Japanese equities have enjoyed a positive run since the start of the year (+20.8% performance to 27 Mar 2024 [1] with the Nikkei recently hitting all-time highs, surpassing the peak of the 1989 bubble[2]. This performance is linked to cyclical factors such as the upturn in global business indicators and, to a large extent, to the depreciation of the yen. However, Japan has also seen a number of reforms since the era of Abenomics.[3] These finally seem to be bearing fruit and, if they continue to be successful, could provide further support for Japanese equities.

Japanese equities buoyed by a resilient global economy and a depreciating yen

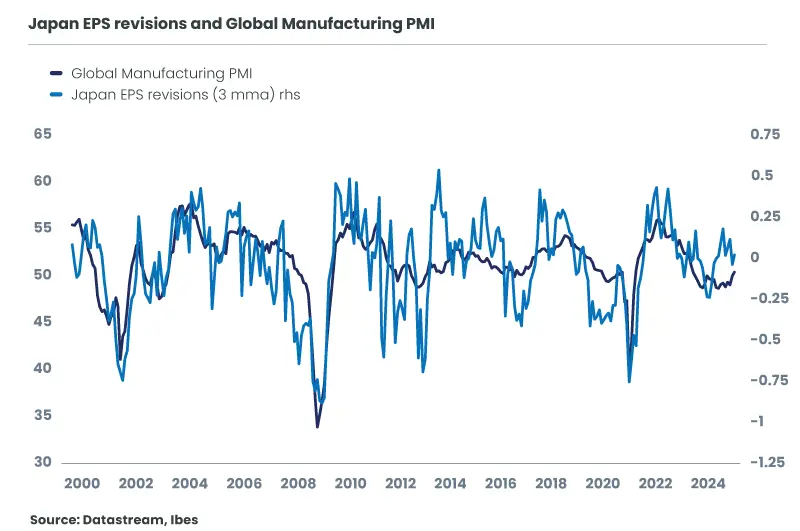

Large-cap Japanese equities, being mostly exporters with a cyclical component, have historically benefited from a recovery in the global cycle. After a long decline in global activity indicators (manufacturing PMIs), PMIs stabilized during 2023, finally moving into expansion territory in 2024 (above 50[4]). For Japanese companies, this has logically translated into positive earnings revisions, with growth expectations steadily revised upwards to reach a target of +8.4% for fiscal 2025[5] .

