At the end of the tunnel, yields, at last!

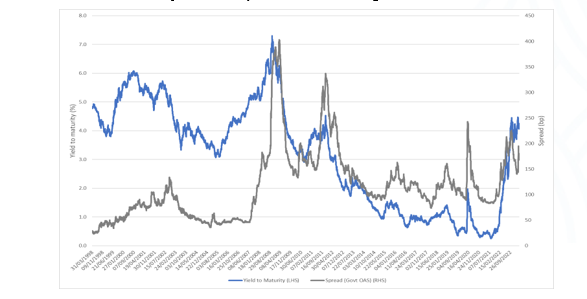

Bond investors did have a rough time in 2022. But a new era begun when central banks initiated their forced march of interest rates hikes, bringing some fresh opportunities to investors. With a current yield of 4.2%[1] and attractive spread levels (see graph), the euro investment grade credit market appears highly attractive in many aspects:

- in historical terms - this level was last seen in 2011;

- relative to other regions – for a European-based investor, euro investment grade credit is the first choice in terms of yield, compared to US, UK or Japanese peers hedged for currency risk; plus, it offers a higher level of diversification ;

- relative to other asset classes - corporate credit yield is above the equity dividend yield, for the first time in fifteen years, providing an attractive risk reward for the asset class.

At such levels, spreads are not fully pricing risks.

With its elevated levels of yields and spreads, investment grade credit looks attractive.

Source : Candriam, Bloomberg©, as at 31/03/ ICE BoA Euro Corporate Bond Index, yield to maturity (LHS) and spread (Govt OAS) (RHS). Past performance of a given financial instrument or index or an investment service or strategy, or simulations of past performance, or forecasts of future performance, do not predict future returns.

Not a straight road - proceed with caution

We believe that the asset class provides a material cushion in case of recession. Indeed, the road is not straight. Although it has been curved down, inflation remains relatively high. Over the past year, central banks’ interventions were more aggressive than ever, raising rates with a magnitude and a pace never seen before.

On the corporate side, the global economic slowdown is putting profit margins and cash flow generation under pressure. In tense financial conditions, corporates’ credit worthiness tends to deteriorate. Nevertheless, we expect some slightly brighter spots later in the year, as companies with healthy balance sheets manage to cope with the slowdown and offer positive earnings growth forecasts. In any case we will continue to see high dispersion both at sector and at issuer level, a favourable environment for active managers on the hunt for alpha generation opportunities.

Potential obstacles call for rigorous issuer selection.

A context of high dispersion requires rigorous issuer analysis to differentiate the potential winners from the weaker profiles. For the past fifteen years, we have put sustainability at the centre of our approach, because we believe that integrating ESG factors is essential to gain a full understanding of the risks and opportunities surrounding an issuer. Besides, Environment, Social and Governance factors have a material impact on issuers’ ability to meet their financial obligations. This is why our internal credit analysis includes not only a review of issuers’ financial health, operational performance and cash flow generation, but also a detailed study of their sustainability profile, at stakeholder level - what are the company’s relationships with stakeholders and how does this impact long-term value - and at business activity level - how is the company impacted by sustainability challenges. As a result, our portfolios only include issuers that have passed the liquidity risk and controversial activities filter, and that exhibit a superior ESG profile.

Credit analysis: taking the sustainable path is a sound decision.

In the recent turmoil of the banking sector, with the collapses of Silicon Valley Bank and Signature Bank in the US and Credit Suisse in Europe, central banks acted swiftly to avoid any contagion and restore market confidence. These events are a reminder of the importance of adopting a selective approach that does not rely on rating agencies alone, and that integrates ESG factors, especially the governance one, on top of purely financial analysis.

In May 2014, Credit Suisse became ineligible for our Candriam Sustainable investments, on the back of a poor score on the Governance factor. Our experience shows that poor governance has only negative impacts on company valuation and cost of capital, ultimately leading to negative outcomes. To us, this case is clear evidence of the validity of the risk mitigation power of a rigorous sustainable approach.

