Last week in a nutshell

- The US economy added 187K jobs while average hourly earnings were still too high giving a mixed message on the US Labour market.

- Euro zone's Q2 2023 economy grew by 0.3%, as lower inflation and better demand offset higher interest rates and declining confidence.

- Continued debt ceiling disputes and rising federal debt have led to doubts about the US meeting payment obligations, prompting a Fitch Ratings downgrade.

- The Bank of England rose interest rates to a 15-year high of 5.25%. Inflation dropped to 7.9% in June but is still the highest in the G7.

What’s next?

- Final readings of inflation, including PPI and CPI for some key countries, such as the US and China, will be in the spotlight as investors look for clues on central banks’ next moves.

- The preliminary Michigan consumer sentiment and current conditions will shed some light on the US consumer’s assessment of economic conditions.

- The UK will publish preliminary Q2 GDP growth rate as well as a series of activity and trade-related data as investors try to assess the sharpness of the slowdown in activity.

- The Q2 2023 earnings season continues with Walt Disney, Alibaba and Berkshire Hathaway.

Investment convictions

Core scenario

- In the United States, latest data continue to point towards a soft landing. Inflation and wages continue to decelerate while growth remains resilient whereas Chinese growth keeps missing growth forecasts raising the odds for more stimulus.

- In the euro zone, growth is weak and expected to remain lacklustre: activity is now contracting in the manufacturing sector and decelerating in the service sector. Receding inflation should help households to regain some purchasing power in H2.

- Most emerging economies have low inflationary pressures and some of the central banks have started to cut rates: They are not at the same stage, in the interest-rate cycle, as developed markets.

- Central banks in developed markets are nearing their peak rates, but interest rates will stay high for an extended period. We expect no rate cuts in developed markets in the second half of 2023.

- During the second half of 2023, we expect a less supportive market environment than in H1 which should translate into a broadly lateral move of financial markets.

Risks

- The steepest monetary tightening of the past four decades has led to significant tightening in financial conditions. Financial stability risks could return.

- A stickier inflation path than already expected could force central banks to hike even more, which implies that the growth outlook is tilted to the downside.

- After the dramatic drop in growth surprises in all major regions outside of the US, the global outlook could become less supportive.

Cross asset strategy

- We have a more cautious equities allocation than during the first half of the year, considering the limited upside potential. At current levels, a positive economic outcome with a softish landing seems already priced in for equities. We focus on harvesting the carry and are long duration.

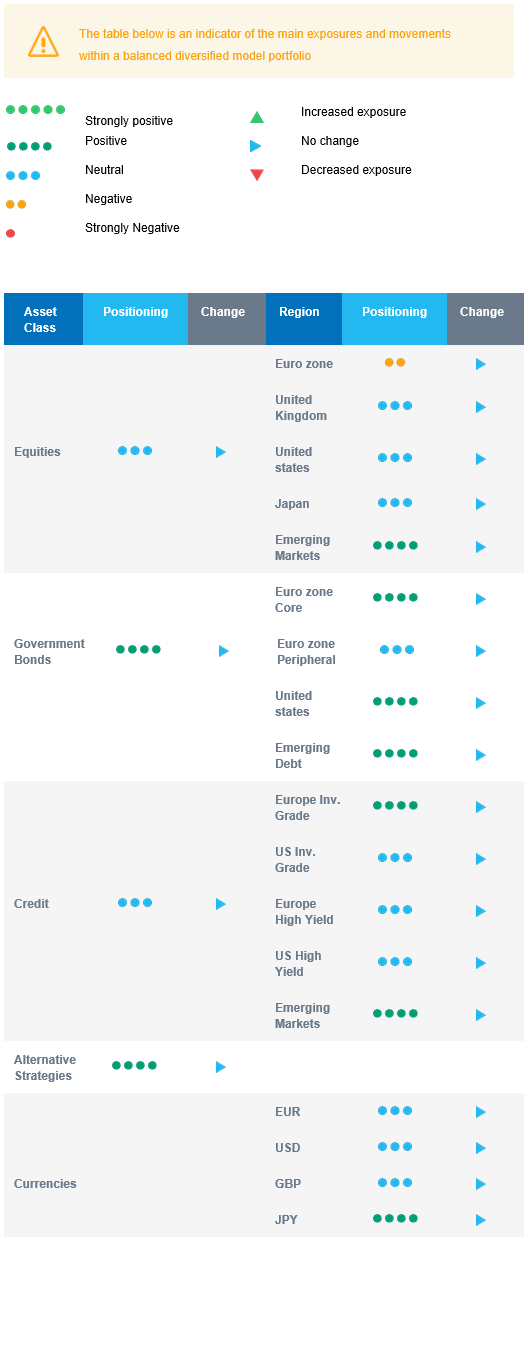

- We have the following investment convictions:

- Our positioning on equities is somewhat more defensive and we are underweight euro zone equities as pricing has become too complacent in our view given the restrictive monetary and financial backdrop.

- We believe in the upside potential of Emerging markets, which should benefit from improving economic and monetary cycles vs developed markets, while valuations remain attractive.

- We prefer defensive over cyclical names, such as Health Care and Consumer Staples, as cyclicals are already pricing a strong improvement and economic recovery. In addition, defensive sectors have better pricing power while further margin expansion is unlikely.

- Longer-term, we favour investment themes linked to the energy transition due to a growing interest in Climate and Circular Economy-linked sectors. We keep Technology in our long-term convictions as we expect Automation and Robotisation to continue their recovery which started in 2022, albeit at a reduced pace compared to the first half of this year.

- In the fixed income allocation, we have a long duration positioning:

- With higher rates and a reasonable level of spreads, we like US and European government bonds and high-quality credit as sources of carry.

- Our overweight stance on investment grade credit is a strong conviction on European issuers since the start of the year as carry-to volatility is attractive.

- We are more prudent on high yield bonds as tightening credit standards should act as headwind and the buffer for rising defaults has decreased in recent months.

- Emerging bonds continue to offer the most attractive carry. The accommodative stance of the central banks is positive for bonds. Investor positioning is still light post-2022 outflows. And the USD is not expected to strengthen, which represents a tailwind for local currency debt.

- We hold a long position in the Japanese Yen and have exposure to some commodities, including gold, both are good hedges in a potential risk-off environment.

- On a medium-term horizon, we expect Alternative investments to perform well.

Our Positioning

Our convictions translate into an overweight bonds vs equities. Within fixed income, we identified European Investment Grade bonds as attractive and remain confident in the asset class. We have a long duration seizing the opportunity as the hawkish ECB policy has driven long-term yields to attractive buying levels. Within equities, we see value in a barbell approach: Overweight Emerging markets mitigated by an underweight on euro zone. Further, we acknowledge a supportive momentum and a US goldilocks episode: More positive surprises on economic growth and less negative surprises on inflation. However, our exposure to the US market comes with a derivative protective strategy as sentiment, positioning, and market psychology are stretched. Markets are increasingly reflecting our soft-landing outlook, limiting the performance potential going forward. Our “late cycle” asset allocation strategy is also axed around defensive sectors over cyclicals.