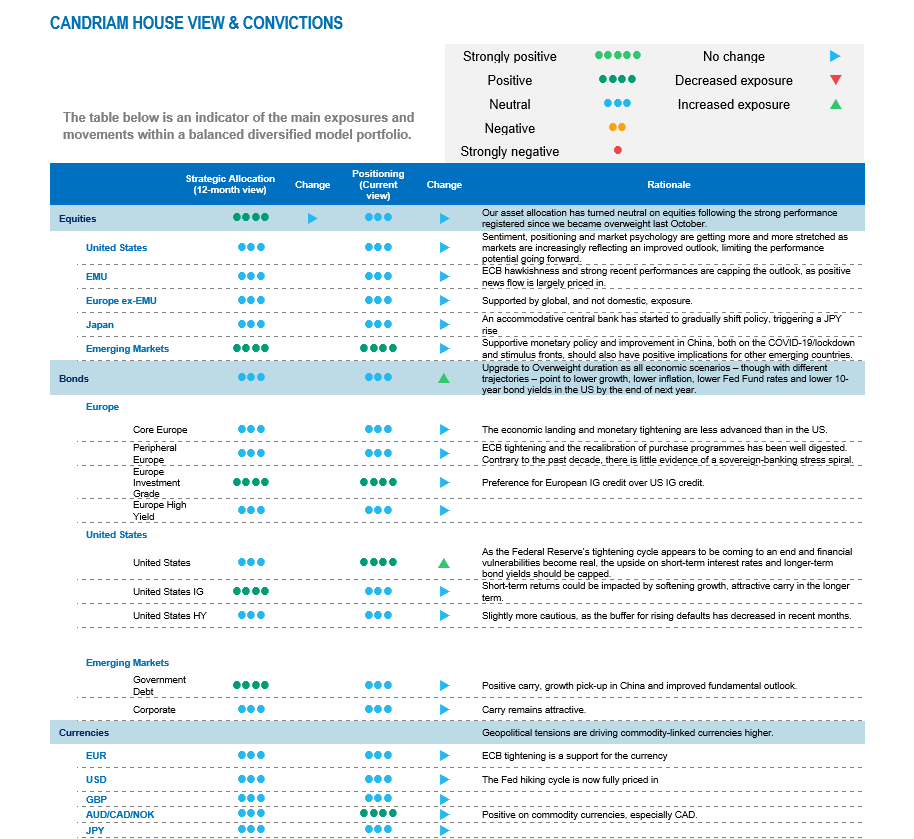

Our main scenario incorporates slow growth, both in the US and eurozone, and continues to remain the most likely. However, we acknowledge that the risk of a more adverse scenario has increased in recent weeks. Looking forward, all our economic scenarios – though with different trajectories – point to lower growth, lower inflation, lower Fed Fund rates and lower 10-year bond yields in the US by the end of next year. As a result, we have further increased our fixed income duration and expect to add duration if markets offer better levels in the coming weeks. We still like Investment grade credit and Emerging market debt since the carry looks attractive. Regarding equities, we stand ready to reduce portfolio risk in the case of complacent financial markets.

Better activity and lower inflation readings are mitigated by several vulnerabilities

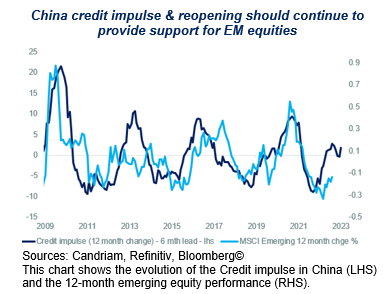

Recent global activity indicators have been better than expected by market participants, while inflation readings have decelerated as expected. In particular, swift action by the Federal Reserve has meant that while the US local and regional banking turmoil is still lingering, it appears manageable from a macro standpoint. European and Asian services are improving, while there has been no pick-up in manufacturing yet. It is noteworthy that China’s reopening from lockdowns in Q4 2022 has triggered a domestic boom since the turn of this year, which should continue this spring.

We note, however, a series of downside risks which have the potential to alter our soft landing view if they materialise:

- Financial conditions tightening, leading to banking turmoil, is a new macro risk. Financial stability risks have resurfaced recently and led the US to add emergency liquidity.

- Credit restrictions, already visible ahead of the events in March, imply that the lending channel is becoming increasingly restrictive.

