After 2022, which covered the end of a decade of monetary policy loosening, 2023 has been the year of the repricing of the whole interest rate curve. The end of Central Banks’ "higher for longer" mantra supported a steepening of the yield curves and repriced real interest rates which are back now in positive territory, for the first time in close to ten years. European Investment grade yields stand at a very attractive level around 3.6%[1] today, from close to the 0% level seen during Covid crisis.

Furthermore, credit spreads, the premium of investment grade credit, are attractive. While still evolving significantly above their historically average, they have also been stable and supported by resilient corporate fundamentals, lower than expected funding needs, and inflows into the asset class.

With higher yields, the investment-grade credit market offers an attractive risk/return ratio compared with other asset classes - an optimal configuration for credit investors. With higher rates and high spreads, it offers an attractive risk/return ratio compared to other asset classes - a sweet spot for credit investors.

Even within a soft landing narrative, we could see some credit dispersion

Although the soft landing narrative still holds, we expect marginal signs of weakness to show up and some credit dispersion to materialise. We have already seen core names surprising the market with negative price action. Corporates are being challenged by higher costs of borrowing, higher input costs, as well as uncertainties around demand and the transformations required by energy transition.

In such a context, we believe an active management approach, rooted in convictions, focused on fundamental analysis, and integrating ESG factors, may be relevant – besides, it naturally contributes to addressing the risk of recession. Implementing fundamental analysis combined with an ESG filter aims to result in a high-quality bias in the portfolio, as it tends to favor issuers that exhibit sturdy balance sheets, good credit metrics and strong ESG profiles. It is, in our opinion, a good start, as these issuers are likely to better resist a potential downturn and a widening of credit spreads in case of a severe recession. Furthermore, we believe the current environment calls for an active management of the portfolio duration, and that the interest rate and credit strategies should be continuously reviewed in light of evolving macroeconomic conditions.

Green and ESG are more than ever on the agenda

The climate crisis, along with the social challenges arising with the global energy transition, remains a prevalent topic in the eurozone markets.

The commitments at the European level are strong: a 55% reduction of greenhouse gas emissions by 2030 (‘Fit for 55’ legislation), a higher share of renewable energy in the power production mix (42.5% target by 2030), and the evolution of carbon pricing mechanisms. European regulators have shown that they are stepping in, with clearer reporting frameworks and demands for enhanced disclosures at issuer and investor level, through for example the CSRD and SFDR legislation. Even the European Central Bank, the largest player of the investment grade market, has elaborated a plan to green its massive purchasing programmes (CSPP and PEPP), by tilting its purchases towards issuers with a better climate performance – as assessed by carbon footprint, environmental disclosures and decarbonization targets.

How to address ESG risk and generate extra-financial results on credit markets?

We believe it is possible to build strategies that aim to contribute to both minimizing ESG risk and creating convincing extra-financial impact on credit markets. Such strategies should address the following three points:

- When building the investment universe, issuer selection should take into account ESG risks related to the issuer’s business activities, transparency and behaviour with stakeholders. At this stage, it is key to seize the existing opportunities around the themes that are likely to shape the world of tomorrow: climate change, resource depletion, demographics, and a sound governance.

To this end, it is essential to be able to rely on specialized and experienced ESG analysts working with screening and quantitative tools to provide qualitative convictions on the issuers within the universe.

- The investment approach should incorporate a focus on managing transition risk, and care about the portfolios’ carbon impact. A sustainable approach should target an ambitious reduction of the portfolio’s carbon footprint risk.

- ESG bonds, at correct valuation levels, should be part of the portfolio. Green bonds specifically, whose purpose is to finance projects with positive impact on the environment, have been key to support credit issuers in their transition commitments. They are also helpful tools for investors eager to increase the impact of their investments.

A strategy well-positioned to benefit from the current environment

We believe Candriam Sustainable Bond Euro Corporate[2] is well positioned to benefit from the current opportunities offered by credit markets.

Its average yield to maturity currently stands close to 4%[3] with a convenient 4.5 year associated horizon. We are slightly overweight versus the reference index (1.1 beta) and well positioned in carry mode. We are positioned on the belly of the credit curve (3-5 year) but remain active in the long-end maturities (20+) hedged on duration, which may perform well when there are large moves on sovereign interest rates.

