Grey swan is an event that is possible and known, potentially extremely significant but considered not very likely to happen.

Grey swan is an event that is possible and known, potentially extremely significant but considered not very likely to happen.

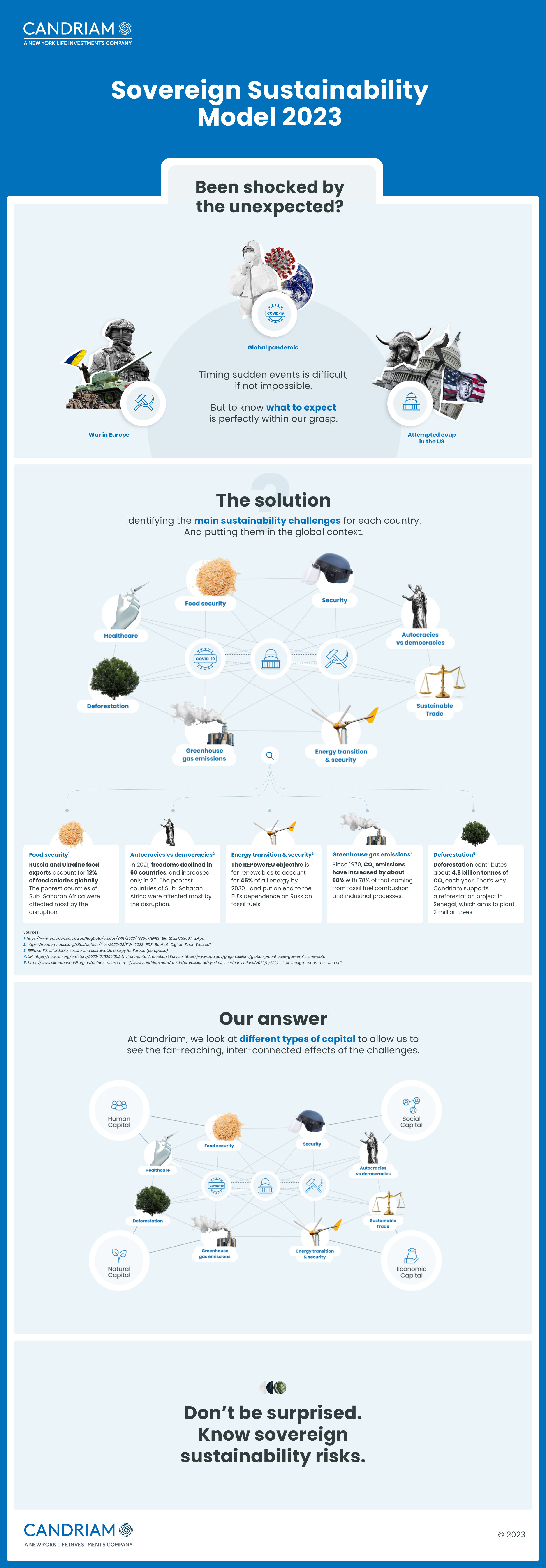

A succession of grey swans has brought in a market environment full of new challenges, impacting countries rich and poor. All this while the world must urgently address the climate emergency. And that can only be achieved through a major transformation of the global economy.

How ready countries are to deal with sustainability challenges will inevitably affect their ability to repay debt. But that is only half of the story. Without governments pulling together, nothing will be solved. Sovereign investors can support them in their crucial role – by investing with those sovereign issuers that take sustainability seriously.

Our Sovereign Sustainability framework is designed to help identify such countries. Read our latest Report to check out our sustainability rankings of countries and discover what we believe are today’s biggest themes for each of the four types of capital -natural, human, social and economic – and how they are interconnected:

Get information faster with a single click