European equities: Cyclicals outperformed defensive sectors in Europe

Cyclicals continue to lead the way

European equity markets had to give away some ground over the past few weeks. There was a clear difference in performance between growth and value sectors. Cyclicals also clearly outperformed defensive sectors, as investors continued to price in the resilience of the global economy.

Against this backdrop, consumer discretionary was the sole sector with a (slight) positive monthly performance, while energy, information technology and consumer staples also outperformed the broader European equity market.

The more defensive healthcare sector was the strongest underperformer since the last committee, followed by utilities.

Earnings expectations and valuations

The Q2 earnings season is set to kick off in the coming weeks. Ahead of the earnings season, earnings revisions have been slightly negative.

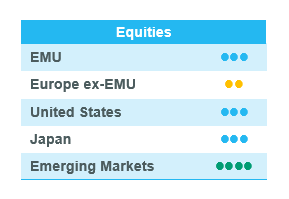

Consensus expectations still point to earnings growth of close to 5% in the coming 12 months for EMU. Considering this expected earnings growth, the European equity market valuation seems attractive, trading at less than 12 times 12-month forward earnings.

Profit taking on energy underweight

Given their good performance since the start of the year, we remained convinced that European equities are already incorporating a lot of positive news. Therefore, we think it makes sense to remain balanced with a defensive tilt towards consumer staples and healthcare, despite the latter’s more laboured performance over the past few weeks. We also maintained our +1 on retail banks, favouring attractively valued retail banks, while avoiding high-risk investment banks.

The sole change we made is related to the energy sector, in which we were already underweight at the beginning of the year. We decided to take profit on the underweight, bringing the sector back to neutral. We recognise that the oversupply that has weighed on the sector over the past few months will disappear in the ongoing quarter. We estimate a supply shortage of 1 million barrels of oil a day in the third quarter, and even 2 million barrels a day in the fourth quarter. In the meantime, demand is set to increase on the back of a revived aviation industry and the driving season in the US. Taking into account an oil price of 80 USD/barrel towards the end of the year, we no longer see any reason to maintain the underweight.

US equities: Investors price in economic resilience

US equities continued their uptrend that began in early June, driven by the suspension of the US government’s debt ceiling until January 2025 and better-then-expected economic data. Investors are now less worried about a global economic slowdown, resulting in a relative outperformance of cyclical versus defensive sectors.

Cyclicals take the lead

US equities continued their uptrend in recent weeks, mainly driven by the strong outperformance of cyclical sectors, such as industrials and consumer discretionary. Information technology performed broadly in line with the broader equity market despite the recent increase in real rates.

Defensive sectors underperformed significantly over the period. Communication services, utilities and healthcare have recorded the strongest underperformance since early June.

Start of the Q2 earnings season

The earnings season is kicking off in the US. Analysts have already revised down expectations over the past few months. For Q2, the estimated decline in earnings for the S&P 500 is now -7.2%, according to Factset. This would be the largest drop in earnings since Q2 2020 and the third consecutive quarter showing an earnings decline. The markets will closely follow companies’ guidance.

Consensus expectations point to an earnings recovery starting Q4 2023, resulting in earnings increases of more than 10% in 2024. In light of this earnings recovery, US equities are trading at 18 times expected earnings for 2024, which is above the five-year average but not excessive.

A word on technology

Information technology has been the best performing sector since the beginning of the year, with a gain of 40% (S&P 500 Information Technology). Few investors doubt the sector’s long-term potential, but the short-term outlook is less clear. At Candriam, we are neutral on the information technology sector in the short term, as the positives balance out the negatives.

On the negative side, we recognise stretched historical valuations, a weaker-then-expected reopening of the Chinese economy, a decline in semiconductor backlogs and elongated sales cycles for software.

However on the positive side, we acknowledge the resilient global economy, the bottoming-out of several subsegments (memory semiconductors, selective consumption-driven models in the cloud space, etc.) and the strength of the AI wave, which could potentially support a broader spectrum of stocks.

In the meantime, the long-term drivers (demographic shifts, technological progress, environment challenges, etc.) remain in place, convicing us that every significant correction is a buy opportunity.

Emerging equities: Positive month

The MSCI EM rose 3.5% (in USD terms, all returns are in USD unless otherwise specified) in 1H23, significantly underperforming the MSCI DM (+14.0%). June was positive for the MSCI EM (+3.2%).

Despite the Fed’s hawkish stance with further rate hikes, a soft landing scenario is more plausible, given that the US has displayed more disinflationary trends. However, US-China relations remained volatile due to the US’s uneven diplomatic actions. On the one hand, the US was determined to put extra pressure on China through additional chip bans. On the other, Washington sent several delegates to China including Secretary of State Antony Blinken, Secretary of the Treasury Janet Yellen (in July), and CIA Director William Burns, in search of “candid communication”. Meanwhile, concerns about China’s weak recovery persisted, but Beijing responded with limited support, such as a minor decrease in loan prime rates. China’s economic recovery weakened further as stimulus fell short of expectations. Growing concerns about the global economic outlook weighed on risk appetite. For global business leaders, China remains appealing. Heavyweights such as Elon Musk, Bill Gates, Tim Cook and Bernard Arnault all visited the country in June. Micron, an American chip giant, also announced more investments in China, despite Beijing’s recent restrictions on the domestic usage of the company’s products.

