The European Long-Term Investment Fund (ELTIF) is a transformative solution that gives investors access to private assets once reserved for institutions or high net worth individuals. Designed to support the real economy, ELTIFs offer a compelling way to diversify your portfolio while contributing to the economic growth.

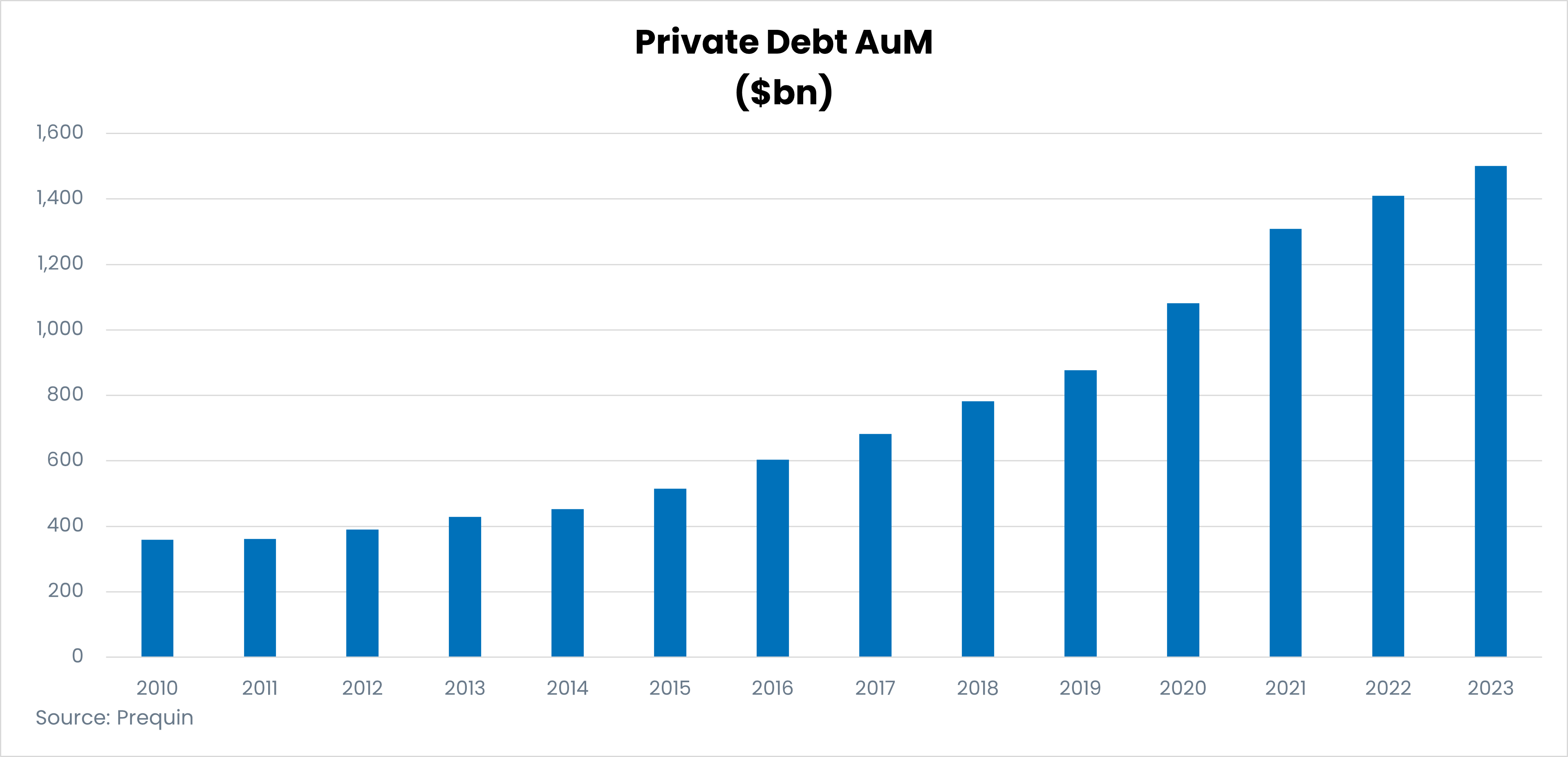

Private debt, a growing segment of the private market, accounts for over 11% of total private market assets and is forecast to grow at an annual rate of 11.1% between 2022 and 2028[1]. As banks cut back on lending due to tighter regulation, private debt has emerged as an important alternative source of capital for businesses.