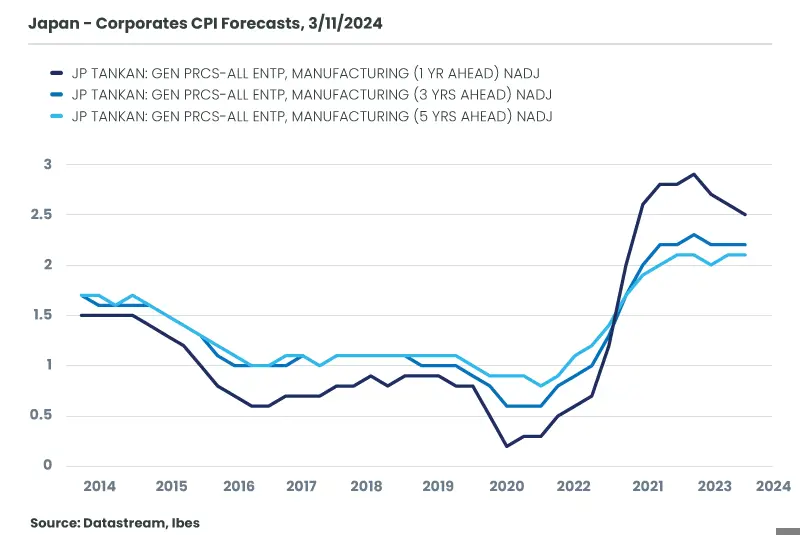

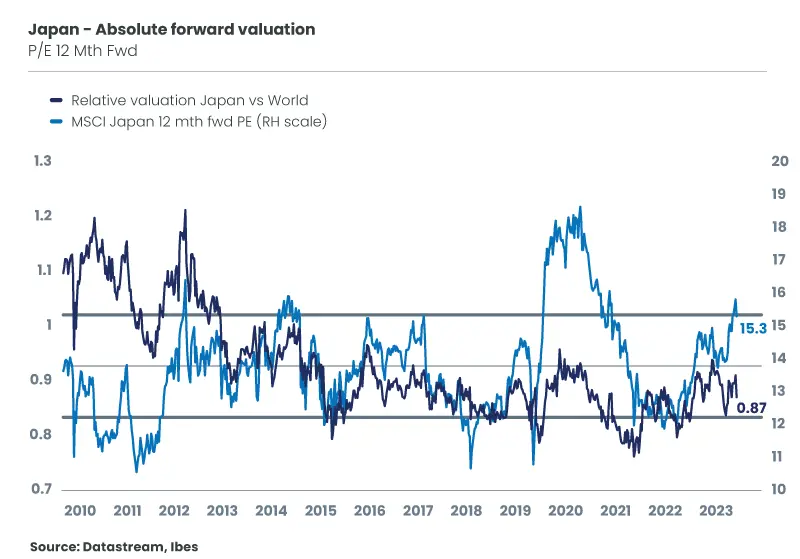

Japanese equity valuations have also benefited from the end of the deflationary cycle, which began in the mid-90s. Inflation projections in Japan have recently picked up and are now anchored above 2%[6] (see charts 2 and 3). Should this inflationary trend persist, margins could continue to recover and valuations could reduce their discount to global equities. This dynamic could offer potential upside of more than +13%[7].

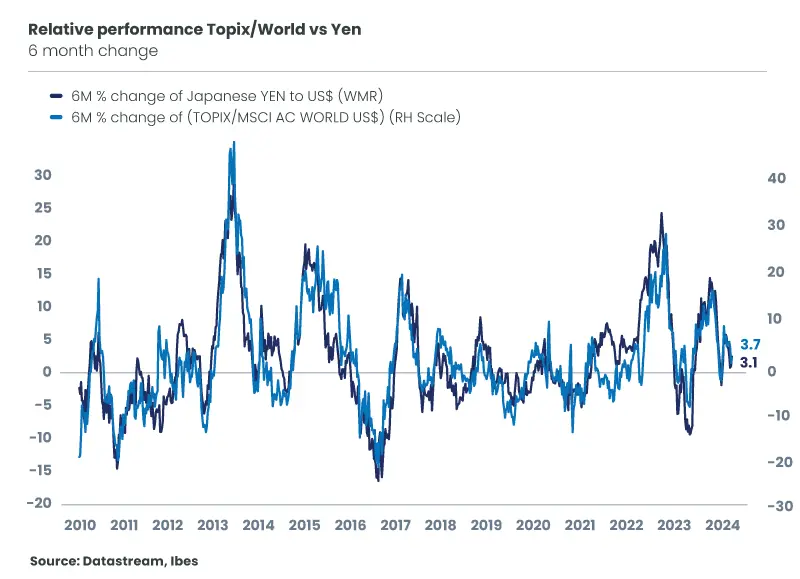

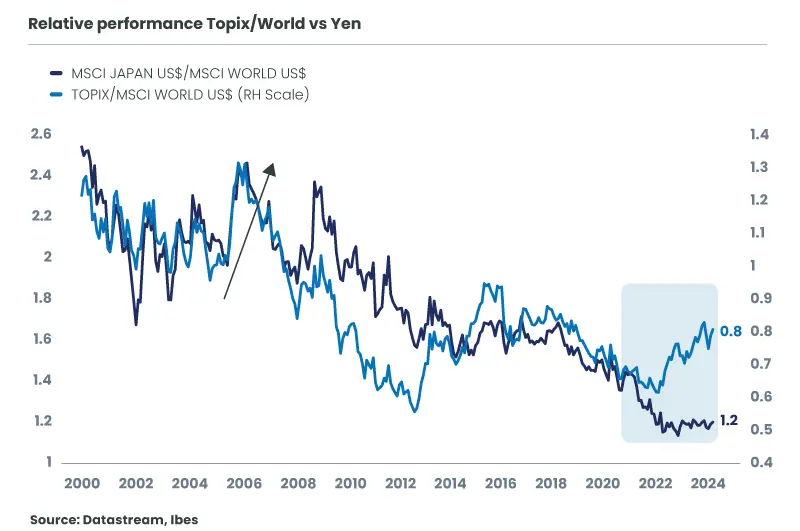

However, this recent performance is largely due to the yen's sharp depreciation.

