As it has over the past 2 years, credit remains an asset class of choice for global fixed income investors. The combination of enduringly sound fundamentals, powerful technical forces, and generous yields has rendered credit a rare anchor of stability in a world still wrestling with volatility and policy uncertainty.

Quality Upgrades and Strong Demand Reinforce Credit Stability

Investment-grade corporates continue to display prudent financial discipline, with leverage contained, cash-flow generation steady, and rating momentum trending upward. Within high yield too, default rates remain contained, downgrades modest, and quality migration positive. Roughly three-fifths of the euro high-yield universe now sits in the BB category[1], underscoring a clear gravitation toward stronger balance sheets. Technical conditions have amplified this resilience. Flows into credit have been vigorous and broad-based, extending well beyond dedicated managers to multi-asset allocators seeking durable income. The rise of ETFs has transformed market dynamics, providing a new and deep source of liquidity across both investment-grade and high-yield segments. Despite heavy issuance, absorption capacity has been remarkable — a reflection of investors’ faith in the asset class. Meanwhile, yields continue to play a decisive role in sustaining this enthusiasm. With euro investment grade yielding close to three per cent and euro high yield around five[2], the carry remains enticing. These levels not only provide income but also cushion portfolios against moderate spread widening. Such robustness has inevitably invited the question: might credit now be the new safe haven?

Credit Approaches Its Turning Point

Yet the notion of credit as an unequivocal refuge merits closer scrutiny. The attributes that currently underpin its strength also betray the characteristics of a market approaching the twilight of its expansion. Record inflows, historically tight spreads and a strikingly low degree of dispersion together suggest a phase of exuberance typical of late-cycle dynamics. The signs are familiar: investor confidence verging on complacency, cyclical sectors outperforming despite mounting macro uncertainty, and single-name shocks beginning to puncture the calm. Even within investment grade, a handful of idiosyncratic incidents — including unexpected downgrades and liquidity stresses among smaller issuers — remind us that quality is not uniformly robust.

From a cyclical perspective, we appear to be in the final leg of the expansionary credit phase. History teaches that the passage from late-cycle complacency to correction is often abrupt. This does not imply an imminent collapse, but rather a heightened sensitivity to shocks. The seeds of the next adjustment are already visible. A surge in prospective issuance is one. Mergers and acquisitions are accelerating, particularly as large corporates pursue artificial-intelligence-related investments that demand significant funding. Simultaneously, the high-yield universe faces a looming maturity wall in 2026 and 2027, forcing issuers to refinance at a higher cost than done previously (in 2020-2021). The resultant increase in supply may weigh on valuations and test the depth of investor demand.

