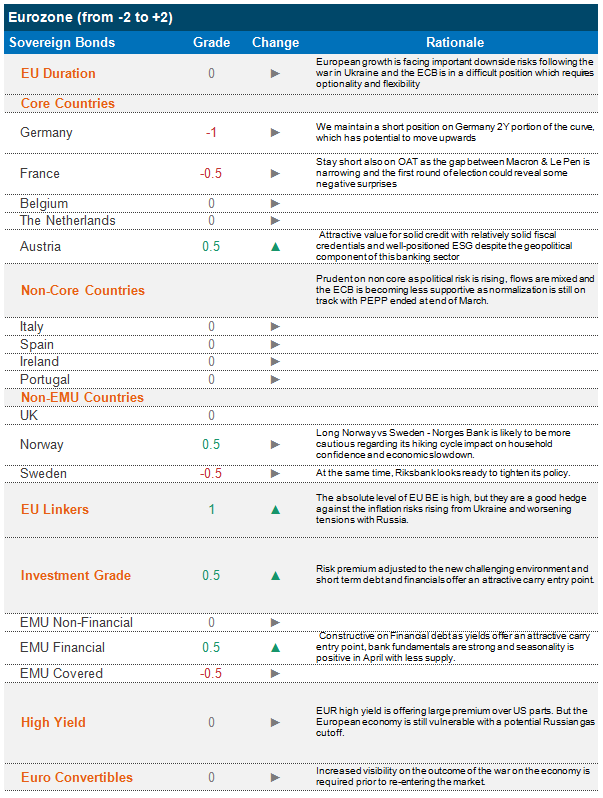

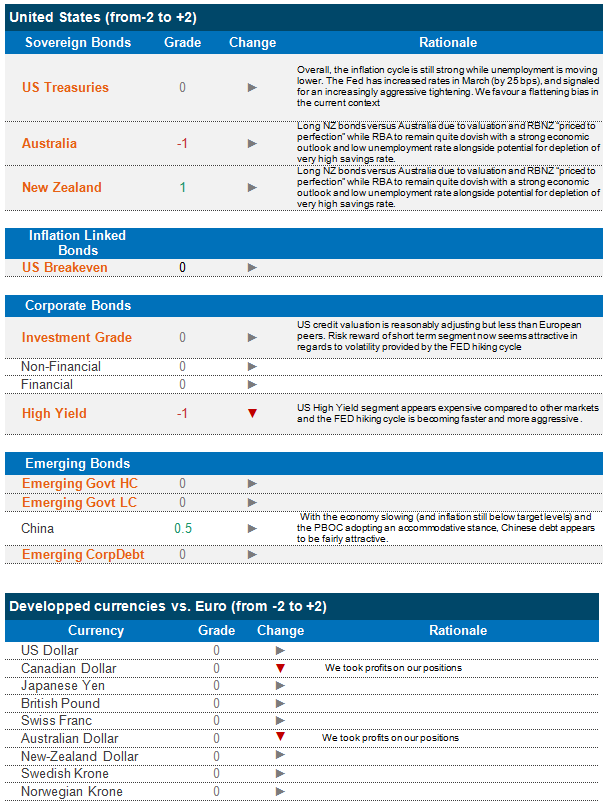

Markets witnessed a sharp rebound over the past month (since March 7) following the sharp drawdown that followed Russia’s invasion of Ukraine. It is important to note that volatility did not subside during this uptick, as a result of growing uncertainty regarding the impact of high inflation, hawkish monetary policy and increased geopolitical risk on the economy. Sanctions brought on by the United States and the European Union continue to impact the Russian economy, and the subsequent measures (payment of oil and debt in roubles, for example) are likely be detrimental to global economies as well. Neither investment grade and high-yield credit markets nor emerging debt has seen a material rebound over the past month, while both European and USD sovereigns have once again posted negative performances. Across Europe, the negative performance has been more pronounced in core markets (Germany, France). Not surprisingly, inflation-linked bonds have posted positive performances as have certain commodity markets such as Natural Gas. Within currencies, the Ruble shot up 53% after the very sharp decline in February, as a result of central bank activity and fiscal measures. Certain Latin American commodity currencies also did well (BRL, MXN), while safe-havens (like JPY) suffered somewhat.

The deadlock in Ukraine and the failed negotiations thus far indicate that the war and resulting human casualties are likely to continue to weigh on sentiment. The resulting volatility and price gyrations will continue to impact fixed income markets in the short term, making flexible and tactical management essential. Over the course of the year, the slightly longer term implications will obviously involve ever- rising inflation, which risks running out of control combined with increasing commodity prices and greater supply chain constraints. It is also possible that this could have an impact on consumption and growth at large across developing and emerging nations. Central banks, in their quest to control inflation, continue to persevere in their hawkish stance. We still expect the Fed to increase its rates (by 25 bps instead of the previously envisaged 50 bps), and we continue to believe that the ECB could hike rates this year, though much later in 2022. In fact, Jerome Powell, the head of the Federal Reserve, has not ruled out ushering in economic slowdown to control inflation. It remains to be seen how markets/economies react to these tightening policies in the absence of fiscal support and in the context of the ongoing geopolitical issues. In Europe in particular, we believe that economies are vulnerable to slowdown and political risk, with the elections in France where far-right candidate Marine Le Pen is delivering a strong challenge. However, we do believe that developed countries are likely to announce an additional fiscal stimulus (through increasing debt), which is likely to deliver some positive effects and could provide a platform for further monetary tightening. All in all, without the support of central banks, fixed income markets are in a territory that they have not witnessed in over a decade. In such a context, it is the fundamentals that are likely to play a key role in determining creditworthiness and, to a lesser extent, price action. The key to navigating current markets is being selective and relying on fundamental research, in a context where European Investment grade markets are posting greater attractivity than High yield.

Strategy & Positioning

It is important to note that Candriam Global Bond and Credit strategies have no exposure to Russian Sovereign debt. Russia has been excluded from our sovereign investment universe based on sustainability characteristics.