In line with our conviction in active management, we continuously manage the duration of the portfolio. To this end, we carefully monitor macroeconomic conditions and receive significant input from our economists and our global bond team. We have the ability to tactically add duration, through futures on the German rates for example, that would protect us from a potential material economic deterioration - as it generally results in lower yields on the German curve.

We avoid sectors with significant ESG risk (oil and gas and brown utilities).

Within corporates, we have a preference for hybrid debt of investment grade issuers.

The sustainable focus of our approach is evidenced by its classification as an article 9 fund under SFDR. Its Key Performance Indicators are threefold: a minimum 10% pocket of green bonds, with a 20% target by the end of 2025; an objective of achieving a carbon footprint at least 30% lower than that of the iBoxx EUR Corporate index; and a weighted average ESG score higher than that of the same index[4].

A team’s experience at the service of a solid approach

With its EUR 2.5bn of assets, Candriam Sustainable Bond Euro Corporate is credited with 3 ESG labels[5]. Over the past three years, it has outperformed its reference index (iBoxx EUR Corporate index Total Return) by an annualized 0.5% (Institutional share, net of management fees)[6] with a volatility of 4.57%, below benchmark level (4.71%).

At 29/12/2023, Net of management fees, Institutional share class

|

|

Fund |

Reference index |

Difference |

|

1 year annualized |

8,7% |

8,2% |

+0,5% |

|

3 years annualized |

-2,3% |

-2,8% |

+0,4% |

|

5 years annualized |

0,3% |

0,1% |

+0,2% |

|

Since inception annualized |

0.9% |

- |

- |

Source: Candriam. Reference index is iBoxx EUR Corporate Total Return. Share class inception date 29/12/2015. Past performance is not a reliable indicator of future performance and is not constant over time. Markets could develop very differently in the future. It can help you assess how the fund has been managed in the past.

The fund is managed by our closely-knit team of fifteen portfolio managers and analysts collaborating with twenty ESG experts. Candriam has been active on credit markets for more than twenty years. Our historic presence and EUR 31.5bn of assets under management make us one of the leading European players in the credit segment.

With all those elements in mind, we believe it should be easy to make the call of investing in our sustainable euro corporate debt strategy.

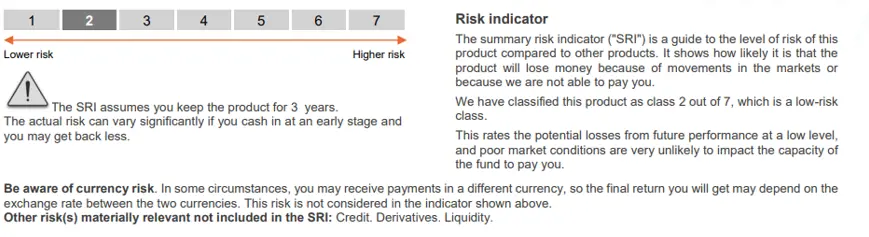

All our investment strategies involve risk, including the risk of loss of capital. The main risks associated with Candriam Sustainable Bond Euro Corporate are: risk of loss of capital, interest rate risk, credit risk, liquidity risk, derivatives risk, risk associated with investing in contingent convertible bonds, concentration risk, counterparty risk, risk of changes made to the reference index by the index provider, risk associated with external factors, share class hedging risk, sustainability risk, ESG investment risk.

This marketing communication is provided for information purposes only, it does not constitute an offer to buy or sell financial instruments, nor does it represent an investment recommendation or confirm any kind of transaction, except where expressly agreed. Although Candriam selects carefully the data and sources within this document, errors or omissions cannot be excluded a priori. Candriam cannot be held liable for any direct or indirect losses as a result of the use of this document. The intellectual property rights of Candriam must be respected at all times, contents of this document may not be reproduced without prior written approval.

