The global economy remains in a delicate state of balance. The US and China have agreed to a 90-day tariff rollback but uncertainty remains high, especially with the US still imposing significant duties. Global growth is expected to slow further, with manufacturing PMIs weakening while inflation offers conflicting signals. More recently, the conflict between Israel and Iran has clouded the market outlook, as the price of oil has spiked.

Our base case has not changed, as growth is softening across all major regions. However, confidence intervals have widened, with noisy macro data and policymaker narratives remaining fragmented. With stock markets trading near the top of their recent range, we hold a neutral equity positioning and favour technology at global level, industrial stocks in Europe and small and mid-caps in Germany, while maintaining a long duration in core-European sovereign bonds. The moment calls for active management and close tracking of shifting geopolitical and macroeconomic regimes in a well-diversified portfolio.

What are the most important risks to this outlook?

Beyond the uncertainties linked to the armed conflicts in Ukraine and the Middle East, we have identified three major risks that could have a negative impact on financial markets in the short term:

- US trade policy: Although there are signs of de-escalation, uncertainty surrounding US tariffs persists. Visibility remains very limited. Market sentiment is fragile and volatility could resurface at any time, even before the end of the 90-day pause of US reciprocal tariffs on 8 July. This could be the biggest risk influencing market direction.

- US budget negotiations: This is also a key issue, impacting notably debt and currency markets. Current discussions point to a widening deficit and potential budget cuts that could disproportionately affect low-income households, putting pressure on consumption, economic activity and therefore corporate profits. These uncertainties could lead to increased volatility and lower investor confidence.

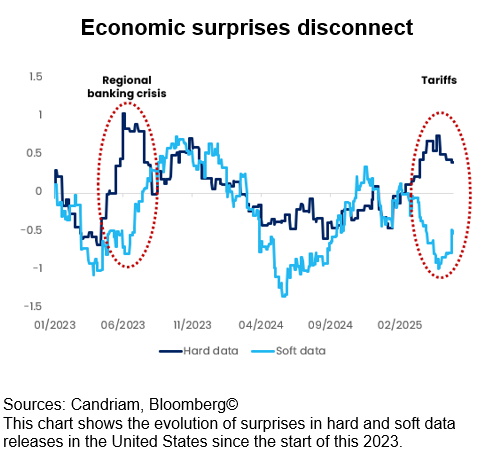

- Noise in the macro data: It is hard to gauge the underlying trajectory of activity, inflation and policy. A hard landing has not happened, but economic growth is slowing. So far, some survey data have shown clear signs of weakness, while hard data remain relatively stable. This disconnection is a rare but well-known phenomenon that occurs when significant shocks erode business and consumer confidence while production and supply chains remain unaffected in the short term. Eventually, the two will have to converge.

What would prompt us to increase or decrease the risk budget in the portfolio?

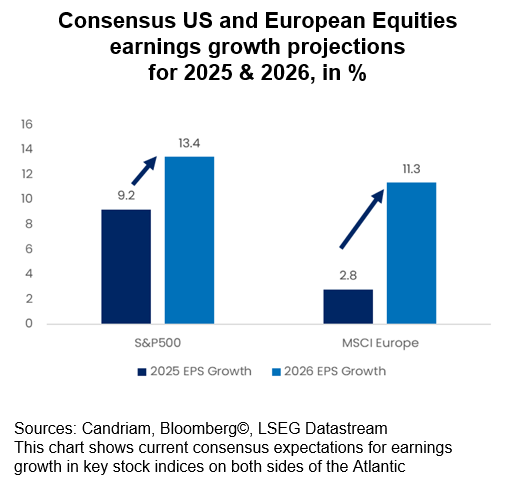

In addition to fading noise in economic releases (either via improving soft data or weakening hard data), we will closely monitor the evolution of profit growth expectations in the coming weeks. For the moment, consensus corporate profit growth expectations appear too optimistic considering our growth projections. Where will 2025 profit growth settle? Will 2026 growth accelerate vs. 2025?

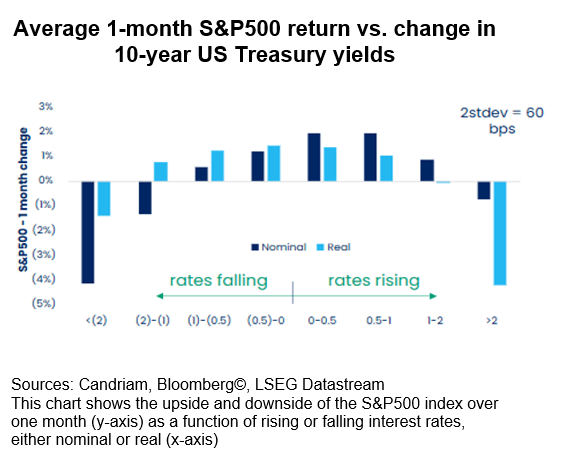

We will also extract signals from the bond market to navigate the risk budget. Bond volatility has risen since the start of this year and a disproportionate speed of change is an important factor for equity market performance: a 2-standard deviation move within one month (the equivalent of 60 bps in the 10-year US Treasury yield) would represent a risk for equity markets. In a nutshell: equity market stability depends on anchored interest rates.