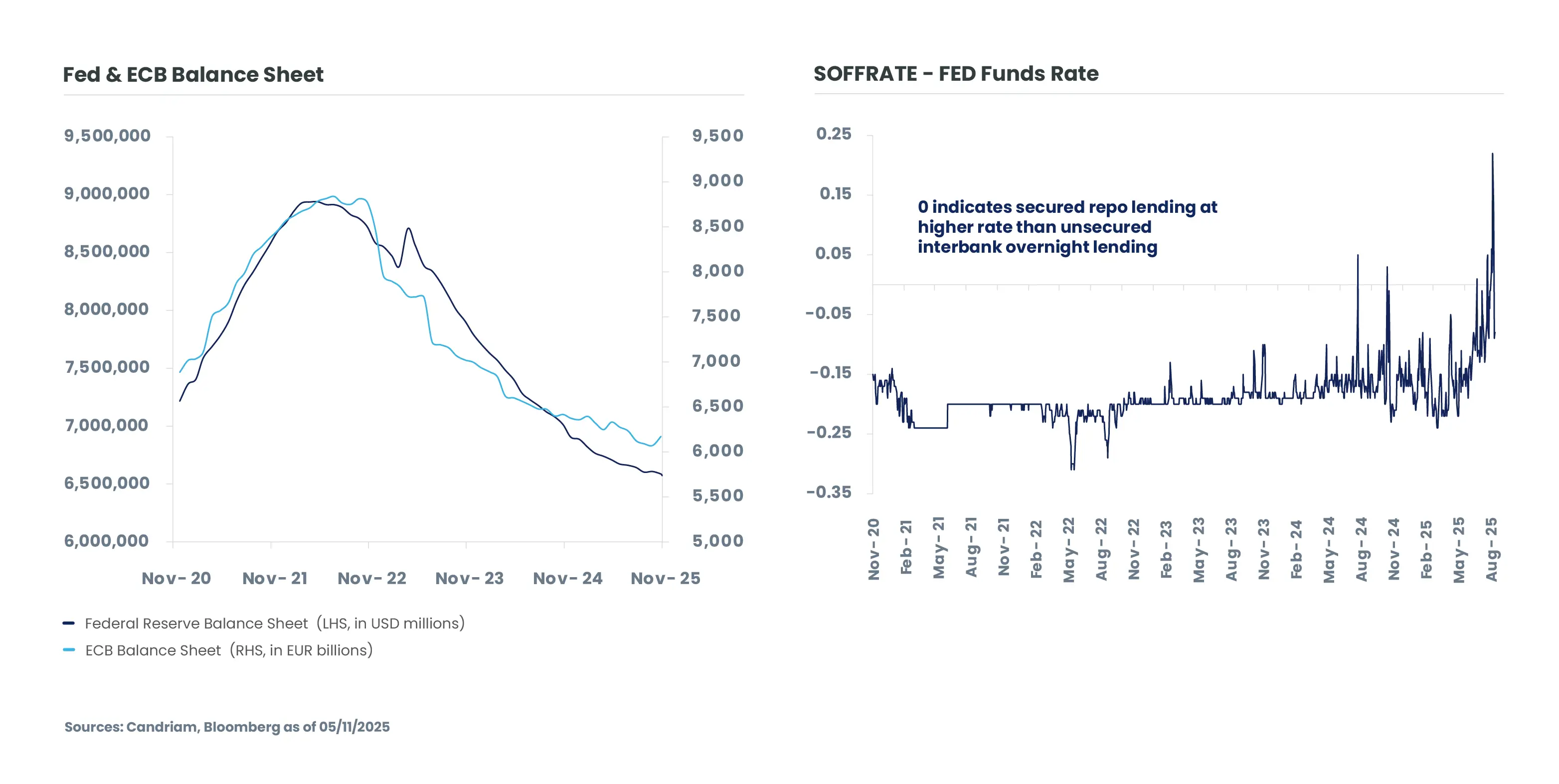

Liquidity represents another subtle vulnerability. Central-bank balance sheets have contracted materially since their pandemic peaks. While further quantitative tightening appears unlikely, the cumulative effect of prior reductions is beginning to manifest in funding markets, as evidenced by the widening gap between the Secured Overnight Financing Rate and the Federal Funds rate. This divergence signals that some institutions are finding liquidity harder to source, a development that could prove challenging for smaller or weaker issuers. The liquidity that once acted as a universal backstop is now more discriminating.

The third pressure point lies in the gradual repricing of debt. The refinancing wave ahead will occur in a world of higher rates than the benign era of 2020–2021, when capital was virtually costless. For many companies, the transition from three-per-cent coupons to six- or seven-per-cent refinancing will compress interest-coverage ratios and narrow financial flexibility. Strong, cash-rich issuers will adapt; those with fragile margins and heavy maturities may find themselves confronting harsher realities. This divergence heralds a future in which credit outcomes are increasingly idiosyncratic.

Widening dispersion calls for issuer selectivity

In that sense, credit’s next chapter will not be defined by a uniform weakening but by widening dispersion. Some sectors — notably those with pricing power, solid governance, structural demand and prudent balance-sheet management — will continue to perform. Others, exposed to cyclical consumption, thin liquidity, heavy capex or aggressive leverage, will find the ground less firm beneath their feet. The skill now lies in discrimination: understanding which balance sheets can weather a world of constrained liquidity and higher real rates, and which cannot.

Thus, while we retain a positive stance on credit as an asset class, the emphasis must shift from participation to preparation. The late stages of a credit cycle might not necessarily reward selectivity and prudence — but they require them. History shows that the transition from exuberance to downturn rarely unfolds gradually; it tends instead to arrive suddenly, sharply, and without warning. Once it begins, the window for adjustment closes swiftly. This is why investors cannot wait for the inflection point to become obvious. Preparation must precede prediction. Now is the time to be discerning, to tighten the focus on balance-sheet resilience, liquidity strength, and management quality. Being selective, active, and prudent is no longer a tactical choice but a strategic necessity. Those who act early, before the turn becomes visible, will be best positioned to navigate the turbulence when complacency gives way to correction.

Credit at a Crossroads

Credit may yet serve as a safe harbour in turbulent seas, but it is no longer a tranquil one. The conditions that have supported it thus far — strong fundamentals, steady flows, and attractive carry — remain largely in place. What changes now is the character of the journey: from the broad tide that lifted all boats to a subtler navigation that rewards discernment. The last lap of the credit cycle invites not complacency but composure, not withdrawal but watchfulness. It is, in essence, a time to prepare rather than to predict — and to remember that even the most solid foundations can conceal fine but meaningful cracks.

[1] Source: Bloomberg, ICE BoA Euro High yield index, end November 2025

[2] Sources: Bloomberg, ICE BofA Euro Corporate and ICE BofA Euro High Yield indices, end November 2025