ESG, SRI

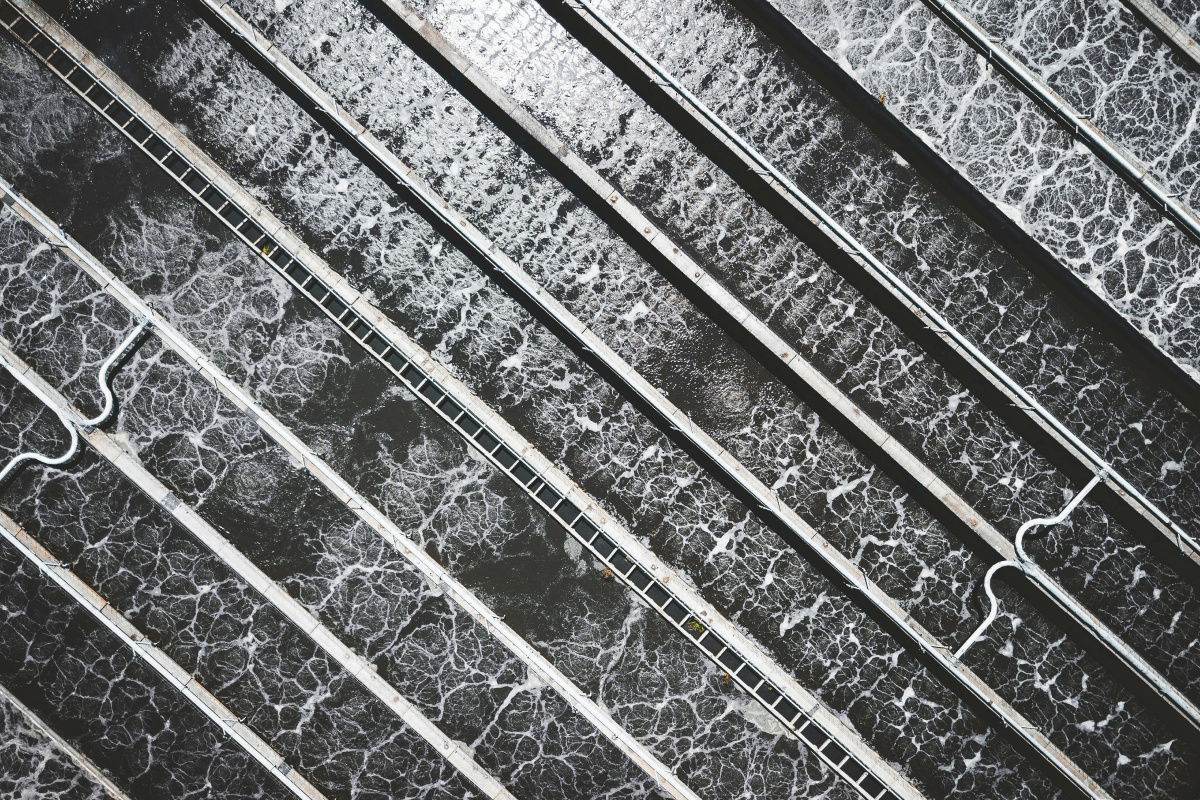

Riding the infrastructure wave: Potential growth beyond the inflationary boom

With the infrastructure sector poised for growth after a tumultuous period caused by the pandemic and subsequent inflationary boom, which areas could offer investment opportunities?