2023 started out on the right foot for holders of financial assets, as the overall performance of equities and bonds was positive. However, a significant part of the financial community is bedazzled by the vigour of the rebound. As a message in a bottle lost at sea, investors seem to be hearing the Fed, but not listening to what they are saying. Time will tell, but for the moment, optimism is in the driving seat.

After a very difficult 2022, January started on a strong note for most equity markets, which posted high single-digit to low double-digit positive returns for the month. The main detractors of 2022 have been among the biggest outperformers since the start of the year. Technology and consumer discretionary reacted very positively to cooling inflation and decreasing expectations of a hard-landing scenario.

After a very difficult 2022, January started on a strong note for most equity markets, which posted high single-digit to low double-digit positive returns for the month. The main detractors of 2022 have been among the biggest outperformers since the start of the year. Technology and consumer discretionary reacted very positively to cooling inflation and decreasing expectations of a hard-landing scenario.

Sovereign and corporate fixed income assets performed well during the month. Long-term sovereign yields have decreased, seeming to indicate that the investment community believes central banks will be able to lower short-term rates to support economic activity. Lower corporate spreads also contributed positively to performances, with a bigger impact from riskier issues.

The HFRX Global Hedge Fund EUR returned +1.43% over the month.

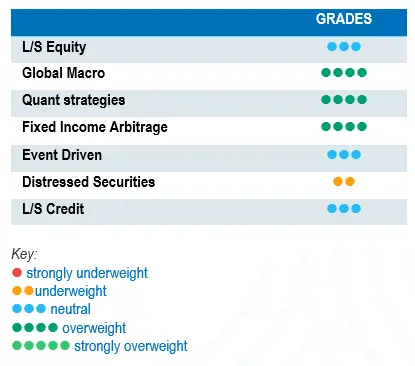

Long-Short Equity

On average, Long-Short Equity long biased funds performed well during the month. In terms of style, directional strategies outperformed, benefiting from the market rally tailwind. Market neutral strategies tended to underperform their peers, penalised by the outperformance of their short books. Poor quality stock prices rebounded aggressively, with market sentiment improving and the upward trend tending to be reinforced with managers looking to cover a portion of their short positions. According to prime brokers, the strong market performance in January and improving outlook kickstarted an active de-grossing process among hedge funds during the month that has continued into February. It was one of the most extreme moves of the last half-decade and was particularly penalising for holders of shorts in high-risk stocks. From a regional perspective, managers with a focus on Europe and the US are keeping their net exposures close to the lows of the last 18 months, while funds investing in Asia continue to raise their net exposures. The heavy lifting of short books’ positive contribution during last year’s equity risk repricing is probably behind us. However, the environment remains favourable for Long-Short equity strategies. Factors such as the rising cost of debt, the possible slowing of economic activity and active risk pricing by investors will benefit equity portfolio constructions from a long-short perspective by picking the winners and losers in the current market environment.

Global Macro

The performances of Global Macro indices were flat to slightly positive during the month, with levels of dispersion relatively tight when compared to other strategies. Many fundamental-driven managers remain sceptical about the optimistic scenario that is currently being priced in by the market. Their base case scenario is not one where we have an economic soft landing. They consider corporate earnings estimates to be far too generous and credit spreads to be below what one would expect in a recessionary environment with rising default levels. Bearish managers tend to be short specific countries, sectors or industries that they consider at risk from a slowdown, but are tactically hedging through long index futures. During 2023, the breadth of financial asset price moves will tend to be lesser than during the last year, which may offer a better environment for strategies with a relative value approach.

Quant strategies

Returns from quantitative strategies were dispersed during the month. Trend-following strategies made a challenging start to the year. Gains from short-term trend-following models in equities were negatively offset by negative contributions mainly driven by short positions in rates and technology index futures. Performance generated by Multi-Strategy Quantitative managers was more dispersed, as they benefited from a greater diversification of strategies and models.

Fixed Income Arbitrage

After a goldilocks year for fixed income arbitrage strategies, the volatility of the interest rate market has fallen both in Europe and in the US. Inflation forecasts are more optimistic than they were, pushing yields lower and bound within a quite narrow range. As 2023 begins, the main focus will be on this new trend. However, it is far from obvious that inflation worries are behind us, and many uncertainties remain (Ukraine-Russia war, pace of the economic slowdown, energy price trends, etc.). In this environment, Relative Value traders should continue to benefit from a healthy environment, while directional funds will face a greater challenge in making directional bets compared to 2022.

Risk arbitrage – Event-driven

Event-driven strategies generated, on average, positive returns over the month. Within multi-strategy funds, special situations and credit were the main positive drivers of performance. Special situations are investments whose thesis is based on soft catalysts and tend to be more directional and more positively correlated to market direction. Furthermore, market expectations of slowing rate hikes is a positive driver for situations requiring financing to restructure their business. The performance of merger arbitrage strategies was more dispersed during January, mainly due to a deal break that impacted the managers arbitraging that specific deal. The merger arbitrage opportunity set is currently animated by opposing driving forces which are generating some level of volatility in merger spreads. The rising cost of debt, the dynamic stance adopted by US regulators in challenging the large deals announced and the level of economic uncertainty are all factors helping to widen spreads and keep them wide. At the same time, the strategy currently offers an attractive deal spread above historic averages, which should attract more interest from arbitrageurs contributing to narrow the spread. The current nervousness on equity and credit markets necessitates more caution when investing in Event-driven strategies, due to a higher probability of deal breaks. Conversely, Merger Arbitrage provides an interesting tool that is structurally short duration, where deal spreads are positively correlated to increases in interest rates.

Distressed

Bankruptcy headlines have captured the implosion of hedge fund strategies and financial intermediaries active in digital assets. The dramatic fall in value of crypto currencies has put the spotlight on a specific number of crypto investors and crypto lenders. Fortunately, this concerns only a very niche segment of the hedge fund universe. Currently, default rates of sovereign and corporate issuers remain relatively low. Credit spreads have substantially retraced since their highs in October 2022 driven by expectations of a less severe economic downturn. We are only at the beginning of the economic slowdown, and most corporations were able to refinance their debt obligations at better rates following the COVID crisis. This will help push defaults further down the line or maybe even decrease their number.

Long short credit

Long short credit managers have done well compared to traditional credit funds. Their short books and hedges have helped mitigate the impact of widening spreads on long holdings. Some of the managers think that the situation does not look particularly upbeat, but they need to focus to pick the right issues, with particular attention paid to corporate leverage levels and covenants. As markets are expecting rates to continue to rise and economic growth to decelerate, the best managers remain diversified, investing in quality longs and focusing on industries with higher pricing power.