The performance of financial markets improved in May, with US markets posting a positive performance for the first time this year. Equities rebounded from their lows of May 19th and the greenback weakened while EUR/USD rebounded towards 1.07. Commodities markets were mixed as the Brent crude price gained ground due to supply risks following the escalated tension between Russia and the West. The rebound in global financial markets during the second part of May reflected the shift of concerns, with a little less emphasis on inflation and more emphasis on slowing growth but more attractive valuations following the year-to-date selloff. However, the release of European inflation figures at the end of May renewed the risky sentiment. Furthermore, the resulting rise in rates caused an uptick in volatility across all the asset classes. The high-quality markets t suffered more in this context, as European government bonds (both core and peripherals) and investment grade credit markets posted negative returns over the last 2 weeks. Emerging debt also posted positive returns in every segment (hard currency, local currency and corporates). Not surprisingly, breakevens posted positive performances (through previously strong performing regions such as Australia), as did certain commodity markets such as natural gas. Within currencies, the ruble’s sharp rise continued after February’s very steep decline, as a result of central bank activity and fiscal measures. The US dollar remains a very strong performer, though it also posted a slightly negative performance vs the euro. Certain EM currencies also did well (BRL, MXN, PLN).

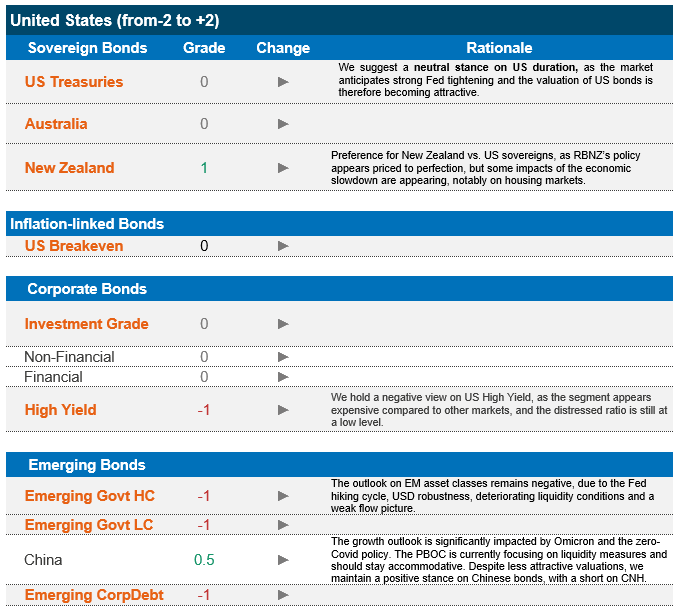

Inflation data is once again the main source of pressure on rates, as data trended upwards with no sign of respite. Geopolitical risk remains omnipresent, with no end in sight for the Russia/Ukraine conflict. Adding to this issue are not only the incremental sanctions that are impacting Russia as well as the rest of the world, but also blockages and embargoes on food commodities, which are having a severe impact in macroeconomic terms. Supply chain issues are also omnipresent and are likely to remain despite the fact that lockdowns in China have started to be lifted in certain areas. In the face of these inflationary pressures, central banks across the globe (excluding China) are compelled to persevere in their hawkish stance. The Federal Reserve has indicated that they are willing to engineer a macroeconomic slowdown (through tightening) in order to control inflation. As a base case scenario, we expect a 50 bps rate hike at each of the next two FOMC meetings, and we will very carefully monitor the resulting impact on the US economy. After extensive external hawkish deliberations from ECB members, President Christine Lagarde clarified that a 25 bps rate hike was imminent in July, and that further (and potentially stronger) rate hikes were in the offing should inflationary pressures persist. The European Deposit Rate will be out of negative territory by the end of the third quarter, and net APP purchases will end very soon, marking the end of any residual ECB support. We continue to anticipate four hikes this year. The question remains on how the European and indeed global economy will react to these rate hikes, as eurozone growth data does not appear to be as sturdy as that of the US, and its proximity to the Russia/Ukraine conflict and its dependence on Russian oil renders it more fragile. In such a context, we can certainly not rule out a recessionary scenario, though this is not our base case.