Japanese listed companies, heavily exposed to international trade, saw their profits boosted by the yen's depreciation. The 8% fall in the yen since the beginning of the year has supported a 20.8% rise in the Japanese market in local currency[8]. However, the outperformance of Japanese equities relative to global indices is much weaker in dollar terms (+3%[9] ), underlining the impact of the yen on the Japanese index.

The yen's support for Japanese equities is likely to fade, however, as further depreciation seems unlikely. Indeed, the Bank of Japan recently ended its negative rate policy, while the US Federal Reserve (FED) and the European Central Bank (ECB) have adopted a more accommodating stance, limiting the prospects of a depreciating yen and, consequently, of future support for the equity market.

Past performance is not a reliable indicator of future performance. Markets may evolve very differently in the future.

However, other growth drivers could propel the Japanese market to higher levels.

Past performance is not a reliable indicator of future performance. Markets may evolve very differently in the future.

The last time the index managed to outperform in both local currency and dollars was in 2004 and 2005, following Prime Minister Jun'ichirō Koizumi's reforms (privatizations, deregulation measures), which had boosted return on equity ratios (ROE) to historically high levels.

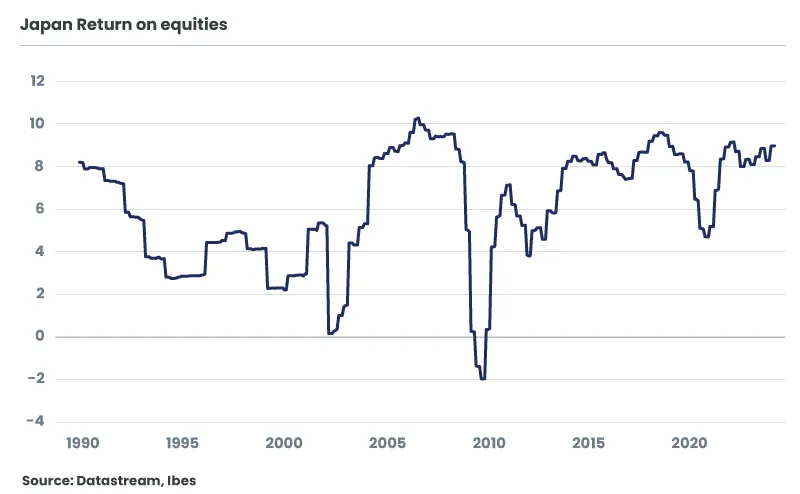

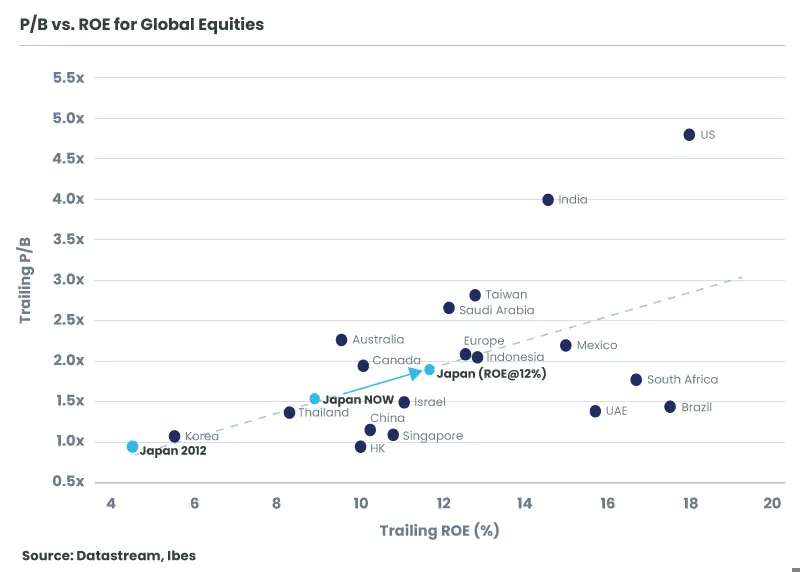

Since 2013, Japan has launched significant new structural reforms aimed at improving corporate transparency and profitability. These reforms are aimed in particular at strengthening the independence of boards of directors and reducing cross-shareholdings, which had a negative impact on valuations. As a result, governance quality indicators have been steadily improving for several years, driving up ROEs from 5% in 2013 to 9% in 2023[10]. However, these have not yet returned to their historically high levels and are not yet in line with international standards -- there is still considerable room for improvement to reach American or European governance standards. If these reforms continue to bear fruit, Japan's ROE could then catch up with the average for other developed countries (12%[11]), and provide additional support of over 20% to the valuation of Japanese equities (see graph 7), triggering a phase of significant outperformance.

At the same time, Japan could benefit from additional structural support. The Japanese government has launched an infrastructure plan to encourage the construction and modernization of high-tech facilities. Following the example of the United States and the Chip Act, this could have a positive impact on manufacturing and technology activities.

Finally, Japanese equities could be supported by several positive flows:

- A reform of the individual savings system (NISA), introduced in January 2014, will be implemented this year. The tax-free holding period will now be indefinite, and the tax exemption limit increased, which could facilitate retail access to listed markets and generate, in an optimistic scenario, estimated flows of between $32bn and $45bn between 2024 and the end of 2027[12] (i.e. between 0.6% and 0.9% of Japanese market capitalization).