Warning: Past performance of a given financial instrument or index or an investment service or strategy, or simulations of past performance, or forecasts of future performance does not predict future returns. Gross performances may be impacted by commissions, fees and other expenses. Performances expressed in a currency other than that of the investor's country of residence are subject to exchange rate fluctuations, with a negative or positive impact on gains. If the present document refers to a specific tax treatment, such information depends on the individual situation of each investor and may change.

In respect to money market funds, please be aware that an investment in a fund is different from an investment in deposits and that the investment’s principal is capable of fluctuation. The fund does not rely on external support for guaranteeing its liquidity or stabilizing its NAV per unit or share. The risk of loss of the principal is borne by the investor.

Candriam consistently recommends investors to consult via our website www.candriam.com the key information document, prospectus, and all other relevant information prior to investing in one of our funds, including the net asset value (“NAV) of the funds. Investor rights and complaints procedure, are accessible on Candriam’s dedicated regulatory webpages https://www.candriam.com/en/professional/legal-and-disclaimer-candriam/regulatory-information/. This information is available either in English or in local languages for each country where the fund’s marketing is approved. This is a marketing communication. Please refer to the prospectus of the fund and to the key information document before making any final investment decision. According to the applicable laws and regulations, Candriam may decide to terminate the arrangements made for the marketing of a relevant fund at any time.

Information on sustainability-related aspects: the information on sustainability-related aspects contained in this communication are available on Candriam webpage https://www.candriam.com/en/professional/market-insights/sfdr/. The decision to invest in the promoted product should take into account all the characteristics or objectives of the promoted product as described in its prospectus, or in the information documents which are to be disclosed to investors in accordance with the applicable law.

Notice to investors in Switzerland: The information provided herein does not constitute an offer of financial instruments in Switzerland pursuant to the Swiss Financial Services Act ("FinSA") and its implementing ordinance. This is solely an advertisement pursuant to FinSA and its implementing ordinance for financial instruments.

Swiss representative: CACEIS (Switzerland) SA, Route de Signy 35, CH-1260 Nyon. The legal documents as well as the latest annual and semi-annual financial reports, if any, of the investment funds may be obtained free of charge from the Swiss representative.

Swiss paying agent: CACEIS Bank, Paris, succursale de Nyon/Suisse, Route de Signy, 35, CH-1260 Nyon.

Place of performance: Route de Signy 35, CH-1260 Nyon.

Place of jurisdiction: Route de Signy 35, CH-1260 Nyon.

Specific information for investors in France: the appointed representative and paying agent in France is CACEIS Bank, Luxembourg Branch, sis 1-3, place Valhubert, 75013 Paris, France. The prospectus, the key investor information, the articles of association or as applicable the management rules as well as the annual and semi-annual reports, each in paper form, are made available free of charge at the representative and paying agent in France.

Specific information for investors in Spain: Candriam Sucursal en España has its registered office at C/ Pedro Teixeira, 8, Edif. Iberia Mart I, planta 4, 28020 Madrid and is registered with the Comisión Nacional del Mercado de Valores (CNMV) as an European Economic Area management company with a branch.

CNMV: 1493

[1] Average Yield to maturity of the Iboxx Euro Corporate Index as of 31/01/2024, source Bloomberg

[2] The fund is actively managed and the investment process implies referring to a benchmark index iBoxx EUR Corporate (Total Return) ©.

[3] Average yield of Candriam Sustainable Bond Euro Corporate at 31/01/2024, source Candriam

[4] The aim to have long-term positive impact on environment and social domains is currently assessed by the calculation of an ESG score which results from Candriam’s proprietary ESG analysis.

[5] Label ISR, Towards Sustainability Initiative, Luxflag, at end September 2023. Even if the sub fund is awarded the label, it does not mean that the same sub fund meets your sustainability objectives or that the label will be compliant with the requirements of future national or European regulations. For further information, please go to https://www.lelabelisr.fr/en - https://www.towardssustainability.be/EN - https://www.luxflag.org. The quality of the ranking, award or label obtained by the fund or the management company depends on the quality of the issuing institution and the ranking, award or label does not guarantee the future results of the fund or the management company.

[6] Candriam Sustainable Bond Euro Corporate, net performance, Institutional share class, at 29/09/2023