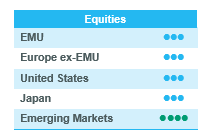

European equities: resilient markets

European equity markets have rebounded strongly since mid-March after the sell-off due to the collapse of Silicon Valley Bank in the United States and the financial turmoil around Crédit Suisse. The rebound was clearly driven by large caps and defensive growth sectors. Healthcare was the strongest outperformer over the past four weeks, followed by utilities and consumer staples. Separately, information technology also held up quite well and outperformed the broader European market.

The two weakest sectors in recent weeks were the financial and industrials sectors, unsurprisingly. Energy also underperformed the broader market over the past four weeks, despite the strong rebound in early April. The OPEC+ surprised the market at the beginning of April with an oil production cut of 1.66 million barrels per day. The announcement pushed oil prices higher, supporting the relative performance of the energy sector that has lagged the broader market so far this year.

Earnings Expectations & Valuations

In the meantime, we are heading into the start of the Q1 2023 earnings season. As it begins, earnings revisions have been slightly positive. Consensus expectations still point to a slight earnings decline for 2023. The decline is mainly due to negative earnings expectations for industrials, materials and energy.

Analysts appear to be more positive in the year to come and count on an earnings growth of around 8% for 2024. Earnings growth expectations are the most positive for information technology and financials.

Considering the above growth previsions, valuations remain interesting. At less than 13 times the expected twelve-month earnings, European equities remain clearly interesting compared to historical levels.

More defensive positioning

We made no significant strategic changes to our allocation over the past few weeks, as we still feel comfortable with our current positioning that remains tilted towards more defensive growth sectors, such as Consumer Staples and Healthcare. Both sectors continued to outperform the broader market in recent weeks, and we will maintain our +2 on Consumer Staples and +1 on Healthcare in the current market context.

The sole change we did make was related to Information Technology. We benefited from our overweight in Technology since the beginning of the year and decided to take some profit by downgrading the sector to neutral from +1. Information Technology gained almost 20% since the beginning of the year and is starting to become expensive, especially as consensus earnings growth expectations (16% in 2023 and 15% in 2024) have become too optimistic in the current market environment. We have no upside left in semiconductors and hardware and also have now downgraded software to neutral from +1. The market segment has become relatively expensive and isn’t immune to a down cycle. Selectivity has thus become increasingly important.

Separately, despite the OPEC+ decision to cut oil production for several, we also maintained our -1 on Energy for several reasons. Firstly, the group often overpromised in the past and didn’t always deliver. Secondly, we expect global demand to slow down in the second half of the year. Finally, the price for a barrel of Brent crude oil is at the top of its trading range, making a further extension of the recent rebound unlikely.

We are convinced that it makes sense to keep a balanced approach with a defensive tilt, as cyclicals have become expensive and the expected economic recovery is already priced in.

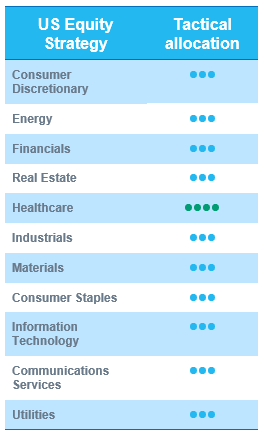

US equities: “Wait and see” approach

US equities have recovered in recent weeks from the shock following the collapse of Silicon Valley Bank. Performance dispersion was nevertheless high, as an acceleration of the economic slowdown and a moderation of real yields resulted in a market shift towards quality growth and defensive sectors.

Quality growth and defensives outperform

In the US, the trend was quite clear over the past four weeks. Large caps clearly outperformed small caps, growth did significantly better and value and defensive sectors took over the lead from cyclical ones. In this context, we recognize the clear relative outperformance of healthcare, utilities and consumer staples.

Separately, information technology held up quite well and outperformed the broader market, whereas communication services was the best performing sector on the back of a strong rise of Meta Platforms and Netflix, among others. Both companies account for more than 21% of the communication services sector.

Finally, energy outperformed as well after a difficult start to the year. The OPEC+ surprised the market at the beginning of April with an oil production cut of 1.66 million barrels per day. The announcement pushed oil prices higher, supporting the relative performance of the energy sector.

The two weakest sectors over the past few weeks were the financial sector and the industrials sector, unsurprisingly. The latter underperformed, as investors started to take into account the Fed’s expectation of a mild economic recession later this year as a result of the country’s banking crisis.

Q1 earnings season kicks off

Besides the ongoing monitoring of inflation figures and the Fed’s monetary stances, investors are bracing themselves for the upcoming earnings season. In anticipation, earnings expectations have been further revised downwards. According to Factset Research, the estimated earnings decline for the S&P 500 in Q1 is -6.8%.

Considering an expected rebound in the second half of the year, earnings will remain flat this year. But consensus expectations are already counting on an attractive earnings growth in 2024, mainly driven by cyclical sectors.

In this context, the expected price earnings of 18.5 for this year is only slightly above the long-term average of the past ten years.

