JPMorgan’s CEO, Jamie Dimon, had to issue a long public apology for his "joke" during a recent trip to Hong Kong. "The Chinese Communist Party is celebrating its 100th year this year. So is JPMorgan," he said, referring to the centenary of the bank’s operations in China. "And I'll make a bet we last longer", he concluded.

Jack Ma, Alibaba’s founder and one of Asia’s richest people, could have forewarned Mr. Dimon that China’s communist leadership does not like being treated as a joke. Only a year previously, one of the largest IPO’s ever, Alibaba’s Ant Finance, was suddenly cancelled at the last minute by the Chinese authorities. There were official reasons of course but the move came after a speech given by Jack Ma criticising the Party for being too conservative and holding back innovation.

This IPO cancellation was the start of a very important and seemingly surprising shift in policy direction by Beijing. The government used anti-trust and anti-monopoly legislation against the increasingly important internet sector, which has seen strong expansion due to low barriers of entry. We believe it was designed to remind the new class of multi-billionaires and other potential opponents who was really in charge in China – namely, the Communist Party and Xi. Jack Ma, who even disappeared for a while after this, was probably the primary target. Other internet moguls quickly reacted to demonstrate their Party’s directions.

The government’s domestically-driven regulatory actions also targeted private education and on-line gaming, property sector among others.

As a result, with a growth environment already slowing down, Chinese equities had one of their worst years of performance on record. Investors’ concerns over the reasons for Beijing’s actions led to over USD 1 trillion in market value of China-listed companies being wiped out1. There was also a big divergence in returns between sectors and stocks that were impacted in different ways by various government initiatives.

Prosperity by decree…

The reasons for all this policy ‘tsunami’ can be found in two big concerns for Beijing: a ticking demographic time-bomb, and the power positioning by Xi Jinping ahead of the 20th CCP Congress taking place next year. The government took action to mitigate any potential threats to its “Common Prosperity” agenda and to demonstrate that the Chinese leadership is firmly in control, to reaffirm social values over economic growth and maintain “social stability”.

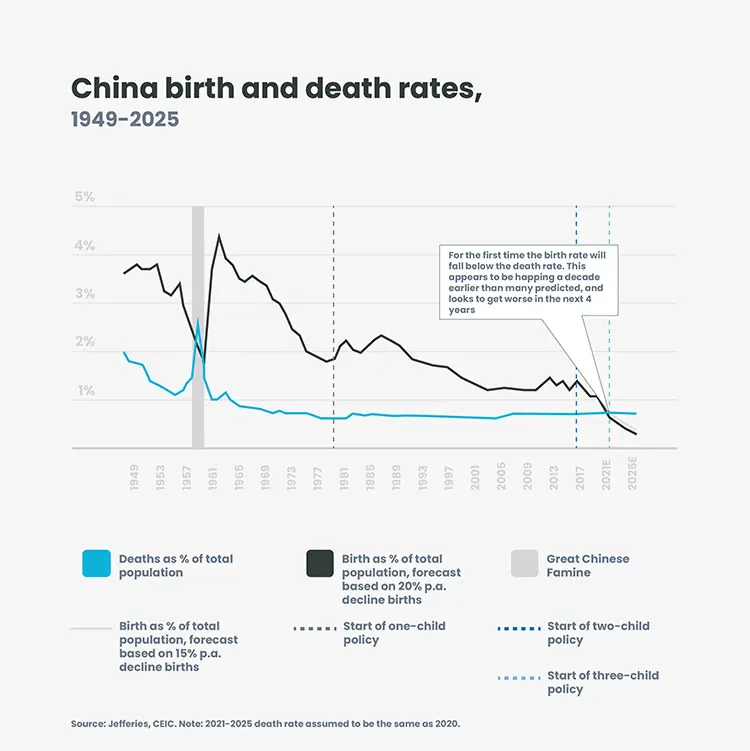

The 2021 Census revealed a clearly deteriorating demographic evolution, resulting in one of the slowest population growth rates since the 1950s. A series of measures followed quickly: an announcement of a “three-child” policy (despite the currently un-successful “two-child” policy), together with incentives for couples to marry and have children.

The government also said it wants to reduce the costs associated with raising a family,- which explain the measures to limit the expensive commercially-provided “after-school-tutoring”, to lower the constant pressure on children to perform, and to mitigate the high cost of housing and health care.

