Immunotherapy has recently revolutionised the way we treat cancer. Engaging the immune system to fight tumours has proven to be less toxic, more specific and more efficacious than traditional treatments such as chemo- or radiotherapy. Currently, one of the most promising therapeutic options is called CAR-T cell therapy and provides a transformative way to fight a complex disease such as cancer.

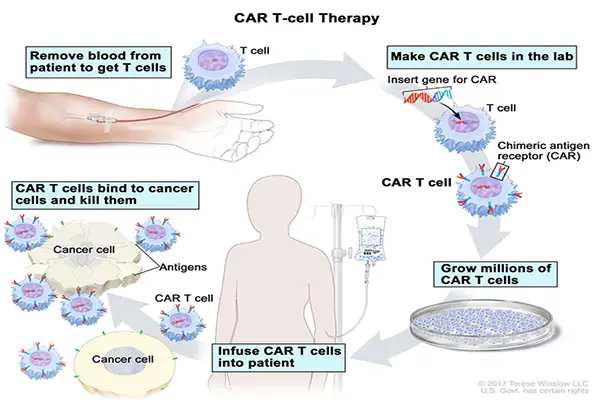

CAR-T cells are made of T cells – an integral part of our immune system. T cells can originate either from a patient’s own body (further called “autologous” therapies - two FDA-approved products) or from a healthy donor (“allogeneic” therapies - currently in the phase of preclinical and clinical development). To perform their anti-cancer function, the cells must be “equipped” with a chimeric antigen receptor (CAR) to better detect and kill cancerous cells. This modification takes place in the specialised laboratories where the genetic code of living T cells is engineered to express the CAR. Afterwards the CAR-T cells are ready to be infused (back) into the patient’s body where they fight the cancer.

Are CAR-T cells truly a revolution that will forever change the way we treat cancer? Although their development is currently booming, there are still multiple challenges that need to be addressed for successful general implementation of these therapies. The limitations of current technologies include high manufacturing cost and logistic hurdles of available autologous therapies. Will allogeneic, or so-called off-the-shelf CAR-T cell therapies present a more accessible and cost-effective treatment option?Science and history

T cells are part of the immune system specialised in killing the infected, cancerous or damaged cells[1] . Unfortunately, cancer cells can sometimes hide from our immune system, leading to a failure of the innate surveillance mechanisms. Scientists came up with an idea of fine-tuning T cells to enable them to seek and destroy cancerous cells more efficiently – it can be done by supplying T cells with a genetically encoded weapon: chimeric antigen receptor (CAR). CARs are designed to perform a double function: to bind specific biomarkers (antigens) on the cancerous cells and to switch on the cancer-killing mechanisms.

“…up to 90% of leukaemia patients achieved complete and durable disease remission ...”

It took several decades to advance this innovative idea from the laboratory to the patient’s bedside: the concept of externally modifying patients’ own immune cells to enhance their cancer-fighting properties was first described 30 years ago[2] . Amazing success of CAR-T technology came in 2015 when in some of the clinical trials up to 90% of leukaemia patients achieved complete and durable disease remission[3] [4] . From that moment on, the amount of research and clinical studies investigating this type of therapy has been growing exponentially; to the end of May a total number of 293 active CAR-T trials have been registered worldwide[5] , compared to 152 in 2017[6] . In 2018 two of the therapies were approved for treating leukaemia and lymphoma patients in USA and in Europe: Gilead Sciences’ Yescarta and Novartis’s Kymriah (recently also approved in Japan, making it the only CAR-T cell therapy available in Asia)[7] . Both Yescarta and Kymriah use patient’s own cells to manufacture the therapeutic product.

CAR T-CELL THERAPY (https://www.cancer.gov/types/leukemia/patient/child-all-treatment-pdq)/

CAR-T cells are made by inserting a gene into the T cell. This gene encodes the chimeric antigen receptor: CAR – a small synthetic protein which from now on will be produced by the cell to decorate its surface. The function of CAR is to bind a specific biomarker (known as an antigen) on the cancerous cell. After binding to the cancer antigen, CAR-T cell is activated by the portion of CAR that projects to the inside of the T-cell and switches the cancer-killing mechanisms.

