A Resilient Asset Class Amid a Maelstrom of Macro Risks

In what can only be described as an event-packed May, financial markets navigated a minefield of global macro developments: escalating US–China trade tensions, a surge in Japanese government bond yields, and renewed concern about fiscal sustainability across developed markets. Against this tempestuous backdrop, credit markets displayed surprising resilience, delivering positive returns despite the ambient noise.

At the core of this robustness lies a simple truth: technicals continue to dominate the credit landscape. Inflows into both Investment Grade (IG) and High Yield (HY) segments have picked up again, offering evidence of persistent investor demand for income in a still yield-starved environment . Meanwhile, the European Central Bank has acted preemptively with a rate cut, but benchmark rates remain elevated, keeping the credit’s carry component structurally attractive. Across the Atlantic, the Federal Reserve has opted for strategic patience, choosing to hold policy steady.

Yet, beneath this surface-level strength lies an undercurrent of vulnerability. That vulnerability is spelled with an "F" — Fundamentals. Long overshadowed by the gravitational pull of technical drivers, fundamentals are now poised to reassert their influence, potentially marking a defining inflection point for credit markets.

Investment Grade: A Stable Core Facing a Potential Policy Shock

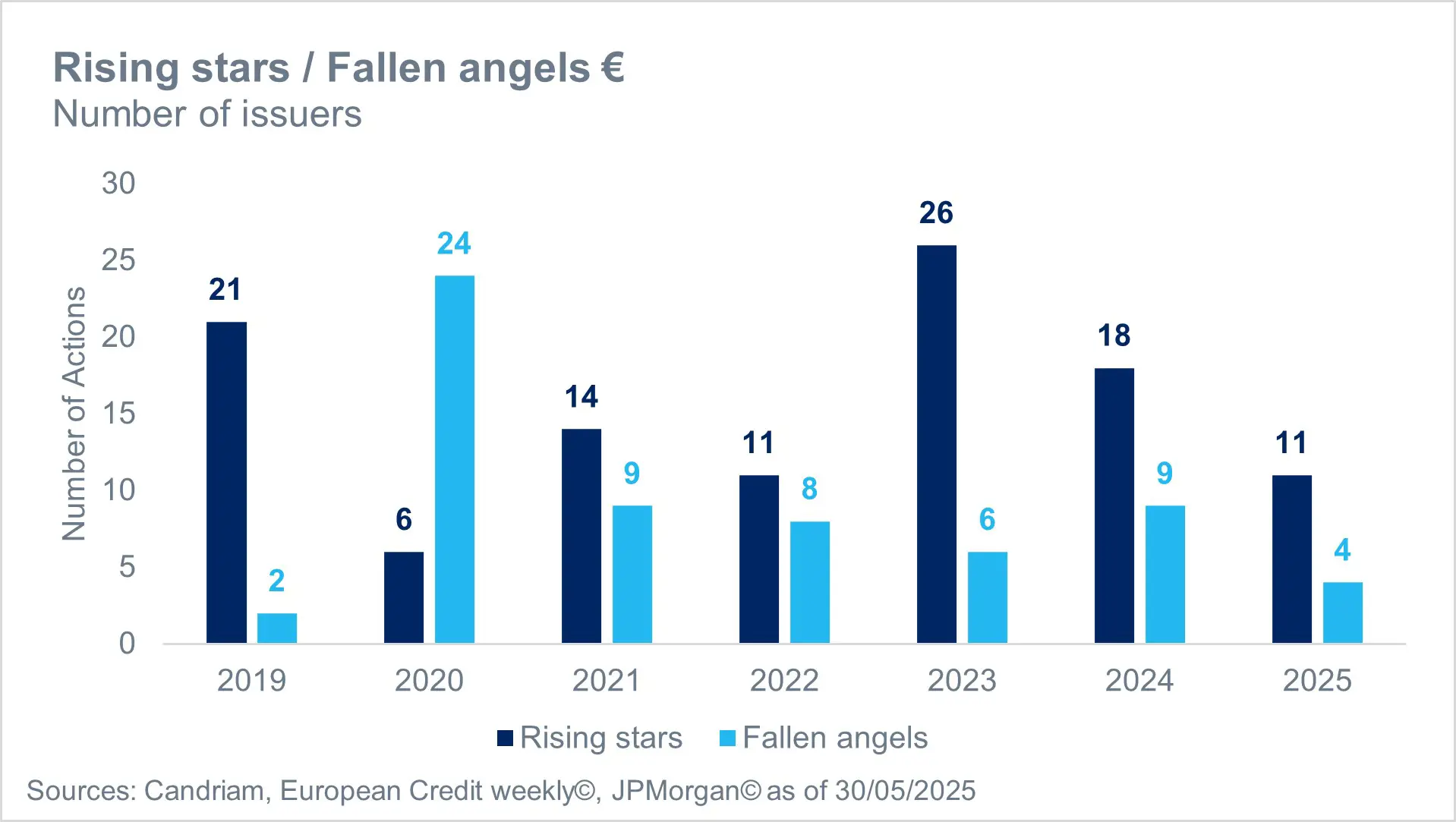

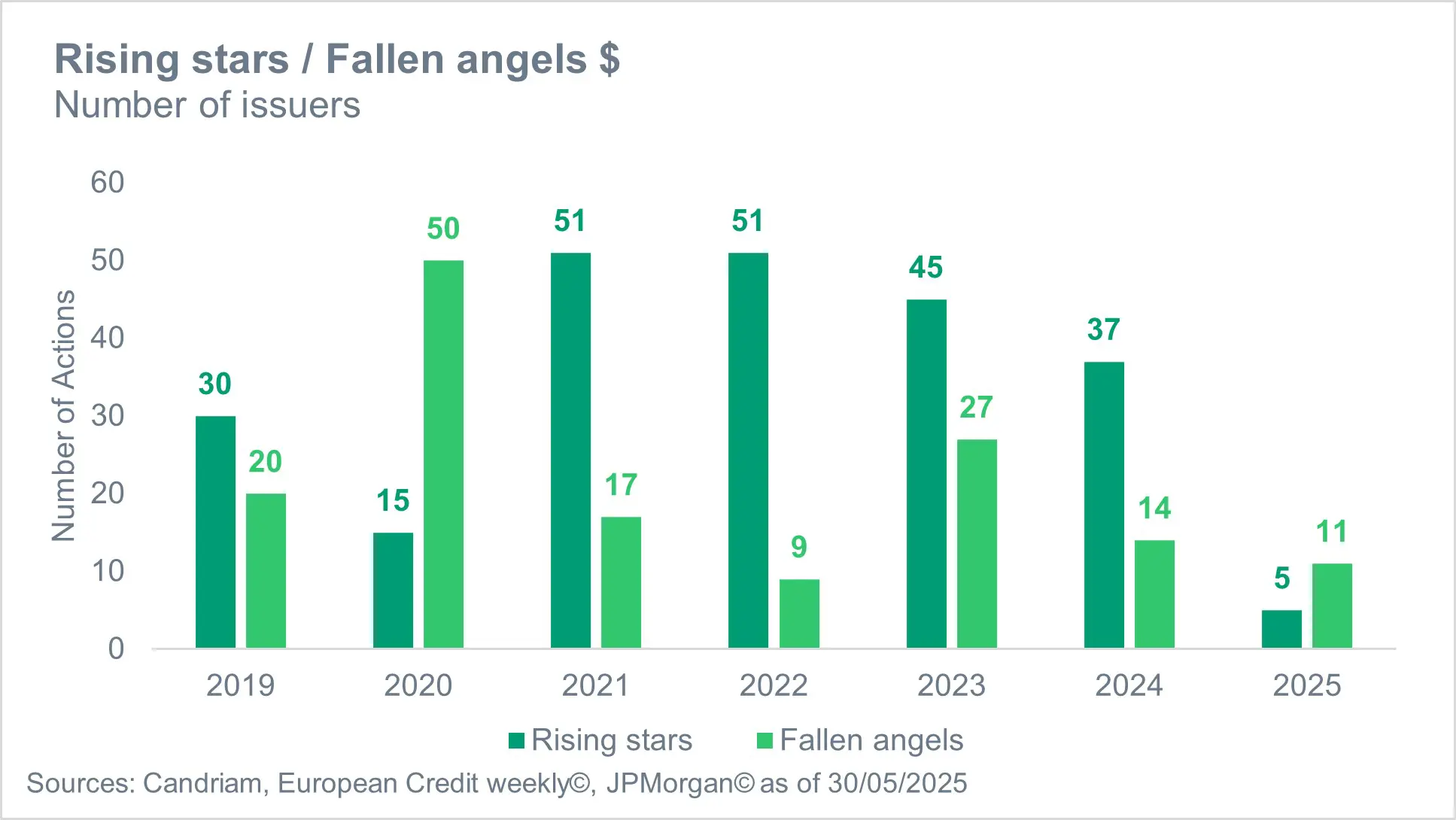

Eurozone Investment Grade remains a bastion of relative stability — for now. Corporate fundamentals are generally well-oriented, with the balance of rising stars outweighing fallen angels [1]. Q1 earnings were broadly strong, supported by robust balance sheets and manageable leverage. However, the forward guidance accompanying those earnings was notably vague. Executives seem increasingly aware of the uncertainties that lie ahead, not least among them, the prospect of a more permanently hawkish US trade policy.

The de-escalation phase of the global trade war appears to be behind us. Tariff tensions are rising once more, with the US recently doubling import tariffs on steel and aluminium to 50%; more sectoral tariffs could be expected. This seem unlikely to be a standalone measure, but rather part of a broader fiscal rebalancing strategy designed to offset the budgetary impact of the expansive reconciliation bill passed in the House —the “Big Beautiful Bill.” Beyond its headline tax cuts, the bill’s Section 899 contains provisions that are expected to weigh heavily on European corporates, particularly exporters and multinationals.

