Our main convictions for H2 2019 were confirmed over the summer, when geopolitical uncertainty caused economic growth to slow down (without triggering a recession) and markets experienced higher volatility (without causing a negative equity year). Beyond the equity vs. bond asset allocation, our main investment conclusion in this context involves adding portfolio hedges through de-correlated assets. We explain why we have added exposure to gold in recent weeks.

First, the historical evolution of the price of gold shows an increase when equity markets drop (and volatility rises) and when real interest rates fall. Hence it is possible to further hedge the portfolio via exposure to gold. Currently, this makes sense, as it is unprecedented in the post-WWII era for the world’s two biggest economies to be locked in a trade and currency (and wider) fight. In addition to these tensions, other geopolitical issues (e.g. Hong Kong, Iran, Brexit) are still part of an unresolved number of current affairs whose outcome could tip the scales from an expected soft landing to a hard landing.

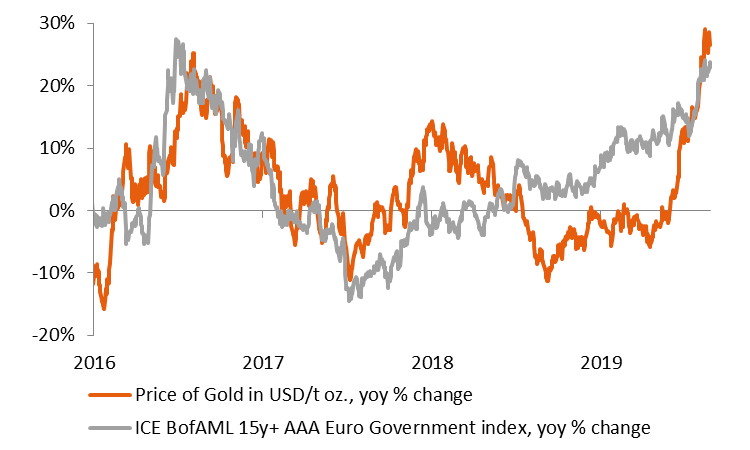

Second, as the investment world faces negative yields on over a quarter of outstanding investment-grade bonds and on additional monetary easing, there is no longer an opportunity cost in holding exposure to gold. A major setback of precious metals as an asset class is the absence of yield, such as dividends for equity holders and coupons for bondholders. The latter has become less relevant, as buying and holding to maturity nowadays could mean investing in assets guaranteed to lose. As the recent performance of gold has been linked to AAA-rated, long-duration bonds whose yield has fallen below zero, the relative attractiveness of this precious metal is shining through.

Finally, financial investors appear to be key marginal buyers of gold. If they start buying gold, it will positively impact demand for the commodity and therefore prices. On the other hand, outflows may have a negative impact. Overall, this is reflected in the volatility of the precious metal. The month of August has shown that short-term occurrences have made gold vulnerable to a pullback. However, on a longer-term perspective, the underlying fundamental drivers appear intact.

The recent performance of gold has been linked to AAA-rated, long-duration bonds in the Euro zone