Why ELTIF is Ideal for Private Debt Investments

- Lower barriers to entry: You can access private markets starting with a small investment.

- Liquidity options: Semi-liquid structure with quarterly subscriptions/redemptions, and fully paid-in subscription unlike most private market investments.

- Regulatory oversight: Provides transparency and greater investor protection.

- Regular distributions: Based on regular interest payments on the loans, you can expect more predictable returns with steady income distributions.

Why Candriam for ELTIF?

In partnership with Kartesia, a recognised leader in private debt, Candriam developed a unique strategy tailored to the financing of pan-European SMEs (Small and medium-sized enterprises) and ETIs (Intermediate-sized company) - key drivers of local economic development. This strategy offers:

- Attractive potential returns: A net annual return target of 8-9%[2], supported by secured loans with strong guarantees and a disciplined investment framework.

- Strategic diversification: Gain exposure to a diverse portfolio mix of senior loans and opportunistic strategies across sectors, geographies, and lower middle market companies that drive innovation and economic growth.

- Integrated ESG approach: Invest in projects that meet rigorous environmental, social and governance (ESG) criteria, to create a positive and lasting impact, in line with Candriam's commitment to ESG principles.

- Expert management: Benefit from the deep expertise of our experienced team, backed by a rigorous investment process and market insight.

- Support for local economies: Invest in a solution that works directly with SMEs across Europe through sponsor-less transactions, building long-term relationships, ensuring robust due diligence and providing tailored finance to drive growth, create jobs and boost local economies.

Key advantages of the lower middle market

Large Market Size

What it means

There are plenty of potential investment opportunities to choose from.

Why it matters

More opportunities mean a better chance of picking the best deals available at that time, which can help grow investments.

Risk Management

What it means

The stragey focuses on deals that potentially reduce risk by prioritizing safer, first-position loans.

Why it matters

This strategy seeks to minimize the chance of losses, even in uncertain market conditions.

Defensive approach

What it means

The strategy ensures that each deal has strong legal terms that aims to protect the investment.

Why it matters

This means that if someting goes wrong, investors may potentially be in a stronger position to recover value.

Direct Access to Companies

What it means

Kartesia works closely with the companies it invests in, often taking a seat on the board

Why it matters

Close involvement allows Kartesia to help steer companies in the right direction and address any challenges at an early stage.

Discover the Power of Private Debt

Private debt is a distinct asset class offering:

- Stable income: Enjoy predictable interest payments to add value to your portfolio.

- Reduced volatility: Protect your investments from the volatility of public markets.

- Real impact: Directly support the growth of European businesses, driving innovation and local economic development.

Your Path to Financial Growth

Candriam's ELTIF strategy allows to

- Improve portfolio diversification: Access private wealth for a balanced and resilient investment strategy.

- Contribute to economic growth: Play a role in financing Europe's small and medium-sized enterprises, the lifeblood of the economy.

- Rely on expert management: Trust our experienced team to navigate complex markets and deliver value.

Contact us today

RISKS

All investments involve risks, including the risk of loss of capital.

The main risks associated with investing in Candriam’s ELTIF strategy are: Risk of capital loss, Credit risk, Interest rate risk, Operational risk, Sustainability risk, Currency risk, Arbitrage risk. Investors should be aware of other risks related to investments in Private Credit such as risk relating to investments in debt instruments, Senior secured loans, Debt instruments secured on tangible assets, Performance of portfolio companies, Terms of investments, Reliance on monitoring and management of debtor companies, Risks associated with debt instruments linked to LBO transactions.

An investment in this strategy, requires a long term commitment with no certainty of return and may not be suitable for Retail Investors that are unable to sustain a long-term and illiquid commitment.