Last week in a nutshell

- The Chinese economy expanded by 6.3% YoY in Q2 2023, below market estimates, raising pressure on policymakers for more stimulus.

- UK inflation fell more-than-expected to 7.9% in June, easing expectations of aggressive interest rate hikes by the Bank of England.

- New-car registrations in the European Union increased by 19% YoY in June, helped by growing demand for electric vehicles (+55%). For the first time, EV sales outpaced those of diesel-fuelled cars.

- The Black Sea grain initiative, which allowed Ukraine to export grains by ship, expired and triggered concerns about rising prices and food accessibility in poorer nations.

What’s next?

- A packed top-down and bottom-up agenda awaits investors this week.

- Central banks will be in the spotlight as the US Fed and the ECB will likely raise rates by 25bp. Communication will be scrutinised by investors to gauge “how tight is too tight”.

- The Bank of Japan will most likely not hike rates at its meeting but could give hints on how to tweak its Yield Curve Control to enhance the sustainability of its policy.

- Global Flash PMIs for manufacturing and services activity will be released as investors and central banks alike keep assessing the broadening slowdown in activity.

- The Q2 2023 earnings season gathers steam as 167 companies or 39% of the S&P500’s market cap will report results. Microsoft, Google, Amazon, and Meta are among the bellwether names to watch.

Investment convictions

Core scenario

- In the United States, latest data continue to point towards a soft landing. Inflation and wages continue to decelerate while growth remains resilient whereas Chinese growth continues to disappoint, confronted with deflationary forces.

- In the euro zone, growth is weak and expected to remain lacklustre: activity is now contracting in the manufacturing sector and decelerating in the service sector. Receding inflation should help households to regain some purchasing power in H2.

- Emerging markets should, as a group, see growth accelerating faster than developed countries over the coming year, while their central banks’ monetary policy could shift gear towards policy easing.

- Central banks in developed markets are nearing their peak rates, but interest rates will stay high for an extended period. We expect no rate cuts in developed markets in the second half of 2023.

- During the second half of 2023, we expect a less supportive market environment than in H1 which should translate into a broadly lateral move of financial markets.

Risks

- The steepest monetary tightening of the past four decades has led to significant tightening in financial conditions. Financial stability risks could return.

- A stickier inflation path than already expected could force central banks to hike even more, which implies that the growth outlook is tilted to the downside.

- After the dramatic drop in growth surprises in all major regions outside of the US, the global outlook could become less supportive.

Cross asset strategy

- We have a more cautious equities allocation than during the first half of the year, considering the limited upside potential. At current levels, a positive economic outcome with a softish landing seems already priced in for equities. We focus on harvesting the carry and are long duration.