Challenging production and complicated logitics

The production process of this personalized treatment includes the collection of the patient’s own white blood cells, separating the T cells, shipping them to the specialized manufacturing facility (where they are modified with CAR), growing modified T cells to achieve sufficient therapeutic dose, shipping the prepared product back to the hospital and finally administration of it back to the patient. The whole process should take approximately 3 weeks and involves two rounds of complicated cold-chain logistics. To ensure the maximal survival of the cells, they need to be kept frozen; to ensure they come back to the same patient, the strict chain of identity must be maintained[8] . Taking into account that this therapy is used mainly in patients who already relapsed on previous lines of treatment - time is precious. The so-called therapeutic window might be missed due to rapid disease progression. Moreover, in some cases the condition of the patient (and the condition of their T cells) does not allow for, or compromises, successful production of the treatment. For example, in clinical trials preceding the approval of Yescarta, one out of 111 patients did not receive the product due to manufacturing failure. Nine other patients were not treated, due to progressive disease or serious complications following collection of their cells[9] . Overall, the logistics of CAR-T cells is lengthy, complicated and on top of that extremely expensive. Also, the quality of the final product is hard to control: as each patient is different, so are their T cells and derivative CAR-T cells. The patients that provide the starting material for autologous cell therapies have various medical histories, different stages of their disease and distinct genetic backgrounds. All these factors contribute to the upstream complications of the production process. Effectively, this setup is remarkably different to a standard, well defined manufacturing process.

“Traditional drug pricing model might be difficult to justify in case of highly variable product that originates from the patient.”

The price issues

A traditional drug-pricing model, which reflects research and development, manufacturing and logistics expenditure might be difficult to justify in the case of highly variable product that originates from the patient. On the other hand, an outcome-based pricing model could be used, with the drug price reflecting the provided benefit rather that relating to development and manufacturing cost. However, using this kind of pricing system is somewhat dangerous in the case of drugs that are indispensable: as CAR-T cells are often used as a last line of therapy, we might end up estimating the price of human life[10] . Still, the investments undertaken by the pharma companies are huge: Novartis spent more than $1 bn since 2012 on bringing Kymriah to the market and Gilead paid almost $12 bn to acquire Kite Pharma, which developed Yescarta. Although it had been briefly suggested by Novartis that only the patients who respond to the therapy within the first month of treatment will be charged the full price of Kymriah, this idea was dropped[11] . Gilead’s Yescarta costs $373,000 per patient, whereas Novartis’ Kymriah has a price tag of $475,000. In 2018 Yescarta sales were $264 M. First quarter of 2019 brought $96 M of revenue, slightly below consensus of $105M. 2018 Kymriah sales came in at $76 M, and first quarter of 2019 was $45 M[12] . Due to their high price, both therapies face some resistance from the approving authorities and insurance companies. Accordingly, all the efforts to bring the manufacturing costs down will have a positive impact on the accessibility of the CAR-T therapies.

Healthy donors are part of the solution...

A great deal of the problems described above could be solved by allogeneic therapies, which instead of patients’ own cells, use the material from healthy, unrelated donors. Better availability of healthy donor cells creates a unique opportunity to pick and choose only the T cells that are perfectly suited for fighting cancer – which is not an option in the setting where the therapeutic product is derived from the patient and potentially lifesaving cells are scarce. Moreover, in contrast to the autologous CAR-T approach where the therapeutic outcome relies on a single treatment dose, off-the-shelf CAR-Ts could provide the flexibility of repeated dosing. Using healthy donors’ cells could also improve the quality and safety of the final product. On top of that, the high cost of cold-chain logistics, often spanning continents, could be theoretically halved, as the CAR-equipped, donor-derived cells would be transported only one way: from the manufacturing facility to the hospital. A more cost-effective manufacturing and delivery process would likely contribute to lowering the prices and better affordability, leading to less resistance from the reimbursement companies and finally greater access for the patients.

...but new challenges emerge

While treating cancer patients with the healthy donors’ cells opens up multiple opportunities of saving more lives, nonetheless it presents great uncertainties and risk as well. The first thing that one could think of is the similarity of the procedure to the transplant, e.g. bone marrow stem cells transplant, where both donor and receiver must be strictly matched to avoid graft-versus-host disease. Graft-versus-host disease (GvHD) occurs when mismatched transplanted CAR-T cells attack not only cancer but all other cells in the organism of the host (patient). At the same time the immune system of the patient might attack the foreign cells and destroy them before they destroy the cancer. This process is called host-versus-graft disease (HvGD). There are several ways to tackle these problems, e.g. matching donors and receivers[13] . Unfortunately, because of the high degree of diversity between both the patients and the potential donors, this strategy seems to be too time-consuming to be of practical use. Luckily, scientists found another way around this obstacle. As mentioned before, in the production of CAR-T cells, both autologous and allogeneic, adding a chimeric cancer-binding protein to the surface of the cell is the most important step. The cells of a third-party donor do need extra modifications which can be done using gene-editing techniques[14] . For example, to render donor cells safe for the patient and avoid GvHD, a molecule called TCR can be removed from the cell-surface. Furthermore, to prevent HvGD, the foreign cells must be hidden from patient’s immune system. To achieve this goal, several strategies can be employed, e.g. lowering the level of a protein called β2M. Off course including these modifications is not an easy task. Nonetheless, thanks to the efforts of numerous scientists, it is already possible.