Some other countries can see opportunities in this new normal of US-China rivalry. For South Korea, the US’s one-year deadline on the country’s chip exports to China has been relaxed, allowing South Korea to continue chip-related operations with China. For ASEAN countries, it would be difficult to stay neutral in the rivalry between the two giants, but they perceive potential advantages in supply-chain relocalisation from China. The spotlight has been on India, whose prime minister Narendra Modi visited the US and was applauded. The country’s structural growth is intact, and the World Bank forecasts GDP growth of 6.3% this year for India.

Regarding other regions, LATAM was the best performer in emerging markets. Brazil, one of the top contributors, saw lower inflation and solid employment. In Turkey, the economy is cooling, and the Turkish government has begun to pursue more conventional economic policies since the election.

AI theme stocks continued to climb this month, supported by strong fundamentals. It would be premature to draw any conclusions regarding its impact, but AI’s broad application, from art creation to everyday operations on laptops, is progressively becoming a reality. Meanwhile, governments are formulating AI regulations and designing blueprints for proper data use.

Regardless of questions and debates, investment will become more pro-ESG. The IFRS Foundation, the organisation that sets international accounting standards, just showed its determination again. Since its last announcement regarding the integration of ESG into corporate accounting, more standards on the climate will be rolled out in January 2024.

Gold and silver prices fell by 2.2% and 3.3% respectively in June. Crude oil prices rose, with Brent increasing 5.1%, due to China’s growing demand and voluntary cuts among oil exporters.

Outlook and drivers

Despite near-term concerns, we remain optimistic about the long-term prospects for emerging market equities.

In China, for instance, despite ongoing headwinds on macro weakness and geopolitical concerns, valuations remain depressed, and any meaningful policy support could again kickstart the region’s recovery. Furthermore, the current market scenario includes new secular growth themes such as digital/cloud roll-out for Chinese enterprises, advancement of high-end manufacturing and the integration of AI features by software and gaming leaders. The rising demand for AI and ChatGPT-associated processing and memory semiconductors is a tailwind for selected companies in Taiwan and South Korea. From a value chain perspective, multiple Asian companies are direct contributors to the whole AI theme’s growth and are expected to be long-term beneficiaries of the transition. In addition, South Korea is poised to gain advantages from demand related to the United States' Inflation Reduction Act (IRA) and the EU's goal to adopt clean technology. Similarly, in LATAM and in Brazil, we are optimistic about domestic consumption names and long duration equities that could be a beneficiary of a possible easing cycle.

Our current position continues to be balanced, with exposure to several diversified clusters and themes. In terms of positioning at both regional and sector level, the strategy's exposure is balanced versus its MSCI EM benchmark, with a reduced active risk exposure, given ongoing uncertainties in terms of the global growth slowdown and geopolitical volatility.

Positioning update

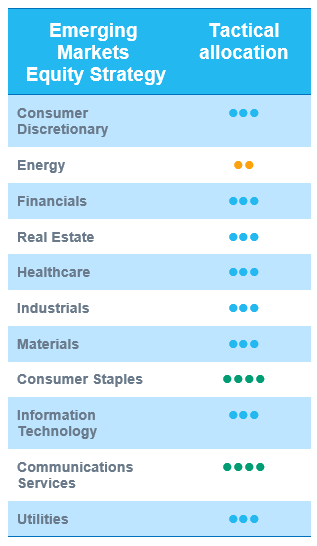

We remain neutral on China and consumer discretionary, and are monitoring upside risk during economic oscillations.

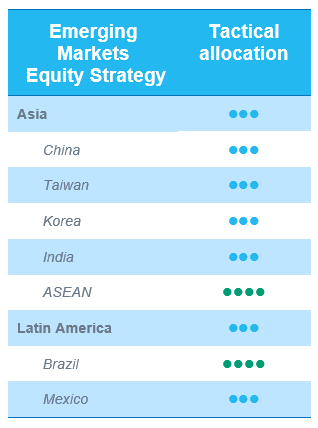

Regional views:

China Neutral – The latest data from China revealed consumer weakness: decreasing exports/imports, falling CPI figures, and a credit impulse that remained neutral. In addition to this, large e-commerce names facing growth concerns are entering a new phase of increased competition. Geopolitical risk and uncertainities are back on the table and could continue to add to headwinds.

Brazil OW – Valuations remain attractive, and macro drivers are broadly supportive. The country is expected to be among the first to start easing.

ASEAN OW – China’s reopening is supportive for ASEAN countries like Thailand (tourism recovery play) and Indonesia (commodity recovery plays), and supply chain diversification, driven by geopolitical factors, benefits the region. We maintain an OW in the region.

Sector and Industry views:

Semiconductor upgraded to OW – the sector benefits from the rise of artificial intelligence and is further supported by the improving economic situation in the United States. Companies in emerging markets such as TSMC have already reported better than expected monthly sales.