Last week in a nutshell

- Political tectonic plates have shifted after a landslide victory for the UK Labour Party and a hung parliament in France.

- The U.S. economy added 206K jobs in June, but as downside revisions are playing a large role each month, employment growth appears to be slowing.

- The FOMC Minutes showed some disagreement, with a few members suggesting rate hikes due to slow progress towards the 2% inflation goal.

- Ongoing expansion in the Euro Zone services sector was unable to offset the continued contraction in manufacturing as witnessed by the PMI’s.

What’s next?

- In addition to the start of the Q2 earnings season, the US consumer will remain in the spotlight with publications on the CPI and preliminary sentiment survey results.

- U.S. Federal Reserve Chair Jerome Powell will give his semi-annual monetary policy testimony to the Senate Banking and House Financial Services Committees.

- UK GDP data and inflation reports from the Euro Area, Japan, and China, along with China's trade balance, imports, and exports, will be published.

- India’s Prime Minister Modi will meet President Putin in his first trip to Russia since the start of the war in Ukraine while the annual NATO summit will take place in Washington DC.

Investment convictions

Core scenario

- Facing a rise in political uncertainty, a higher risk premium appears justified in continental Europe. In the US, the hawkish repricing of the monetary policy from the Federal Reserve is now largely behind us.

- Beyond the election uncertainty in the euro zone, the activity pick-up from quasi-stagnation should represent a support for equity valuations.

- Global disinflation trends have been confirmed by the most recent inflation data. At the current juncture interest rates have peaked and growth remains resilient.

- In China, economic activity has shown some fragile signs of stabilisation but the evolution of prices remains deflationary as consumer confidence remains at very low levels.

Risks

- Snap elections in France have brought political risks back into focus for financial markets, especially for French stocks and government debt. Over the next year, we see a risk of downgrade or a negative outlook in all scenarios as the debt ratio is rising.

- Bond yields are to be monitored especially given the diverging paths taken by the US central bank and its European counterpart.

- Although unlikely, a stickier-than-expected US inflation path while economic growth slows down too much and unemployment rises, could force the Federal reserve to reconsider its course.

- Geopolitical risks to the outlook for global growth remain tilted to the downside as developments in the Middle East and the war in Ukraine unfold.