…while the economy is slowing down.

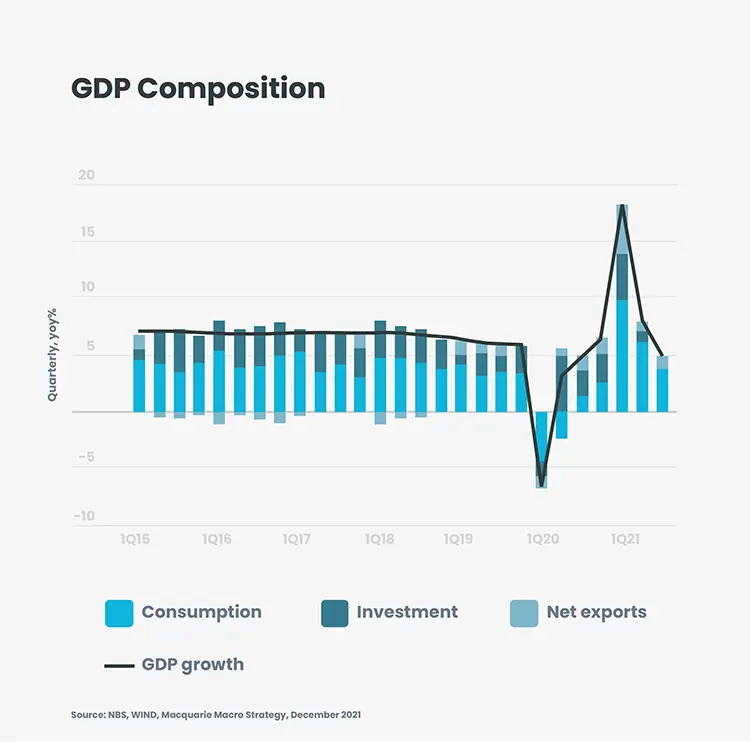

In the meantime, the Chinese economy has been slowing down, weighed down by the now familiar problems stemming from the (debt) crisis of the all-important real estate sector, high local government debt as well as a tight credit policy. The economy was also impacted by recent floods, a short but severe power shortage and the zero-tolerance policy towards COVID (which by the way resulted in zero cases in megacities like Shanghai, and which will at least be continued until after the Beijing Winter Olympics). If no supporting actions are taken quickly, growth is expected to fall to under the psychologically sensitive threshold of 5%. The planned economic meetings in December will be closely monitored.

There have been many new negative factors too, which may not be so easy for Beijing to mitigate. Among them are increasing calls for action from Western political leaders in connection with security threats posed by China, which include its (potential but not likely if not forced) military intentions towards Taiwan, offensive cyber capabilities and accusations of serious intelligence presence in the West. There is also the issue of the financial burden for several developing countries from the Chinese ‘Belt and Road’ investments.

Grave concerns remain over human rights, suppression of political expression (particularly in Hong Kong), and Beijing’s repression of Uyghurs in the Xinjiang province. There were new “disappearances” of high profile figures - artist Ai Wei Wei or tennis player Peng Shuai, which also did not help improve the image of China abroad.

Rule forever?

The 20th Congress of the Chinese Communist Party will take place in 2022 to elect the new power structure. While being in office, Xi Jinping managed to stifle most of the opposition and even prolong his term as paramount leader, but he is clearly opting for an indefinite leadership, putting himself in the same league as his predecessors Mao Zedong and Deng Xiaoping.

In 2021, investors in China faced an unusual degree of uncertainty around the increasingly un-predictable policy shifts and growing centralised party control at all levels of public and private activity. And while the market environment generally has been disappointing, the combination of these headwinds will challenge how both domestic and foreign investors approach the Chinese market.

Investors have the choice to decide whether or not to invest in the Chinese economy or markets, but they at least have the possibility to vote with their feet by their investment decisions to keep pressure on the Chinese government to develop a sustainable economy and society. Institutional investors and international companies working in China, like JP Morgan, can’t run every time something happens they do not like but they have an important role to play. Whether they will outlive the Chinese Communist Party for another 100 years remains to be seen. In any case, none of us will be around to witness it.

1 https://www.wsj.com/articles/china-corporate-crackdown-tech-markets-investors-11628182971