Risk-taking in a shifting world order

We believe that the world order is changing. The transition towards a new equilibrium is currently underway, and the announcements linked to the trade war are part of it. Investors have already faced similar tectonic shifts in recent history. We can schematically summarise the past few decades as follows:

- 1990s: The end of the Cold War and the ‘peace dividend’

The fall of the Berlin Wall marked the end of bipolar geopolitics and the rise of liberal market democracies. With reduced defence spending and greater global cooperation, capital flowed more freely, fuelling optimism and investment in emerging markets. It was a decade of deregulation, privatisation and expanding global markets – a foundational shift for modern investors. - 2000s: Globalisation and delocalisation reshape growthThe early 2000s saw globalisation reach full speed. China joining the WTO in 2001 unlocked a wave of offshoring and global supply chain integration. The rise of emerging markets became a new growth engine. As a consequence, investors leaned into commodities, tech and multinational plays benefiting from scale and cost efficiencies.

- 2010s: The post-GFC era of TINA and ultra-low ratesThe 2008/09 “great financial crisis” (GFC) ushered in aggressive monetary policies, including zero and even negative interest rates. Central banks dominated market narratives, and traditional income strategies faltered. With "There is no alternative" (TINA) to equities, risk assets surged despite economic sluggishness. Passive investing and liquidity-driven markets defined this phase of investment.

- Currently, a new, different, phase is underwayToday, the global order is fragmenting and a more fractured, uncertain world demands agility. Trade wars, geopolitical tensions, inflation shocks and policy divergence are creating a new investment regime. With the new equilibrium still forming, this phase demands flexibility, active management and careful risk-taking.

Investment Implications

With stock markets trading near the top of their recent range and several geopolitical uncertainties looming, we remain comfortable with a balanced and well-diversified positioning, maintaining a patient, diversified and transition-focused investment approach.

- In equities, we avoid regional biases, emphasising sector and factor diversification – particularly in areas with strong earnings momentum like Technology and sectors benefiting from fiscal support such as European infrastructure and defence. We hold an overall neutral positioning and think an overweight is not warranted yet, as US and European equities face headwinds from earnings fatigue and policy uncertainty. As a result, we favour a well-diversified approach.

- In fixed income, we are long duration in core Europe and neutral on US Treasuries. We prefer Investment Grade bonds over High Yield ones, with a tilt towards European credit due to its resilience and strong fundamentals. We are slightly more cautious on High Yield, given tight spreads and limited risk premiums. Our view on emerging market debt has improved slightly, supported by positive real yields, a weaker US dollar and easing tariffs.

- USD peak narrative is intact. The dollar remains firm on a historical basis, but as Fed cuts are finally delivered in H2 and growth weakens, we expect depreciation. We maintain an overweight exposure to defensive currencies such as the Japanese yen and see opportunities in select EM FX where real yields are attractive and balance sheets are improving. This has led us to upgrade EM debt further by one notch from slight underweight to neutral.

- Gold as a strategic anchor: Gold remains a strong hedge in a world of geopolitical complexity and real rate volatility. Despite high nominal yields, demand for gold is buoyed by central bank purchases and a shift in reserve preferences. In addition, retail and ETF demand has strengthened, as investors seek protection from macro tail risks. We maintain our overweight position.

- Alternatives and market-neutral strategies: In light of persistent volatility and asymmetric market risks, we maintain our allocation to alternative strategies. These approaches provide portfolio stabilisation and complement more traditional and directional exposures.

Candriam House View & Convictions

Legend

-

Strongly Positive

-

Positive

-

Neutral

-

Negative

- Strongly Negative

- No Change

- Decreased Exposure

- Increased Exposure

| Current view | Change | |

|---|---|---|

| Global Equities |

|

|

| United States |

|

|

| EMU |

|

|

| Europe ex-EMU |

|

|

| Japan |

|

|

| Emerging Markets |

|

|

| Bonds |

|

|

| Europe |

|

|

| Core Europe |

|

|

| Peripheral Europe |

|

|

| Europe Investment Grade |

|

|

| Europe High Yield |

|

|

| United States |

|

|

| United States |

|

|

| United States IG |

|

|

| United States HY |

|

|

| Emerging Markets |

|

|

| Government Debt HC |

|

|

| Government Debt LC |

|

|

| Currencies |

|

|

| EUR |

|

|

| USD |

|

|

| GBP |

|

|

| AUD/CAD/NOK |

|

|

| JPY |

|