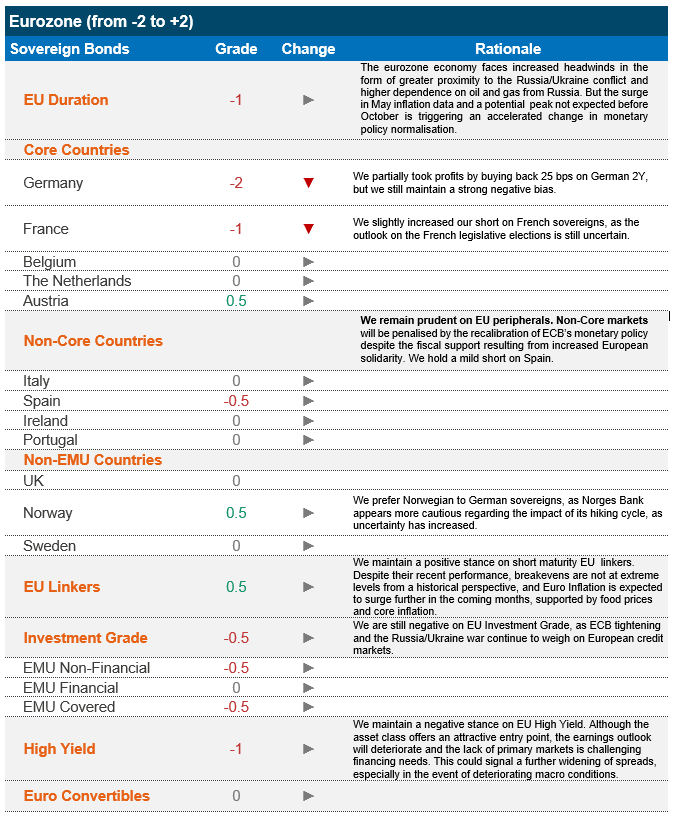

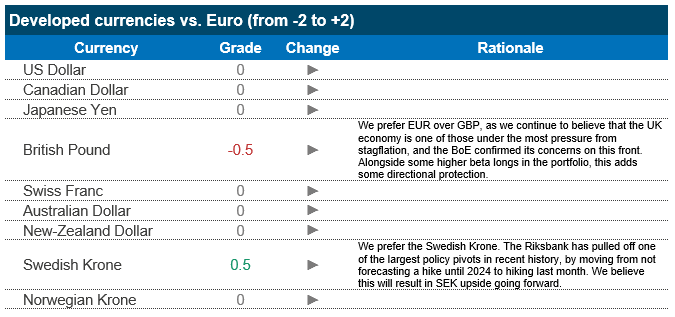

Against this backdrop, we expect volatility to remain high and rates to trend upwards over the coming weeks. We suggest a neutral stance on US duration and underweight on EU duration, as the ECB is under pressure to normalise more rapidly due to high inflation. Valuations on fixed income markets are certainly more compelling, though we recognise the need to wait for rates to stabilise before we turn positive on risky assets. We expect dispersion to materialise soon, as fundamentals return to the forefront (in the absence of external support) and the impact of key trends (deglobalisation, decarbonisation and digitisation) starts to materialise. However, currently, in a market that is expected to continue to be negatively impacted by the external factors mentioned above, we plan to maintain our overall defensive stance while monitoring markets very closely. We also have a cautious view on emerging markets as China’s economic slowdown, Fed policy tightening and the USD weigh on the asset class. The political situation will likely deteriorate as cost of living concerns start to severely impact economies that are more commodity dependant and less resistant. On the positive front, we believe that inflation linked bonds can offer investors a good hedge against elevated levels of inflation that are set to persist. In this context, we maintain a positive view on the segment.

Strategy & Positioning

It is important to note that Candriam Global Bond and Credit strategies have no exposure to Russian sovereign debt. Russia has been excluded from our sovereign investment universe based on sustainability characteristics.