The competitive landscape and expected eventful end of the year

Despite all the new challenges, off-the-shelf CAR-T therapies are being widely developed. The increased interest in the donor-derived therapies is already reflected in the statistics of cold-chain supply companies. Cryoport is one of the leading companies in the logistics of temperature-sensitive materials such as living cell medicines. In the first quarter of 2019, more than 30% of its services were provided for clinical trials testing allogeneic therapies.

“Despite all the new challenges, off-the-shelf CAR-T therapies are being widely developed.”

The first clinical trial of allogeneic therapy for relapsed/refractory acute lymphoblastic leukaemia was conducted by Cellectis and provided somewhat mixed results. On one hand, the outcomes were very encouraging, as the majority of the treated patients positively responded to the therapy. On the other hand, two patients have died from therapeutic toxicity[15] . The Cellectis’ program of allogeneic CAR-T, in addition to the portfolio of preclinical cell therapy assets from Pfizer, is now being developed by Allogene in collaboration with Servier. Allogene has been formed by two of Kite Pharma’s former executives who left Gilead. Next year, Allogene should report initial results of the treatment of acute lymphoblastic leukaemia, whereas the clinical trial of relapsed/refractory non-Hodgkin lymphoma has been recently initiated. Cellectis is advancing three other allogeneic clinical stage CAR-T product candidates: each one of them targets different type of cancer via selected tumour antigen. Meaningful data updates are expected by the end of this year. In November 2018 Celyad announced the injection of the first patient with its alloSHRINK CYAD-101 therapeutic product for unresectable metastatic colorectal cancer. CYAD-101 originates from the company’s former collaboration with Japanese ONO Pharmaceutical, which currently works with Fate Therapeutics to develop two new off-the-shelf cell products. What significantly differentiates Fate’s preclinical project from all the other CAR-T therapies is the attempt to use induced pluripotent stem cells instead of donor-derived cells. Precision Biosciences’ allogeneic drug candidate for relapsed/refractory non-Hodgkin lymphoma and B-cell acute lymphoblastic leukaemia was introduced into the clinic in April. First outcomes are expected by the end of 2019 or at the beginning of 2020. A gene-editing company, CRISPR Therapeutics AG, will start clinical trials of its CTX110 CD19 allo-CAR-T program this year. Its competitor, Editas Medicine, also focuses on developing allogeneic cell medicines for cancer. Gilead collaborates with Sangamo on KITE-037, the project that is about to enter the clinic in 2020. ATARA Biosciences, which works on allogeneic T-cell immunotherapies targeting viral infections and cancers consequential to viral infections, also has four CAR-T projects in their preclinical pipeline.

The number of innovations in immunotherapy keeps growing as more and more healthcare companies take up the fight against cancer. Currently there are approximately 140 companies worldwide with at least one CAR-T focused therapeutic program[16] . Also, multiple companies are working specifically on off-the-shelf CAR-T cells in the laboratory and in the clinic. At Candriam we see our role as supporting the most promising developments. We are carefully monitoring the field and following all the technological advances. Our deep analysis includes careful assessment of the innovative technologies and understanding their potential impact on the share price of the companies which develop them. Supporting the most dynamic companies in this sector is the aim of the Candriam oncology strategy.

[1] https://www.nature.com/subjects/cytotoxic-t-cells

[2] https://www.ncbi.nlm.nih.gov/pmc/articles/PMC298636/

[3] http://embomolmed.embopress.org/content/early/2017/07/31/emmm.201607485.long#DC4

[4] https://www.ncbi.nlm.nih.gov/pubmed/25317870?dopt=Abstract

[5] https://clinicaltrials.gov

[6] https://celltrials.org/public-cells-data/all-car-t-trials-cumulative-through-end-2017/56

[7] https://www.novartis.com/news/media-releases/kymriahr-tisagenlecleucel-first-class-car-t-therapy-from-novartis-receives-second-fda-approval-treat-appropriate-rr-patients-large-b-cell-lymphoma

[8] https://www.biopharmadive.com/news/car-t-supply-chain-cell-therapy-challenges-pharma/521560/

[9] https://www.yescarta.com/files/yescarta-pi.pdf

[10] https://www.europeancancerleagues.org/wp-content/uploads/2018/06/CAR-T-ECL-Article_Final_20062018.pdf

[11] https://cancerworld.net/cutting-edge/the-car-t-cell-revolution-what-does-it-offer-and-can-we-afford-it/

[12] https://www.evaluate.com/vantage/articles/news/corporate-strategy/novartis-hopes-kymriah-acceleration-can-save-its-car

[13] https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5088751/

[14] https://www.ncbi.nlm.nih.gov/pubmed/30735463

[15] https://servier.com/wp-content/uploads/2018/12/PR_Servier-Allogene_ASH2018.pdf

[16] education session entitled “Driving CARs in Aggressive Lymphoma” at ASCO Annual Meeting 2019, May 31 - Jun 4, 2019