Policy clarity, solid fundamentals, and attractive valuations

On Tuesday, September 30, the pharmaceutical industry issued its first formal response to President Trump’s recent letter on drug pricing, announcing a deal between Pfizer and the US administration. The outcome is favourable for biopharma, biotechnology, and related life science sectors, with equity markets reacting positively.

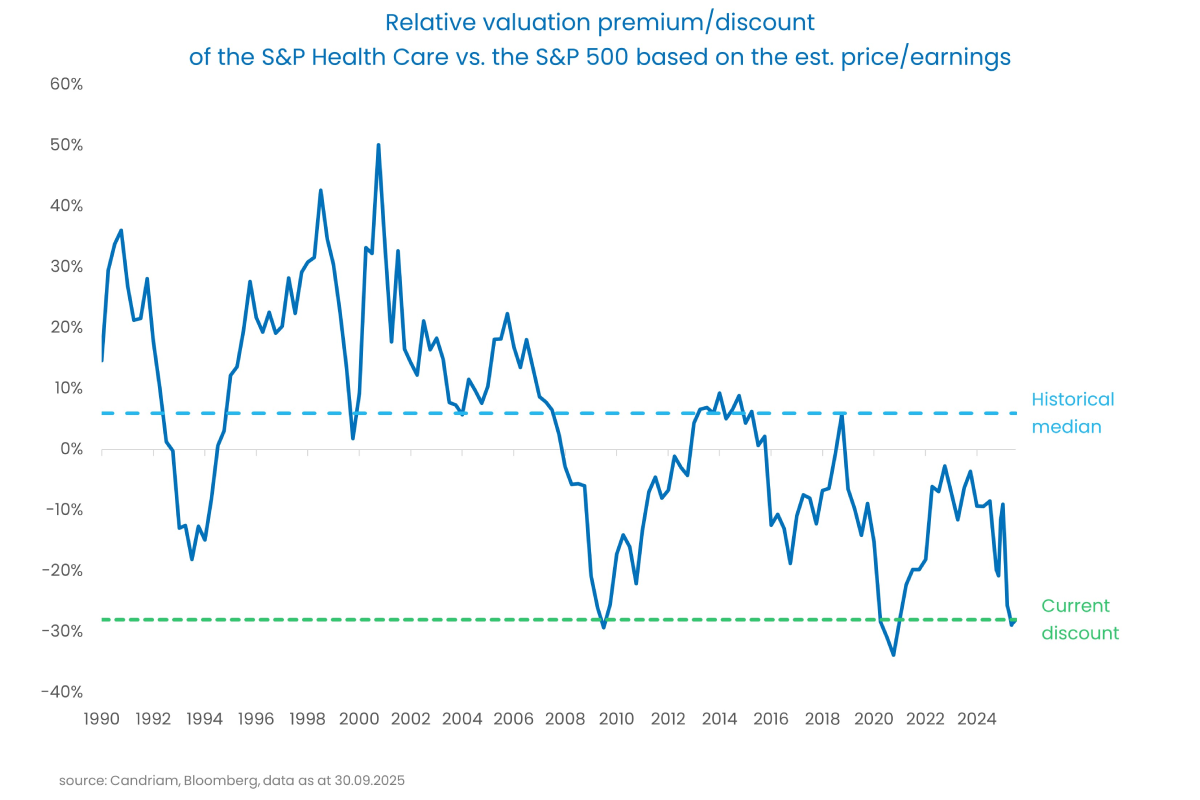

The healthcare sector is now trading near 35-year lows in relative valuations, while its weight in the S&P 500 has fallen to a 24-year low. This creates meaningful room for sustained momentum in a sector that remains heavily under-owned.

With that announcement the overhangs for the sector are now largely cleared. A short recap:

- The U.S Food and Drug administration (FDA )remains operational during the shutdown.

- M&A activity is strong and in our view, likely to accelerate.

- Interest rates are trending lower.

- Tariff risks are being reduced by manufacturer commitments to invest in the US.

- The Pfizer–US administration drug pricing agreement offers a workable template for the industry.

We believe these developments provide an interesting entry point for healthcare strategies, with investor focus shifting back to fundamentals.

In biotechnology, we see the beginning of a new growth cycle, as a wave of mid-cap companies approaches large-cap scale. Oncology remains well-positioned to benefit from regulatory momentum, with exposure across pharma, biotech, and life science tools and services — the “picks and shovels” of biomedical research.

Appendix Pfizer

For those who want to go into the details, please find some background on the Pfizer deal.

In late July, President Trump’s letter to pharmaceutical companies requested:

- Most Favoured Nation (MFN) pricing for Medicaid.

- MFN pricing guarantees for newly launched drugs.

- Repatriation of international revenues to benefit American patients and taxpayers.

- Direct purchasing at MFN pricing levels.

The financial effect is negligible:

- Medicaid exposure is limited and already subject to steep discounts.

- Most drugs will still flow through insurers, not direct consumer purchases.

- For new launches, ex-US markets must either accept higher pricing or risk delayed access.

- Importantly, this removes significant overhangs: pricing risk and tariff discussions are now largely off the table.

Where do we go from here? Negotiations are ongoing with the broader sector, with Eli Lilly likely to be the next mover.

- Companies with larger Medicaid exposure could face a marginally greater impact. However, Medicaid pricing is already heavily discounted, limiting the downside.

- Sector-wide, this marks a decisive positive catalyst, reducing regulatory uncertainty and improving visibility.

[1] A new government-run website with Pfizer as its first partner, offering select drugs at discounts direct to consumer.