Last week in a nutshell

- US bond yields rose as the latest data releases showed stronger economic figures on retail sales, housing starts, unemployment claims and consumer sentiment.

- At Davos, Christine Lagarde mentioned the decreasing inflation in the euro zone, along with signs of a loosening job market and hinted to likely ECB rate cuts in the summer.

- Japan's core inflation stayed above the central bank's 2% target in December but slowed for a second consecutive month, taking some pressure off the Bank of Japan to phase out its large monetary stimulus.

- Disappointing Chinese economic growth reached 5.2% YoY during the last quarter. The youth unemployment rate, now at 14.9%, just resumed publication.

What’s next?

- The New Hampshire primary follows the Republican caucuses in Iowa, where former President Donald Trump won decisively.

- The US earnings season will gather steam with publications from Tesla, Johnson & Johnson, Procter & Gamble, Netflix, American Express and Visa.

- Several central banks will be in the spotlight, among which the European Central Bank, the Bank of Canada, the Bank of Japan and the Central Bank of Turkey.

- First estimates of manufacturing and services activity for the US, the euro zone, the UK and Japan will help assess the current trend in economic activity and gauge its health.

- The euro zone will publish preliminary estimates of its consumer confidence. The European Commission’s indicator has been in negative territory but on an uptrend since the October reading.

Investment convictions

Core scenario

- Inflation gave way and is set to fall rapidly below 3% in both the US and the euro zone, and is no longer a primary concern for investors. The growth / inflation mix is thereby finally returning to “familiar” territory although the start of the year could be somewhat bumpy.

- A soft-landing/ongoing disinflation scenario in the United States remains our most likely scenario, implying no rush for the Central bank to deliver monetary support. We don’t expect the first monetary easing before the end of H1 2024, still leaving room for disappointments compared to today’s market pricing.

- 2024 should bring better visibility with a narrowing economic growth gap between countries and most central banks having restored room for manoeuvre. For now though, the ECB appears to be a step behind the Fed when it comes to rate-cut timing as the odds are still in favour of a standstill or mild recession.

- In China, economic activity has shown some fragile signs of stabilisation (4% GDP growth expected in 2024) while the evolution of prices remain deflationary.

Risks

- Geopolitical risks to the outlook for global growth remain tilted to the downside as developments in the Red Sea unfold. An upward reversal in the price of Oil, US yields or the US dollar are key variables to watch.

- A remote risk would be a stickier inflation path than expected which could force central banks to reverse course.

- Similarly, financial stability risks could return as a result of the steepest monetary tightening of the past four decades and the tightening in financial conditions.

- Upside risk would be an earlier exit from central banks’ restrictive monetary policy.