- In March, central banks continued their rate hike cycle. This anti-inflation stance is slowing the economy and is capping the upside potential for risky assets.

- At some point this year, central banks will have to compromise between price stability (rate hikes) and financial stability (decisive liquidity action).

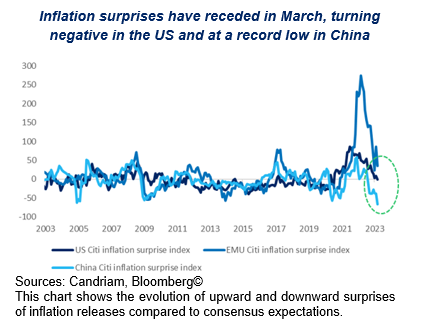

Recent inflation indicators confirm and even exceed the expected deceleration: US inflation surprises are on the downside for the first time since the pandemic, European inflation also receded in March, and we have seen record downside inflation surprises in China despite the reopening boom.

We expect central banks to keep rates on hold this summer

In our fixed income allocation, we have further increased the duration of our portfolios and now have an overall slightly overweight duration. We maintain a preference for Investment grade credit and quality issuers but are more cautious on High yield bonds.

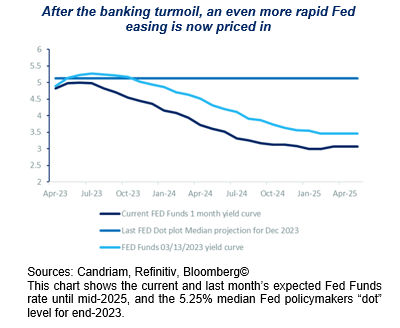

While markets have been pricing in a decline in central bank reference rates as soon as this year for a while, the recent banking turmoil has led markets to price in an even more aggressive scenario: while the Fed is expected to hike its funds rate one last time at its next FOMC on 3 May, rate cuts are now expected to start as soon as this summer. We disagree, because there is still “more work to do” (Fed Chair Jerome Powell), as inflation numbers, while declining, remain above the comfort zone and a weakening US dollar leads to higher imported inflation. Barring a sharp downturn, we expect central banks to keep rates on hold this summer and pivot at a later stage.

Compared to mid-March, the market pricing of a cut in the Fed funds rate has been further brought forward. We disagree with this precipitous timing as the Fed will likely need to maintain a higher rate for longer to restore its inflation credibility. Ultimately, this should cap the level of long-term yields and therefore support fixed income markets. One year into the sharpest rate hike cycle of the past four decades, the focus will now increasingly turn to evaluating the lags between the policy tightening and its impact on the real economy.

Regional preference for Emerging markets

In our multi-asset allocation, we maintain a neutral view on equities, considering both upside and downside risks.

Our regional equity allocation maintains a preference for Emerging markets. We continue to expect emerging markets to outperform based on fundamental aspects. Valuations remain relatively more attractive, and Asia maintains its superior long-term growth prospects vs. developed markets. The reopening in China with significant pent-up demand and household excess savings to be deployed is already unfolding and should drive emerging markets further. Also, in the current context of financial vulnerabilities, there is no monetary headwind ahead in the region. We will discuss the potential impact of the geopolitical risk premium on emerging market allocations in an era of geoeconomic fragmentation in the coming weeks.

In line with our balanced approach given the various uncertainties, we have a preference for defensive assets and quality in the stock markets. Investors will likely prefer structural growth over cyclicity for now, given the potential risks financial restriction poses to growth. We shall therefore prefer the following sectors: healthcare (globally and particularly US), staples (with European leaders) and selected utilities, which should benefit from the electrification trend. Generally speaking, we favour innovative and/or quality companies (profitability, visibility and solid solvency).

In our view, cyclical stocks have already priced in a better economic outcome than the slow growth we expect. A striking illustration of the extent the European recovery is now priced in is the relative performance of cyclical vs. defensive stocks: the recent performance implies a Euro Manufacturing PMI around 55 points, from the current 45.5. Clearly, we would need new positive catalysts to pull cyclicals’ valuations higher.

The Q1 earnings season and the corporate guidance for the upcoming months will be the next important microeconomic hurdles for markets. Along with credit availability data releases, central bank decisions early-May constitute the next obstacles on the macro side.