Read more on Candriam’s view on ESG in the banking industry

Seize the opportunities of integrating climate considerations in your credit portfolios !

A sustainable perspective is a compelling option at issuer selection level, but also at a broader scale. Climate ambitions have become part of companies, governments, regulators roadmap. The adoption of ambitious decarbonization targets by the European Central Bank (ECB), and the greening of its balance sheet, are clear signs of how seriously institutions are taking the matter - and should create market opportunities that we believe investors should embrace.

The ECB announced in October that, in a view to green its asset portfolio, it will take into account the issuers’ carbon footprint, environmental disclosure and, above all, decarbonisation targets, and favour the most ambitious issuers with the highest transparency at the expense of poor performers. It will also increase its exposure to green bonds, which should provide support to this market segment, whose size has quadrupled in five years[2].

Green lights for a sustainable euro investment grade strategy

In this volatile environment, where dispersion generates opportunities for active managers, we believe our active and sustainable approach to investment grade credit is relevant in many respects: to manage issuer risk and generate alpha, a well as to benefit from the opportunities offered by the ECB’s integration of climate imperatives into its portfolio.

Candriam Sustainable Bond Euro Corporate is rated 4 stars by Morningstar[3], with 1.513 billion euros in assets under management as at 28/02/2023. It currently holds 18% of green bonds and exceeds by far its carbon footprint reduction objective[4]. It is also classified article 9 according to the SFDR regulation.

Candriam’s approach to sustainable euro corporate bond investing was implemented over the past fifteen years by a closely-knit team of fifteen portfolio managers and analysts collaborating with twenty ESG experts.

In a nutshell, we believe our sustainable euro corporate strategy offers a compelling opportunity for investors looking to invest in the euro credit space.

All our investment strategies involve risk, including the risk of capital loss.

The main risks associated with Candriam Sustainable Bond Euro Corporate are:

- risk of capital loss,

- credit risk,

- interest rate risk,

- risk related to derivative financial instruments,

- liquidity risk

- ESG investment risk.

The non-financial objectives presented in this document are based upon the realization of assumptions made by Candriam. These assumptions are made according to Candriam’s ESG rating models, the implementation of which necessitates access to various quantitative as well as qualitative data, depending on the sector and the exact activities of a given company. The availability, quality and reliability of these data can vary, and therefore can affect Candriam’s ESG ratings. For more information on ESG investment risk, please refer to the Transparency Codes, or the prospectus if a fund.

This document is an advertising communication. Please refer to the fund prospectus and key information document before making an investment decision. This document is published for information purposes only. It does not constitute an offer to buy or sell financial instruments or financial advice and does not confirm any transaction, unless specifically agreed otherwise. Although Candriam carefully selects its data and sources, errors and omissions cannot be ruled out. Candriam cannot be held liable for any direct or indirect losses as a result of the use of this document. Candriam’s intellectual property rights must be respected at all times. The contents of this document may not be reproduced without prior approval in writing.

[1] ICE BoA Euro Corporate Bond index, source Bloomberg, 31/03/2023

[2] Green bond market size: $1600 billion as at February 2023, vs $400 billion as at December 2018, source Bloomberg

[3] © 2023 Morningstar, Inc. All rights reserved. The information contained here: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. For more detailed information about the Morningstar Rating, including its methodology, please go to: https://s21.q4cdn.com/198919461/files/doc_downloads/othe_disclosure_materials/MorningstarRatingforFunds.pdf The quality of the award won by the UCI or the management company depends on the quality of the issuing institution and that the award does not guarantee the future results of the UCI or management company.

[4]The strategy is actively managed, its benchmark is the iBoxx EUR Corporates index. The strategy aims to reach a carbon footprint 30% below the benchmark’s (scope 1&2). Carbon footprint reduction is 62% compared to benchmark as at end February 2023. The Sub-Fund aims to enable shareholders to benefit from the growth of euro denominated corporate bonds markets, with an investment in securities selected by the portfolio management team on a discretionary basis, and to outperform the benchmark. The selection is based on the securities characteristics, growth prospects and proprietary analysis of ESG criteria.