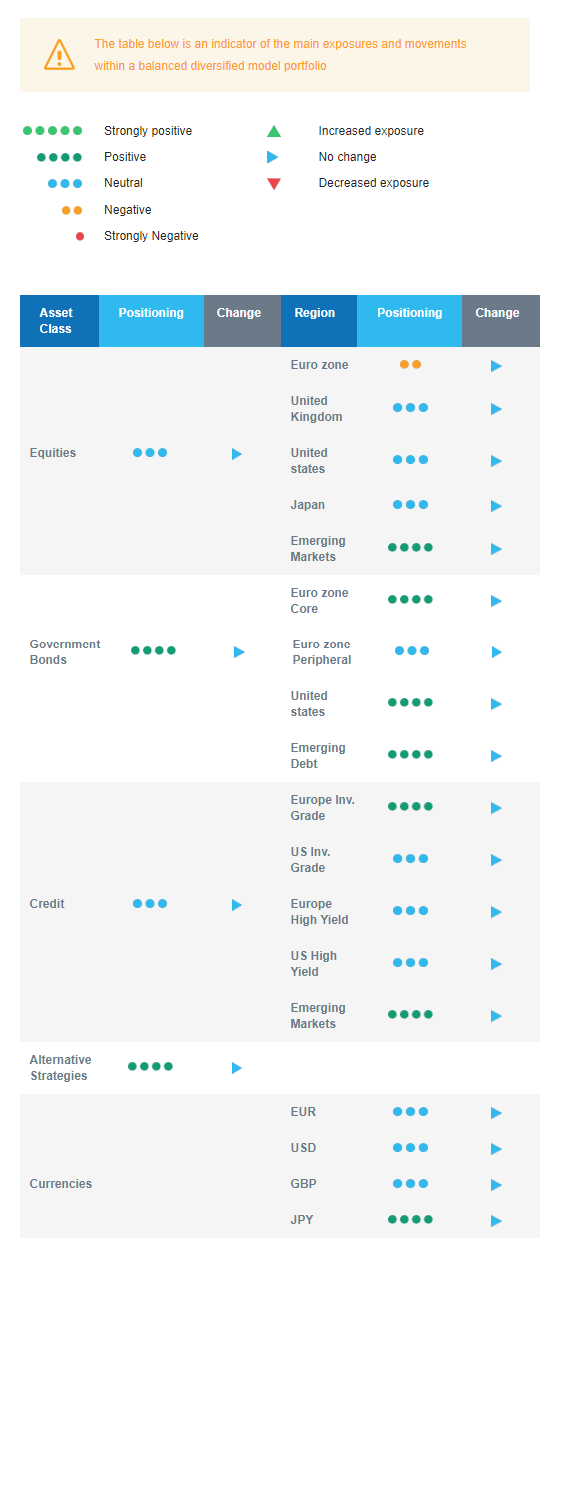

- We have the following investment convictions:

- Our positioning on equities is somewhat more defensive and we are underweight euro zone equities as pricing has become too complacent in our view given the restrictive monetary and financial backdrop.

- We believe in the upside potential of Emerging markets, which should benefit from improving economic and monetary cycles vs developed markets, while valuations remain attractive.

- We prefer defensive over cyclical names, such as Health Care and Consumer Staples, as cyclicals are already pricing a strong improvement and economic recovery. In addition, defensive sectors have better pricing power while further margin expansion is unlikely.

- Longer-term, we favour investment themes linked to the energy transition due to a growing interest in Climate and Circular Economy-linked sectors. We keep Technology in our long-term convictions as we expect Automation and Robotisation to continue their recovery from 2022, albeit at a reduced pace compared to the first half of the year.

- In the fixed income allocation, we have a long duration positioning:

- With higher rates and a reasonable level of spreads, we like US and European government bonds and high-quality credit as sources of carry.

- Our overweight stance on investment grade credit is a strong conviction on European issuers since the start of the year as carry-to volatility is attractive.

- We are more prudent on high yield bonds as tightening credit standards should act as headwind and the buffer for rising defaults has decreased in recent months.

- We are buyers of Emerging bonds, which continue to offer the most attractive carry. Dovish central banks should become a support as soon as H2 2023. Investor positioning is still light post-2022 outflows. And the USD is not expected to strengthen, which represents a tailwind for local currency debt.

- We hold a long position in the Japanese Yen and have exposure to some commodities, including gold, both are good hedges in a potential risk-off environment.

- On a medium-term horizon, we expect Alternative investments to perform well.

Our Positioning

Our convictions translate into an overweight bonds vs equities. Within fixed income, we identified European Investment Grade bonds as attractive and remain confident in the asset class. We have a long duration seizing the opportunity as the hawkish ECB policy has driven long-term yields to attractive buying levels. Within equities, we see value in a barbell approach: overweight Emerging markets mitigated by an underweight on euro zone. Further, we acknowledge a supportive momentum and a US goldilocks episode: more positive surprises on economic growth and less negative surprises on inflation. However, our exposure to the US market comes with a derivative protective strategy as sentiment, positioning, and market psychology are stretched. Markets are increasingly reflecting our soft-landing outlook, limiting the performance potential going forward. Our “late cycle” asset allocation strategy is also axed around defensive sectors over cyclicals.