;

;

In the vast subject of the challenges and difficulties of climate analysis from an investor's point of view, scope 3 emissions emerge insistently as one of the main stumbling blocks: the data is incomplete, unreliable and, as it stands, impossible to define decarbonization trajectories and therefore investment targets. Companies, for their part, point to the difficulties of calculation, and also to the fact that these emissions, by their very nature indirect, are not their responsibility. Conversely, many experts see scope 3 data as a kind of "grail" that would finally complete the complex circle of climate analysis. What do you think?

At Candriam, our point of view is clear: while scope 3 carbon data are indispensable elements in climate analysis, and in particular for assessing companies' alignment with the objectives of the Paris Agreement, it is necessary to be aware of their limitations, whether contextual or structural.

;

;

”The quality and reliability of scope 3 emissions are central to improving climate analysis and integrating climate considerations into investments

Scope 3 emissions: essential elements of a company's carbon analysis

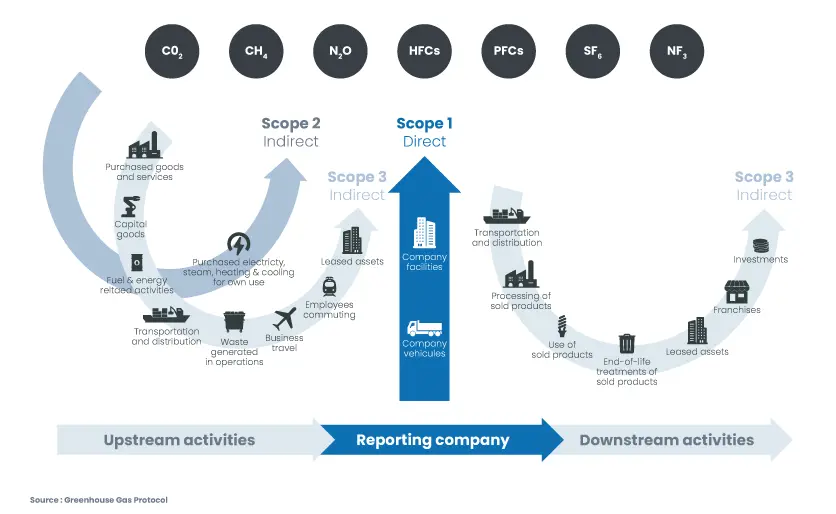

Scope 3 emissions are indirect greenhouse gas emissions, occurring either upstream (suppliers, etc.) or downstream (distribution, product use, end-of-life management) of a company's operations.

Source: Greenhouse Gas Protocol

Although these emissions are indirect, it is important to take them into account, because very often carbon issues are not linked to the production of a product itself, but rather to the raw materials of which it is made, or to its use - elements which are not taken into account in a company's scope 1&2 emissions. It makes little sense, for example, to analyze only the scope 1&2 emissions of an oil company, when 90% of oil-related emissions occur downstream of operations, when oil is burned in customers' engines. Focusing on the decarbonization of scopes 1&2 alone would mean focusing only on the way the company extracts oil, and not on the finished product, which by its very nature is extremely carbon-intensive.

Taking an interest in scope 3 emissions in no way means trying to allocate to each company the emissions for which it is ‘responsible’ - a complex and subjective exercise. Investors are interested in scope 3 emissions because they are essential for analysing corporate risks and the long-term resilience of business models. The most carbon-intensive value chains are those which will have to make the greatest effort, and this will have an impact on all the players in the value chain. Analysis of scope 3 emissions is essential to understanding a company's positioning in the ecological transition, the transformations required to adapt to a low-carbon world, and the associated risks and opportunities - key elements in assessing the relevance of long-term investment, particularly in the most carbon-intensive sectors.

Scope 3 data reporting limits

A partial measure with strong sectoral bias

While scope 3 offers a more precise idea of the emissions produced by the entire value chain of an activity or industry, there are very strong sectoral biases - just as there are for scopes 1&2 emissions. By their very nature, some sectors have much higher scope 3 emissions than others, particularly in industry - although this is no guarantee of the quality of their positioning or their climate strategy. This is particularly true of capital goods, which by their very nature are at the heart of industrial processes and have very high scope 3 (downstream) emissions. This is even more the case for suppliers of equipment or solutions to reduce their customers' energy consumption, who will have in their scope 3 part of the CO2 emissions associated with their customers' energy consumption. Although these companies are at the heart of the energy transformation of our industries, they could be excluded from the portfolios of investors wishing to reduce scope 3 emissions in their investments, or even be encouraged to lose interest in their highest-emitting customers in favour of sectors and activities that are already low-carbon - a nonsense for the financing of the transition!

Progress needed on the corporate side

Publication of scope 3 emissions by companies remains poor and patchy, due to the complexity of the exercise and the lack of common standards for calculating emissions. The GHG Protocol itself leaves companies a great deal of latitude in defining their material emissions and the method of calculation, leading to wide disparities, even within the same sector.

Take the case of semiconductor manufacturers, who are also at the heart of the industrial energy transition. As B-to-B intermediaries, they are not required to communicate the carbon impact of their products (the much discussed Category 11. Use of Sold Products) according to the GHG Protocol. Many companies consider it impossible to know where and how their products are used - a valid argument, if these same companies weren't so quick to communicate about their scope 4, the famous "avoided emissions". Yet this data is much more complex to calculate and requires a detailed knowledge of scope 3 emissions... spot the error! Clearly, many prefer to communicate the positive carbon impact of products, without having a complete analysis of their negative carbon impact.

Let's hope that future regulations, and in particular the CSRD (Corporate Sustainable Reporting Directive), will bring greater consistency to corporate climate reporting. This is essential if investors themselves are to obtain and communicate reliable carbon data.

... and from data suppliers as well

As a general rule, emissions data are published by companies on a voluntary basis to the Carbon Disclosure Project (CDP), then collected and, where necessary, reprocessed by data providers. In practice, very few companies report in full. In this case, their scope 3 emissions are ‘estimated’ using statistical models which embed numerous methodological biases in the databases.

Firstly, these estimates do not take into account the specific features of the company's business or its end markets. Equipment manufacturers for electric vehicles can end up with the same scope 3 ‘downstream’ emissions as the average equipment manufacturer for thermal vehicles! What's more, as in all statistical models, extreme data are often eliminated. This means that, in some sectors, the few companies that carry out an honest and rigorous exercise to calculate their scope 3 emissions may find themselves considered ‘outliers’ by statistical algorithms, and end up with reported emissions well above the sector average attributed to their peers who disclose nothing. This system does not encourage companies to publish comprehensive data.

The lack of reliability, consistency and stability of scope 3 data complicates the task of investors: how can portfolio-level targets be set? - especially for concentrated, actively-managed portfolios with a strong climate positioning, which require the selection of companies with differentiated positions in relation to their competitors.

In reallocating capital to the ecological transition, the quality of scope 3 data is a necessary condition... but not sufficient

The quality and reliability of scope 3 emissions are central to improving climate analysis and integrating climate considerations into investments. It is essential to make collective progress on this subject: companies, investors, data providers. We must continue to encourage companies to report fully and transparently on their scope 3, and where appropriate to integrate scope 3 targets into their decarbonization plans.

On the other hand, even complete scope 3 data will only ever be one indicator among many for analyzing the climate positioning of a company or portfolio. Climate analysis, in particular the assessment of a company or portfolio's alignment with the Paris Agreement objectives, will remain a far more complex and fundamental exercise than carbon data comparisons. This is the price to pay for a real ecological transition.

It's in investors' best interests to surround ourselves with experts!