Cross asset strategy

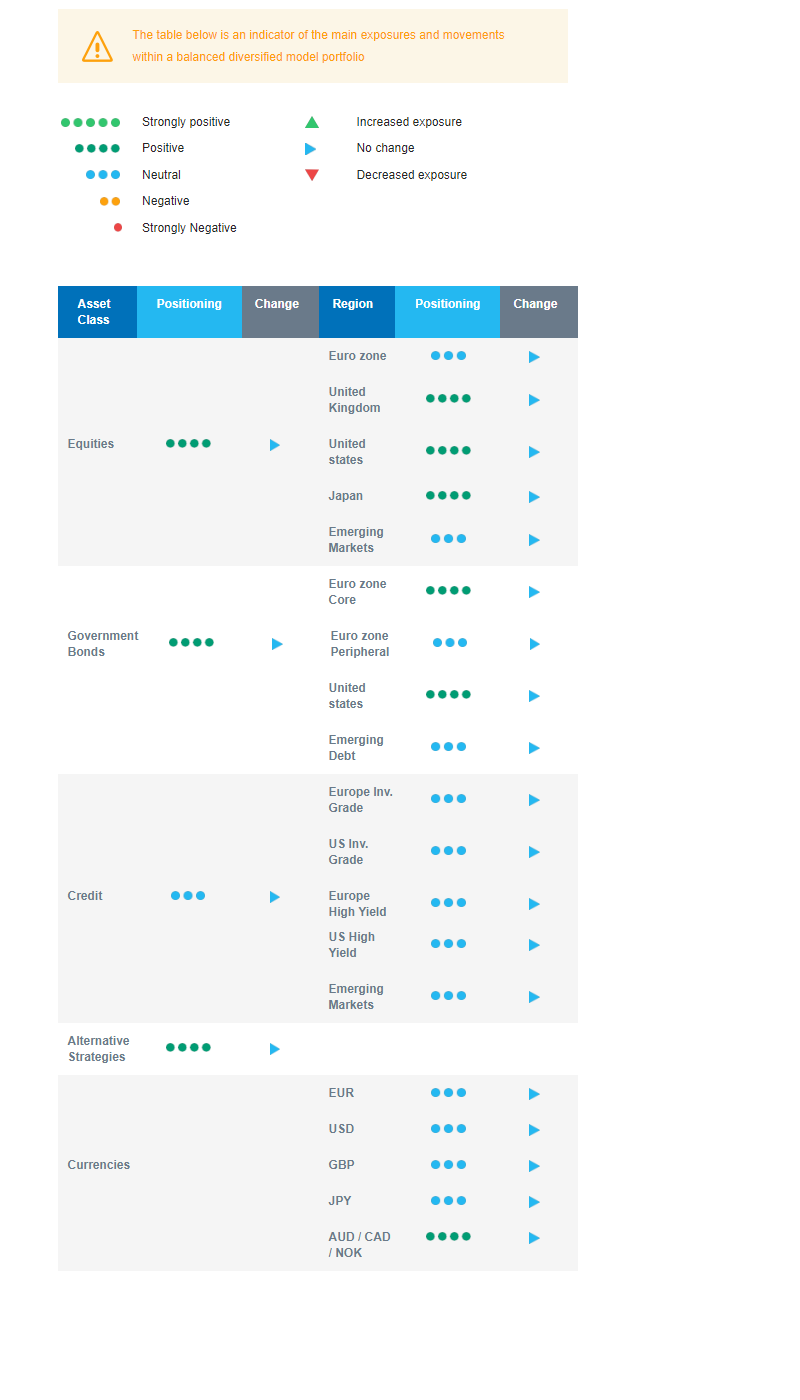

- While the recent rise in political uncertainty spilled over into financial markets and French assets, leading to somewhat higher volatility in the region, we are currently slightly overweight equities.

- We have the following regional equity investment convictions:

- Neutral euro zone equity as the bloc faces a rise in political uncertainty and a higher risk premium appears justified.

- Slight overweight US, UK and Japan, neutral Emerging markets.

- In Japan, exiting the multi-decade long deflation as well as corporate governance reforms bearing fruit should more than counterbalance a less dovish Bank of Japan.

- In the equity sector allocation:

- We have a positive view on the Tech sector: good earnings and guidance, peaking long-term yields, reasonable valuations, broad market leadership within IT and the industry’s relative insensitivity to the upcoming US presidential elections.

- A Pan-European small cap bias gives us the benefit of lower inflation, lower central bank rates and higher growth than expected.

- In the fixed income allocation:

- We prefer carry to spreads, with a focus on quality issuers, hence we are neutral peripheral European bonds and prefer core countries. We continue to watch OAT-Bund spreads as key macro risk gauge.

- We seized an attractive entry point on US government bonds as yields shot back up to 4.7% in April.

- We have a relatively small exposure to emerging markets sovereign bonds amid very narrow spreads and a strong US dollar.

- We are neutral on investment grade and high yield bonds, regardless of the issuers’ region.

- In our forex strategy, we are positive on commodity currencies, such as the Australian dollar, as the global manufacturing cycle is gradually picking up. Contrary to the ECB in Europe, the RBA has become more hawkish amid higher than expected inflation and strong economic data.

- We expect Alternative investments to perform well as they present some decorrelation from traditional assets and keep an allocation to gold.

Our Positioning

Our outlook on equity remains positive but we take into account the latest political developments in France, the UK and the U.S. We are slightly overweight developed markets equities and neutral euro zone. We are overweight US Tech and pan-European small and mid-caps, a reflection of our conviction in lower inflation, lower central bank rates and higher-than-expected economic growth. We are neutral Emerging markets equity until consumer confidence gains traction. On the fixed income side, we are positive on Core European duration as a safe haven and UK duration. The objective is to benefit from the carry in a context of cooling inflation and pending rate cuts by the ECB and BoE. In credit, we remain neutral - high yield and emerging debt - amid very narrow spreads and a strong USD. In our forex strategy, we bought some Australian dollars.