Cross asset strategy

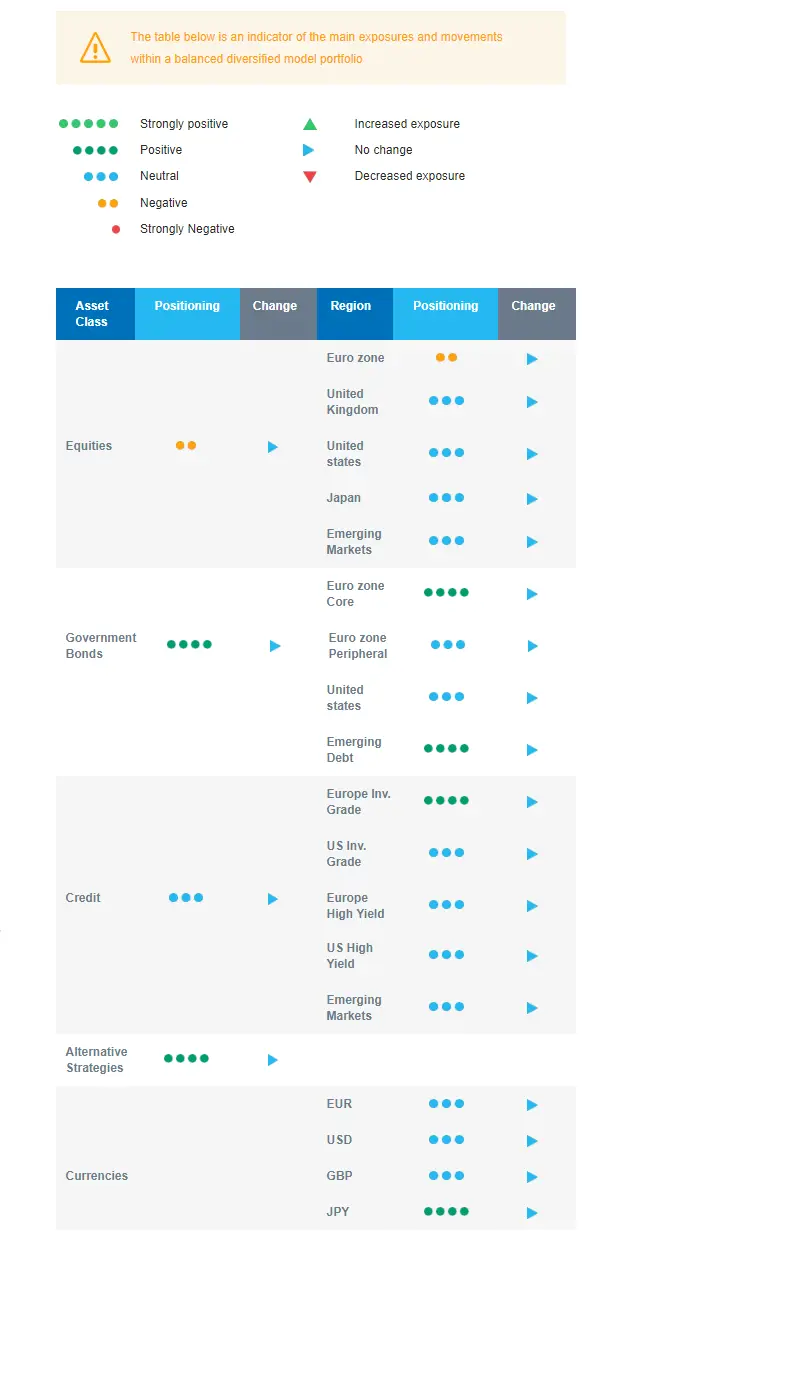

- Our asset allocation shows a relative preference for bonds over equities as the equity risk premium is currently insufficient to encourage investors to reweight the asset class.

- We have the following investment convictions:

- We expect limited equity upside, and are currently slightly underweight on equities pending a better risk/reward and clearer signals on when to increase our exposure. We have a cautious view on euro zone equities and are neutral on other regions.

- We look for specific themes within Equities. Among them, we like Technology / AI and look for opportunities in beaten down stocks in small and mid-caps or within the clean energy segment. We also remain buyers of late-cycle sectors like Health Care and Consumer Staples.

- In the fixed income allocation:

- We focus on high-quality credit as sources of carry.

- We also buy core European government bonds with the objective to benefit from the carry in a context of slowing economic activity and cooling inflation. As US yields have fallen from 5% in mid-October to 3.8% at the end of 2023, we took profit on our long US duration stance, keeping a neutral stance on American government bonds.

- We remain exposed to emerging countries’ debt to benefit from the attractive carry.

- We still hold a long position in the Japanese Yen albeit after some profit taking and have exposure to some commodities, including gold, as both are good hedges in a risk-off environment.

- We expect Alternative investments to perform well as they present some decorrelation from traditional assets.

Our Positioning

Our strategy takes into account that sentiment has turned bullish, imbalances have risen and Fed rate cut expectations have been brought forward to Q1 2024. With equities becoming relatively less attractive, we look for specific themes within this asset class: we are building a barbell strategy with last years’ beaten-down stocks in clean energy and Health Care and Consumer Staples as more defensive counterweight. In terms of sectors, we are also constructive on the US Technology sector. Within regional equities, we are underweight euro zone and stay neutral on Japan, Emerging markets, and the US. We maintain a long European bond duration and a neutral US duration. Our focus is also on credit that brings carry, i.e., investment grade and emerging debt.