;

;

And yet, despite their importance, biotechnology remains under-represented in the major stock market indices. This paradox creates opportunities for long-term investors, provided they adopt a selective, rigorous and informed approach.

A demanding investment universe, where selection is key

The innovative nature of the sector, centered on research and development, means that stock market performances vary widely. Success is based on a careful selection of companies, taking into account the quality of clinical data, commercial potential, management teams and market cycles.

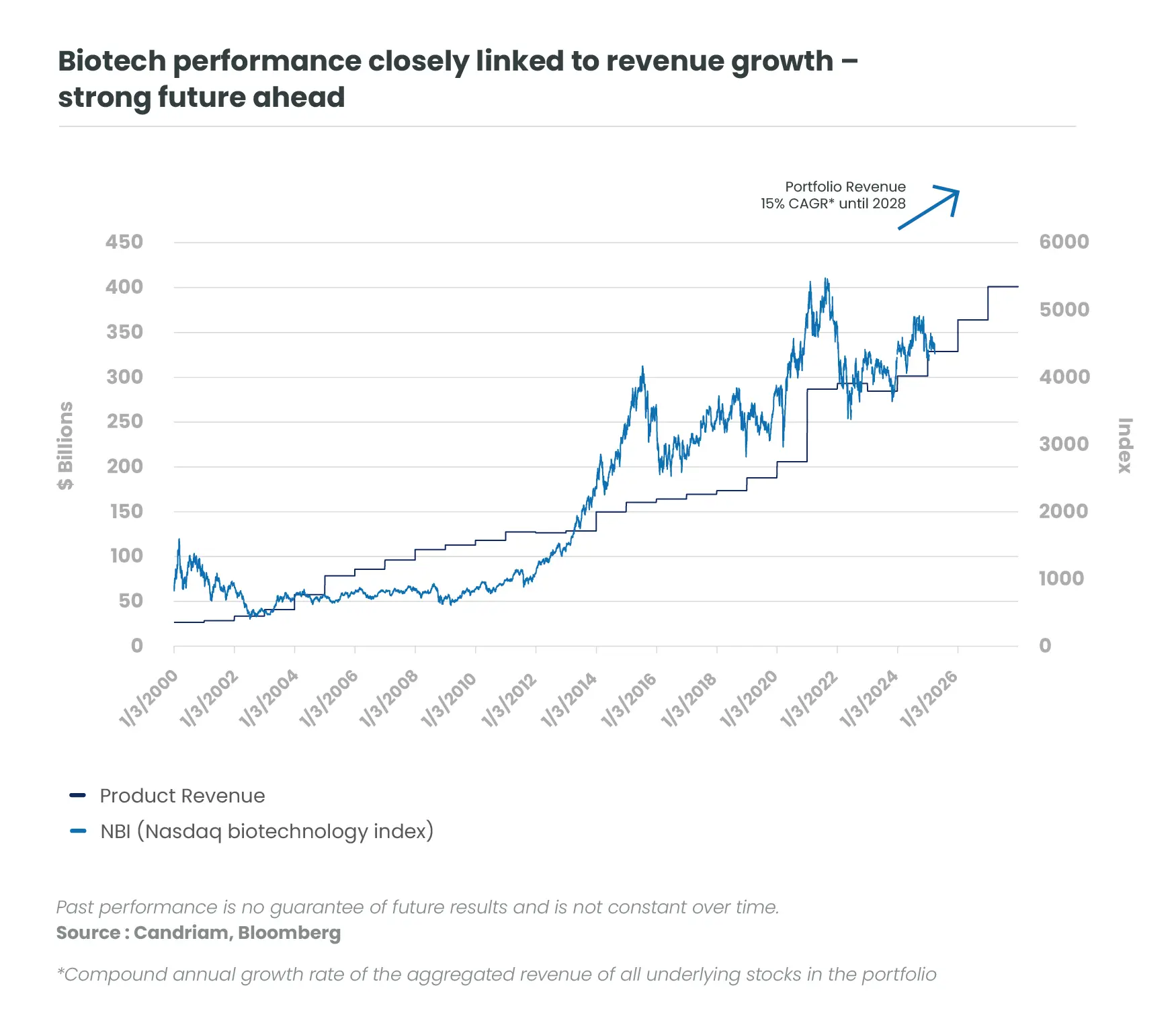

A growing structural dynamic

Aging demographics, unmet medical needs, technological advances and strong M&A activity are supporting the sector over the long term. Today, the majority of the world's best-selling drugs are derived from biotechnology.[1]

A promising investment theme for decades to come?

Investors looking for sustainable growth prospects and diversification can benefit from the dynamism of this sector, propelle by major therapeutic advances and constant innovation.

A growth dynamic with little correlation to economic cycles

;

;

”We are convinced that disruptive medical innovations will continue to shape the future of medicine. Investing in biotech means betting on the treatments of tomorrow

Any investment in our strategy involves risks, including the risk of capital loss.

The strategy's main risks are :

- Risk of capital loss

- Equity risk

- Foreign exchange risk

- Liquidity risk

- Concentration risk

- Derivatives risk

- Sustainable development risk

- ESG investment risk

[1] Source : Candriam