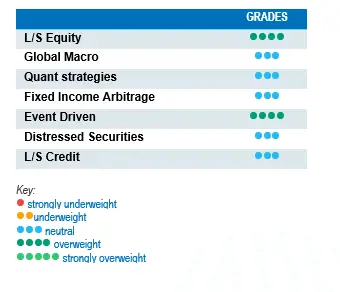

Long-Short Equity

It was a strong month for Long-Short Equity strategies, which benefited from stock-market dispersion to drive returns from stock-picking on long and short positions. According to Morgan Stanley Prime Brokerage, the average Global Long-Short Equity captured 70% of the equities upside. Strategies with a focus in Europe and China returned a positive average return while their respective indices were negative for the month. US-focused strategies returned the highest average return in absolute terms but fared less well in relative terms, capturing only half the upside of US equities. Style-wise, market-neutral and growth-bias strategies outperformed managers with a value bias. Now that the rate-hiking cycle has probably reached the end of its course, we expect higher dispersion inter and intra sectors which will be beneficial for Long-Short Equities. Furthermore, these strategies have more tools than traditional long-only strategies to help navigate market volatility should the consensus scenario of moderate growth for 2024 hit a road bump.

Global Macro

Average performances for Global Macro strategies were relatively muted during the month, with a fair level of dispersion. After a challenging year in 2023, many managers adjusted their portfolios, downsizing their positions and reviewing the implementation of their hedging strategies as pay-offs linked to cross-asset correlations did not play as expected. Risk-averse managers are favouring relative value implementations rather than straight directional bets. While returns generated by Global Macro strategies during the last 12 months have been relatively muted and below expectations, we expect the current and foreseeable environment to offer interesting investment opportunities.

Quant strategies

January was a strong month for Quantitative strategies. On average, both Trend Following and Multi-Strategy Quantitative strategies returned positive returns during the period, with the later significantly outperforming the former. Trend models had positive contributions from positions in equities, currencies and commodities, while allocations in fixed income were usually detractors. Multi-Strategy Quantitative allocations benefited from the positive dynamic in Trend models but also drove significant contributions from market dispersion and statistical arbitrage models.

Fixed Income Arbitrage

2023 will undoubtedly be a year to remember for the Fixed Income market, succinctly summarised in four words: the need for speed. As 10yr US Treasuries reached the 5% mark, the entire bond market experienced its most intense reversal in the history of the interest-rate market. Since then, the volatility of all the interest-rate market complex has dropped and opportunity set has shrunk. The market seems positioned in a “wait and see” stance, supporting carry strategy but neither directional nor relative value strategies. Hence we have reduced our outlook for the strategy.

Risk arbitrage – Event-driven

After delivering a solid return throughout the last quarter of 2023, performance generated for Event Driven was relatively muted during January. Performance contribution from Merger Arbitrage was relatively uneventful. Special Situation investments, which tend to have a value bias, lagged equity markets at the start of the year. Merger announcements have been relatively muted for the last two years, which is understandable in the context of market volatility. According to strategy specialists, the number of deals announced is more correlated to the level of visibility corporate management has on the state and direction of the economy rather than the level of the cost of debt itself. As inflation slowly trickles down and interest rates get closer to peak, we might be at the beginning of a beneficial cycle for the strategy.

Distressed

Expectations for distressed opportunities have evolved significantly over the last 18 months. Towards the end of 2022, the red-hot inflation levels and rapid rate-hike cycle were indicators of a distressed cycle bonanza not seen since the Great Financial Crisis. These expectations dwindled during 2023 as the economy and job market remained resilient. The opportunity set during the year was opportunistic in nature, taking advantage of specific events, such as the banking crisis in the US during the first quarter of 2023, and idiosyncratic situations. Currently, default levels have started to increase, although expectations remain contained considering that most corporations opportunistically refinanced their outstanding debt at lower rates during the period 2020-2021 and that the financial health of consumers remains relatively strong. While strategy specialists remain largely on the side-lines, focusing on idiosyncratic opportunities, they remain cautious about investing in high-yield issuers and have identified cracks in specific areas such as the loan market. Some market participants have taken large debt loads through loans, which are usually floating-rate issues, without anticipating such a meteoric rise in short-term rates.

Long short credit

The attractiveness of long-short credit strategies seems to be improving. An environment of higher rates for longer could be a tailwind for alpha generation both on long and short positions as fundamental research becomes more important in portfolio construction. Absolute return or hedged investment approaches have gained more relevance as positions in AT1 issues have generated significant volatility and market losses for the investment community. It is a fact that yields have widened, restoring fixed income’s place in asset allocation. As recent events have demonstrated, however, risk diversification is very important and should be an integral part of the investment allocation process.