In the US, meanwhile, the Fed's Beige Book and minutes reflect a rising concern about economic deceleration. The probability of recession is increasing, particularly if the fiscal impulses expected from the “Big Bill” fail to translate into real economic activity. This scenario would erode company fundamentals, impacting creditworthiness across the Investment Grade universe. Compounding the issue is a broader trend of corporates passing through inflationary pressures, which, while preserving margins in the near term, anchors inflation expectations and makes a significant decline in interest rates unlikely.

High Yield: Cracks Begin to Show

The Euro High Yield market, long shielded by ample liquidity and benign default rates, is starting to exhibit signs of stress. After two tranquil months, May saw three European high yield issuers default on their obligations, affecting a combined €6.0bn — a monthly default record exceeding the previous high of €5.0bn from June 2016[2]. The most prominent of these was SFR, which missed a bond coupon and sought accelerated safeguard proceedings. Additional stress emerged from maturity extensions on a few other names, underscoring a clear shift in the fundamental risk profile of lower-rated credits.

Across the Atlantic, the picture is already deteriorating. US High Yield default rates have climbed, reflecting the challenges posed by higher borrowing costs, tighter financial conditions, and weakening economic momentum. Importantly, the breadth of stress is widening — from highly leveraged, idiosyncratic issuers to more cyclically exposed sectors.

Rating drift favours EU vs US

This deterioration in fundamentals poses a latent threat to the supportive technical backdrop. Should a large downgrade (e.g., a fallen angel from IG to HY) or a material default occur, the fragile balance of inflows could be disrupted, triggering a chain reaction of outflows and spread widening. Credit spreads are still trading at historically tight levels, leaving little buffer against fundamental surprises.

The Importance of Issuer-Level Scrutiny

At this juncture, monitoring fundamentals is essential. While a broad-based blowup is unlikely in the near term, the risk lies in concentrated shocks. Companies with excessive leverage, weak free cash flow profiles, or significant refinancing needs will struggle in the current environment. The maturity wall looms large, especially for lower-rated issuers who may find themselves locked out of primary markets or forced to refinance at prohibitively high rates.

Where fundamentals falter, technicals often follow. In a market environment where spreads are compressed and complacency is rife, even isolated credit events can reverberate far beyond their origin. The recent default by SFR is a prime example: while localised in nature, it sparked a wave of reassessments across the European High Yield space. In tightly wound markets, where yield is scant and risk premia are artificially low, sentiment can shift quickly. Downgrades or missed earnings guidance — even by small or mid-cap issuers — can force passive and benchmark-aware investors to de-risk mechanically, generating outsized moves in secondary markets.

Moreover, many technical indicators — from fund flows to spread compression — are themselves a function of perceived fundamental strength. When that perception breaks down, the feedback loop can be brutal. Outflows lead to forced selling, leading to wider spreads, which in turn exacerbate liquidity pressures and trigger further outflows. The illusion of stability, often supported by mechanical inflows and ETF activity, can quickly give way to volatility when underlying credit quality is questioned.

In this environment, issuer-level due diligence is the investor’s best line of defence. Credit investors must seek clarity on earnings durability, pricing power, cost pass-through ability, and refinancing optionality. Businesses tethered to macro volatility, cyclical industries, or export-driven revenues are particularly susceptible to rapid re-rating. Conversely, defensive sectors with stable demand and strong balance sheets are more likely to maintain market access and preserve investor confidence.

Conclusion: Opportunity Persists — But With New Rules of Engagement

The case for credit remains compelling. Elevated yields, resilient technicals, and a reawakening investor appetite have so far enabled credit markets to weather the storms of 2025.

Investment Grade credit stands on firmer ground, supported by resilient fundamentals that suggest a capacity to withstand mounting economic pressures. Investor appetite remains strong, and elevated yield levels have enhanced the appeal of Euro IG as a credible alternative to traditional safe havens. In fact, markets are beginning to question whether lending to Eurozone sovereigns — whose debt trajectories and fiscal outlooks raise increasing concern — is as prudent as investing in comparably rated corporates offering solid fundamentals, attractive valuations, and supportive technicals. In contrast, the High Yield segment tells a more cautious story. Here, weaker fundamentals and less stable technicals leave the asset class more exposed to volatility and afore mentioned external risks (such as tariffs, trade wars and volatility).

Nevertheless, for both asset segments. the key determinant will ultimately be the severity and persistence of the external shocks, and how deeply they cut into credit quality across the spectrum. While they have so-far failed to derail the rally, the real test lies ahead. A slow-burning deterioration in fundamentals, if left unchecked, could well become the defining spoiler of the last leg of this credit cycle.

For the thoughtful credit investor, this is a time to pivot towards a more nuanced, fundamentals-driven allocation strategy. The era of indiscriminate yield-chasing is over. What lies ahead is a market that will reward diligence, selectivity, and an unrelenting focus on corporate creditworthiness.

[1] Rising stars are bonds that are rated as junk bonds but could become investment grade because of improvements in the issuing company’s credit quality. Fallen angels are bonds that were initially rated investment grade but were downgraded to junk status due to a deterioration in the financial condition of the issuer.

[2] Source: Candriam, Bloomberg, June 2025