- As a result of reforms and the reduction in cross-shareholdings, share buyback programs in Japan have risen sharply, from $33 billion 5 years ago to over $66 billion[13] This trend is set to continue.

- Benchmarked institutional investors are still underweighting the region, despite improving fundamentals. If these investors were to move to a +0.5% overweight in their allocation, this could generate massive flows of nearly $200 billion[14] into the region, representing around 4% of Japanese market capitalization.

Conclusion:

While Japanese equities benefited from a buoyant economy and a favorable reflationary trend, their main impetus came from the depreciation of the yen, which supported Japanese corporate earnings.

However, this period of depreciation now seems to be over, and to maintain a cycle of outperformance, Japanese equities will need further support.

These factors could be, on the one hand, a rise in flows thanks to an increase in holdings by Japanese private investors and share buybacks by companies; and, above all, the pursuit of structural reforms aimed at improving shareholder value creation. Indeed, if ROEs were to surpass their previous peaks, a new phase of outperformance for Japanese equities could begin, prompting institutional investors to rebalance their portfolios in favor of the region.

This document is provided for information and educational purposes only and may contain Candriam opinions and proprietary information. It does not constitute an offer to buy or sell financial instruments, nor does it constitute investment advice, nor does it confirm any transaction, unless expressly agreed otherwise. Although Candriam carefully selects the data and sources it uses, errors and omissions cannot be ruled out. Candriam ne peut être tenue responsable de dommages directs ou indirects résultant de l'utilisation de ce document. Candriam’s intellectual property rights must be respected at all times. The contents of this document may not be reproduced without prior approval in writing.

[1] Nikkei index performance in yen between 12/31/2023 and 03/27/2024. Past performance is not a reliable indicator of future performance. Markets may evolve very differently in the future.

[2] Source Candriam at 03/27/2024

[3] Abenomics: series of economic reforms introduced in 2012 by Prime Minister Shinzo Abe

[4] Source : Datastream IBES

[5] Source : Datastream IBES

[6] Source : Datastream IBES

[7] Source Candriam - IBES Datastream - based on a cancellation of the MSCI Japan vs MSCI World valuation discount. The scenarios presented are an estimate of future performance based on past evidence of how the value of this investment varies and/or current market conditions and are not an exact indicator.

[8] Source : IBES Datastream

[9] YTD comparison of MSCI Japan vs MSCI World in dollars at 27/03/2024

[10] Source : IBES Datastream

[11] Source : IBES Datastream

[12] Source: Citigroup - Japan equity strategy

[13] Source Morgan Stanley to end 2023

[14] Source: Morgan Stanley