Industrials back to neutral

The US equity market has started to shift slightly towards more defensive sectors. Our overweight in healthcare has contributed positively in recent weeks and consumer staples also performed well relative to the market.

Our industrials overweight was nevertheless slightly negative. Taking into account the acceleration of the economic slowdown due to the fallout of the banking crisis, we prefer to adapt a “wait and see approach” and downgrade the industrials sector back to neutral (from +1). The sector is vulnerable in the event of a sharper than expected growth slowdown of the US economy.

In this context, it appears logical to keep a balanced portfolio. As of today, we only maintain a +1 grade on the healthcare sector that will outperform on the back of its defensive nature.

Emerging equities: Decent recovery in March

Emerging Markets staged a decent recovery in March, overcoming fears around a banking crisis in developed markets and taking positive cues from supportive policy developments in China.

Recovery was led in the second half mainly by China, as the administration tried to restore private business sentiment. The highlight for the month was corporate restructuring announcements, first from Alibaba and then from JD.com. China PMI figures continue to remain strong and supportive of economic recovery. However, geopolitical uncertainty lingered following President Xi’s visit to Russia. Domestic A shares benefitted as well, especially companies that enable digital and cloud infrastructure in China following supportive policy announcements.

The export-oriented economies of Korea and Taiwan also showed resilience, with Korea outperforming for the month, helped by prospects of eventual recovery in the semiconductors sector and benefits from the US IRA. India continued to remain under pressure for the month, with worries around Indian IT names being exposed to US financials weighing on index returns, together with Index heavyweight financials under pressure as sentiment deteriorated.

In LatAm, Mexico displayed resilience (although it was underperforming versus the broader Index), as worries around a US slowdown weighed on sentiment. Brazil remained under pressure as the Brazil central bank’s continued hawkish stance and the Lula administration’s comments on the central bank unnerved markets.

In terms of commodity complex, dollar weakness clearly helped gold and silver to post gains for the month, with gold hovering around $2000/ oz level.

Outlook and drivers

Looking beyond the near-term volatility, we remain optimistic on the outlook for Emerging Market equities. With China reopening and its policy environment turning supportive, sentiment around China is improving on the margin. The recent PMI figures reaffirm the recovery thesis for China. There could be some change in sector leadership as consumer retail continues to battle the heightened competitive environment, which should eventually be beneficial for Chinese consumers. There are also new secular growth thematics including digital/cloud rollout for Chinese enterprises, high-end manufacturing and rollout of AI features from software and gaming giants.

The outlook for the export-driven economies of South Korea and Taiwan is also improving, thanks to pickup in AI- (and ChatGPT) related processing and memory semiconductor demand adding to prospects of a sooner than expected recovery. South Korea also stands to benefit from trends like US IRA-related demand or the EU clean tech transition.

In terms of positioning, given that in the near-term volatility could continue to impact markets, we have reduced the risk exposure of the strategy while maintaining the core thematic and sustainable growth exposure. The portfolio holdings on average are expected to deliver higher sustainable growth and generate higher returns on equity compared to the average for benchmark.

Positioning for recovery

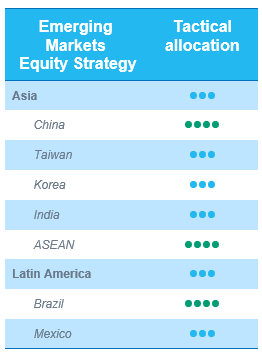

We make no changes to our regional views – maintaining an overweight on China, ASEAN and Brazil while remaining neutral on the other markets.

Regional views:

China maintain OW: Latest PMI figures confirm that China’s recovery continues to unfold. Recent policy announcements on enabling the digital transition, the reforms on State-Owned Enterprises and reassurance for private business were also positive. Market expectations continue to build on policymakers addressing cyclical concerns especially in the infrastructure and real estate sectors. However, geopolitical narratives continue to put a lid on valuations.

Brazil OW: Given markets in Brazil in Q4, valuations remain attractive, and macro drivers are broadly supportive. China’s reopening could provide some tailwind to Brazilian equities.

ASEAN OW: China’s reopening is supportive for ASEAN countries such as Thailand (tourism recovery play) and Indonesia (commodity recovery plays), and thus we maintain an OW in the region.

Mexico neutral: Despite tailwinds from the US nearshoring thematic, we maintain neutral for Mexico, given the sharp rally we have seen in Mexican equities.

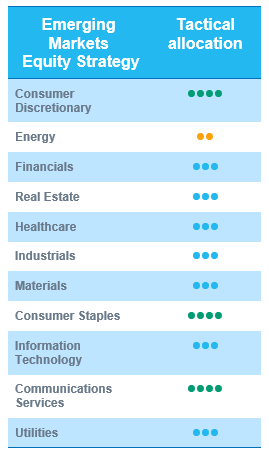

Sector and Industry views:

No changes to sector views. We continue to monttor the Semiconductor sector (maintain neutral) where some demand support from AI and cloud-driven investments could draw recovery earlier than anticipated.