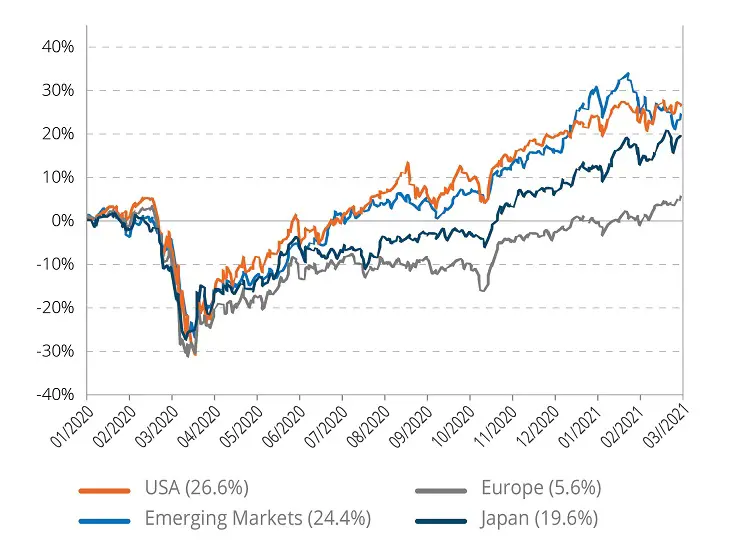

Many equity indices are at all-time highs. This is the case of the US S&P 500 index, up 26% since January 2020, the MSCI Emerging Markets index, up 24%[1], and even the Japanese Nikkei index, which has reached its price level of early 1989! Looking at these figures and graphs, the health crisis seems to be well behind us. This is what has been making investors feel uncomfortable for many months, as the financial markets seem to be getting ahead of our daily reality. We have since found some rational explanations for this market behaviour. The composition of stock market indices only imperfectly reflects the economic fabric around us. The US stock market index is a symbol of this, with a historically high concentration of mega-caps , mostly linked to the technology sector, which has benefited from the COVID crisis. The strong performance of risky assets can also be explained by the unprecedented monetary and fiscal support that has made most of the major economies resilient and limited the number of bankruptcies. The impact of the second and third waves of the epidemic is much less economically significant than that of the first, particularly on the manufacturing sector, which continues to expand everywhere.

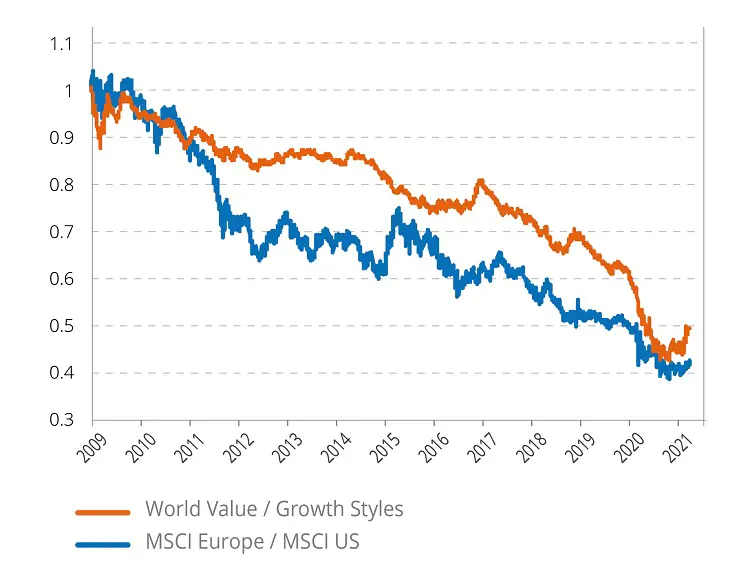

The announcement of the remarkable efficacy of RNA vaccines in November 2020 and the start of vaccination campaigns has given a new impetus to the riskiest assets: equities and commodities. In just a few months, much of the performance gap has been closed between "cyclicals" and "defensives" and then "value" and "growth". Is the catch-up behind us? Is the reopening of our economies already priced in? Historical observation shows us that, as long as we are in a phase of economic recovery, accompanied by rising interest rates, we should continue to favour cyclical and value stocks. Their earnings-per-share momentum will start to accelerate and far outpace the more defensive and growth part of the market. Financial markets are anticipating the economic recovery, but it has not really started, especially in Europe... The exuberance we have seen in certain assets since March 2020 in a context of excess liquidity may now affect the more traditional value and cyclical sectors, which will benefit fully from the consumer boom expected in the coming months. The price of bitcoin has increased sixfold since March 2020, the price of Tesla equities has increased tenfold, and the price of copper has doubled, to name but a few examples. It is reasonable to expect some surprises, as the economic recovery is expected to be strong and rapid. Inflation and interest rates may temporarily exceed the expectations of a relatively cautious consensus and lead to a much stronger outperformance of assets/regions/sectors that traditionally benefit from them. Europe remains a good choice in this context, as do the banking and commodity-related sectors.

What risks will we face? For us, they are of two kinds. In the short term, the race between vaccination and new viral strains is not yet won. Further lockdowns will slow down the economic recovery and may produce temporary disappointments in economic figures. The main risk identified today is that of expectations of an exit – within the next 6 months – from monetary and fiscal support.. The credibility of central banks and the control of rate hikes are essential to enter a more normalised growth phase in 2022 without too much volatility. Similarly, the financing of economic support schemes will come back into the debate more intensively once we have emerged from this long tunnel of imposed restrictions. We need to keep the trajectory in mind and withstand the volatile phases we are bound to experience in the coming weeks.

[1] Data as at 30/03, source : Bloomberg