Economic fundamentals did not dramatically change over the summer. Central bank rhetoric of rates higher for longer is still well in place although inflation is growing at a slower and decreasing pace. In the US, the state of the economy, consumer health and corporate earnings remain relatively resilient. Some might say, surprisingly so. However, investor sentiment changed over the summer to adopt a more cautious stance.

Economic fundamentals did not dramatically change over the summer. Central bank rhetoric of rates higher for longer is still well in place although inflation is growing at a slower and decreasing pace. In the US, the state of the economy, consumer health and corporate earnings remain relatively resilient. Some might say, surprisingly so. However, investor sentiment changed over the summer to adopt a more cautious stance.

Most equity indices softened over September, returning negative low to mid single-digit performances. Small caps, technology, consumer discretionary and industrials were the lagging sectors. Energy and financials outperformed the other sectors.

The front end of the curve was stable over the period in the US and the eurozone. Sovereign yields for long-term maturities widened significantly over the month, increasing by around 50 basis points. Corporate credit spreads followed the same trend, reversing several months of risk easing.

The HFRX Global Hedge Fund EUR returned -0.22% over the month.

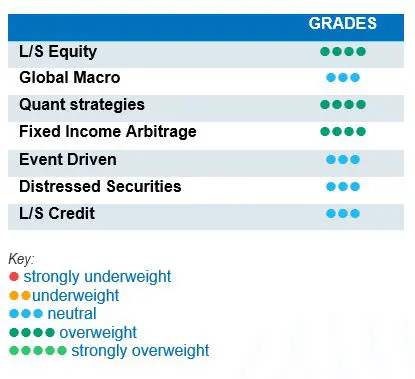

Long-Short Equity

On average, Long-Short equity indices were negative at close to -1% during September, but performance was dispersed across the peer group. Down capture ratios varied substantially according the region of investment focus. North America- and Asia-focused strategies captured around 35% of the downside of long equity indices. Low net exposure and market neutral strategies generated positive absolute returns. Short books substantially underperformed the index while longs performed in line with the index. According to Morgan Stanley Prime Brokerage, since the start of the year, Long-Short Equity funds investing in the US have generated the highest absolute returns but the up capture ratio of strategies investing in US, Europe and Asia is relatively similar and stands at around 40% of the regional equity index. Performances for the strategy have been relatively muted since the start of the year due to low breadth markets which are not ideal for deploying well-diversified Long-Short Equity strategies, but these market moves tend to be of limited duration, with the trend normalising after August. After periods like these, market trading tends to normalise, offering a larger spectrum of long and short opportunities based on company fundamentals.

Global Macro

September was a good month for Global Macro strategies. The move at the back-end of the yield curve was an important performance driver for the funds whose managers monetised through short positions, but positions in commodities and currencies tended to contribute positively to performance. Currently, Global Macro strategies tend to be diversified, holding a wide variety of small bets across equities, rates, currencies and commodities, rather than concentrating their portfolio in just a couple high conviction trades. Returns generated by macro strategies since the start of the year have been relatively muted and below expectations. However, the current and foreseeable environment is expected to offer interesting investment opportunities.

Quant strategies

A strong month for Quantitative strategies, which benefited from an increase in volatility and marked trends in rates. Trend-following strategies tended to outperform the more diversified Multi-strategy funds. The more aggressive trend followers generated double-digit returns, helping to partially recover the steep losses from earlier in the year. Since the start of the year, Multi-strategy Quantitative strategies have been more resilient than CTAs, balancing negative contributions from trend models with positive contributions from non-directional arbitrage models.

Fixed Income Arbitrage

Fixed income arbitrage specialists have managed to navigate a tricky year for the strategy, generating decent performances. On the one hand, strategies that combine pure price arbitrage with fundamental relative value positions have been able to capitalise on fixed income market volatility. While on the directional side, if market participants suffered in March, some managers were able to capitalise on the recent environment to recover their losses with more measured risk. Relative value traders will continue to benefit from a healthy opportunity set, while directional funds will continue to face a more challenging environment for directional bets compared to 2022.

Risk arbitrage – Event-driven

On average, returns were modest but positive for Event-driven strategies. Merger Arbitrage indices have outperformed Special Situation strategies over the period due to their lowest sensitivity to small market movements. Special Situation strategies invest in soft-catalyst situations more correlated to market direction. Merger Strategies invest in deals announced by companies wishing to acquire or merge with another company. According to strategy specialists, the number of deals announced is more correlated to the level of visibility corporate management has on the state and direction of the economy rather than the level of the cost of debt itself. However, in a phase of rapidly increasing rates and increased economic uncertainty, it is normal for corporations to pause and reassess their development plans at a later stage. As inflation slowly trickles down and interest rates are getting closer to peak, we might be at the beginning of a nice cycle for the strategy.

Distressed

The distressed community got an adrenaline shot in March with the collapse of several US financial institutions and Credit Suisse. The surprise failure of Silicon Valley Bank provoked a panic, leading to an indiscriminate sell-off of financial stocks which progressively reversed for most assets. This was a major event due to the size of the failed banks but contained to a limited number of institutions exposed to a big percentage of uninsured bank deposits. Although the amount of non-performing loans, defaulting issues and bankruptcies remains relatively low, investors are much more alert to the risk of cracks in the market, as economic fundamentals might continue to deteriorate. One area of particular attention is commercial real estate and the percentage that the financing of these assets represents in US regional banks.

Long short credit

Long-short credit strategies seem to be gaining in appeal. An environment of higher rates for longer could be a tailwind for alpha generation both on long and short positions, as fundamental research becomes more important in portfolio construction. Absolute return or hedged investment approaches have gained more relevance as positions in AT1 issues have generated significant volatility and market losses for the investment community. It is a fact that yields have widened, again giving fixed income a seat at the asset allocation table. However, as recent events have demonstrated, risk diversification is very important and should be an integral part of the investment allocation process.